Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

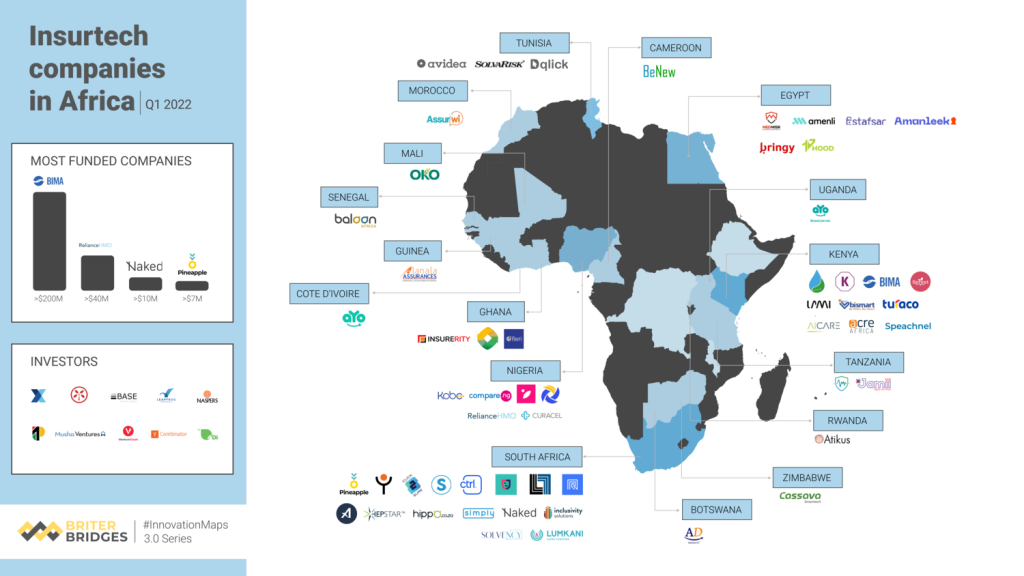

While the Insurtech sector may be limited to developed economies, Insurtech companies and other tech companies that service insurers are prevalent even in Africa.

Insurance Technology (Insurtech) is quickly gaining much-needed ground in Africa, having long been overshadowed by more lucrative sectors.

This is despite its undeniable importance in the continent’s economic progress. Africa is gradually emerging as a potential Insurtech hotspot for startups.

According to McKinsey and Company, the African insurance industry will be worth US$70 billion in 2020, with a compound annual growth rate (CAGR) of approximately 7% between 2021 and 2025.

This is about twice as quickly as North America, more than three times that of Europe, and faster than Asia’s 6%, placing the continent as the world’s second-fastest-growing insurance region, trailing only Latin America.

This article looks at the top 15 Insurtech companies making waves in Africa. Let’s dive in.

Also read – Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2024

Insurtech is a combination of the terms “insurance” and “technology,” referring to the use of technology in insuring people or property. Insurtech adds technology to the way insurance operates.

However, insurance is a contract in which one party agrees to indemnify or guarantee another against loss caused by a certain contingency or risk.

Experts feel that insurance, one of the oldest financial sectors, is mature enough to withstand twenty-first-century technology developments that could disrupt the industry.

Insurtech aims to improve insurance practices and automate their daily activities by providing streamlined policies social insurance and harnessing new data streams from Internet-enabled devices to price premiums dynamically based on observed behaviour.

This makes the insurance procedure easier and more efficient.

Insurtech companies in Nigeria began over a decade ago to improve insurance services. Unfortunately, the industry remains unknown ground, with huge untapped potential.

Also read – Loan Calculator and How to Use it

Insurtech refers to digital and technology-driven products that protect individuals and organizations from financial loss, including life insurance, car insurance, and crop insurance for farmers.

African Insurtech companies are aggressively working to increase the continent’s historically low insurance product penetration rates.

According to McKinsey & Co., barely 3% of Africa’s population is insured, the world’s lowest rate. Excluding South Africa, Africa’s most insured market, the figure falls to a stunning 1.12%.

Most Insurtech startups in Africa focus on facilitating access to and distributing insurance products rather than providing insurance as an underwriter.

They produce products that assist insurers, banks, or other organizations in expanding existing insurance lines or developing new ones that serve as additional revenue streams, promoting product uptake for the primary service.

Here are the top 15 Insurtech companies that are leading the revolution in the African market

Total funding to date: $266.2 million. JUMO is at the top of our list, offering financial services to individuals and small businesses.

The organization connects users with various financial institutions and insurers, making obtaining low-interest loans, savings, and insurance easier.

With a total capital of $266.2 million, its reach extends across numerous nations, enabling financial inclusion and inexpensive insurance coverage for marginalized communities.

JUMO can make its financial and insurance solutions more customer-focused with a user-friendly mobile app and data-driven algorithms.

JUMO is a leading force in Africa’s technological scene, empowering individuals and businesses to improve their financial capacities, hence boosting economic progress and financial well-being.

Total funding to date: $220.2 million. MFS Africa ranks second on our Top 15 Insurtech companies serving Africa.

MFS Africa connects mobile money users to service providers, including insurance, to create a smooth mobile experience for both people and companies.

The company unites multiple financial institutions, mobile network carriers, and merchants via a comprehensive and secure infrastructure, allowing efficient and cost-effective transactions. It also connects insurers from around the continent.

MFS Africa, which has operations in Ghana, South Africa, Kenya, Uganda, and Mauritius, has significantly expanded its services thanks to a total funding of $220.2 million.

Also read – Internet Blackout in Sudan: Two Months After, Telcos Struggle to Restore Mobile Coverage

The total funding to date is $200.6 million. BIMA offers innovative insurance solutions, focusing on providing affordable coverage to underserved populations.

Rounding up our Top 3, the company has received $200.6 million in total financing, receiving widespread accolades for its transformative services, allowing Africans to obtain insurance coverage they could not access through traditional means.

BIMA, a subsidiary of multinational insurer Allianz, uses mobile technology to provide microinsurance coverage and assist Africans with specific insurance needs.

Total funding to date: $13.3 million. Turaco, headquartered in Nairobi, Kenya, provides insurance solutions designed specifically for low-income individuals and families.

Its primary focus is on providing accessible healthcare coverage, which includes outpatient treatment, hospitalization, and maternity benefits insurance.

Turaco, which raised $13.3 million, has played a critical role in accelerating the growth of quick, affordable healthcare across Africa.

Total funding to date: $9.7 million. Pula specializes in agriculture insurance products and provides a diverse spectrum of consumers across multiple geographies.

Its operational activities centre on providing insurance services targeted to the demands of farmers and agribusinesses.

Pula aims to reduce risks and improve agricultural resilience by embracing innovative technologies and data-driven initiatives.

With $9.7 million in total funding, Insurtech has streamlined its services to assist smallholder farmers by providing tailored insurance solutions.

Total funding to date: $9.1 million. Pineapple, another South African insurtech startup, is helping to transform the African insurance scene with its camera feature, which speeds up the customer onboarding process.

Customers may snap the product they want to insure, whether it’s a car or another home item, and receive rapid coverage options.

Its distinct feature has enabled it raise $9.1 million in total finance and expand its operations into new African areas.

Total funding to date: $7.5 million. Nomanini provides innovative fintech and insurtech solutions to help informal retailers enhance their companies by merging new digital financial services with existing distribution networks.

Its South African location and significant features add to its distinct value proposition, which includes integrated financial solutions for SMEs and insurance.

The company’s creative concepts, technologies, and business models have positively impacted the insurance industry and the consumer experience.

Total funding to date: $6.1 million. WorldCover, ranked 8th on our list of Top 15 insurtechs, has raised $6.1 million in total fundraising, with MS&AD Ventures providing the lead investment.

This money came in 2019, and since then, the weather insurer has expanded its operations throughout Africa, offering bespoke insurance policies tailored to the individual demands of each region.

These needs are constantly changing as a result of climate change, and insurtech has helped develop ways to alleviate the effects of changeable weather.

WorldCover’s CropAssure solution is designed to assist almond growers in protecting against weather threats such as frost and excessive rain.

Total funding to date: $5.8 million. Inclusivity Solutions aims to improve insurance accessibility for individuals and businesses throughout Africa.

The insurtech company raised $5.8 million in capital and is one of the continent’s leading mobile insurance providers, providing quick, affordable coverage through its app.

Along with the explosion of cellphones in Africa, Inclusivity Solutions has been able to help address customer reach, providing coverage for all Africans.

Total funding to date: US$5.6 million. Insurtech Lami has raised $5.6 million in total fundraising over four rounds.

Lami, which provides various digital insurance products, aspires to modernize the insurance business by emphasizing customer-focused technology advances.

Lami, who has developed multiple agreements with insurers, is vital in helping Africa’s insurance business evolve by providing services suited to clients’ needs.

Also read – Bolt Rewards Programme: Bolt Nigeria is Offering Drivers Fuel and Insurance Discounts

Yalu is a digital insurance provider specialising in delivering low-cost credit life insurance to South Africans.

The company aims to offer customers debt protection in an understandable and accessible manner.

Yalu’s insurance solutions are designed to be economical, with premiums starting as little as R2 per day.

The company’s creative underwriting methodology and use of technology enable it to provide quick approval and a straightforward claims process.

Naked is a South African digital insurer that wants to offer customers a more personalized insurance experience.

The company’s innovative insurance solutions enable clients to personalize their coverage to their specific needs, perhaps resulting in lower premiums.

Naked’s app-based platform allows clients to easily manage their policies, submit claims, and track spending.

The company’s AI and machine learning technologies provide bespoke pricing based on individual risk profiles.

Click2Sure is a South African insurtech startup that provides various insurance options to businesses and individuals.

The company’s digital platform enables users to purchase insurance products fast and easily through a simple online approach.

Click2Sure’s unique claims procedure leverages artificial intelligence to automate claim assessments, lowering claim processing time and cost.

The organization has collaborated with a variety of industries, including e-commerce platforms, to provide insurance packages suited to individual customer needs.

JaSure is a South African insurtech startup that wants to give customers a more transparent and hassle-free insurance experience.

Customers may easily and quickly purchase insurance plans, manage them, and file claims using the company’s app-based platform.

JaSure’s insurance solutions are designed to be reasonably priced, with premiums starting at R30 per month.

The company’s AI and machine learning technologies provide bespoke pricing based on individual risk profiles.

Curacel is a Nigerian-based Insurtech platform that uses AI (Artificial Intelligence) to provide various insurance services, including health, travel, auto, and security insurance.

It was founded in 2019 and features an easy-to-use interface that allows insurers to automate the insurance process seamlessly.

Its goal is to drive insurance inclusion in Africa using technological means.

The Insurtech Startup allows its users to choose the insurance service and plan that best suits their needs.

Users can track claims and check for fraud, waste, and abuse (FWA) on the platform.

Curacel works with over 10 insurance carriers in Africa, has assisted 600+ hospitals, and has processed over 700 insurance claims while reducing unnecessary ones.

It is also ranked as one of the top 100 insurtech platforms worldwide.

Also read – mTek, a Kenyan Insurtech Startup, Secures $1.25M to Expand Across East Africa

Insurtech companies are transforming Africa’s insurance landscape by leveraging technology to address key challenges such as low penetration rates, limited accessibility, and high operational costs.

These companies simplify buying and managing insurance by using digital platforms, making it more accessible to a broader population, including those in remote and underserved areas.

Mobile technology plays a crucial role, allowing users to purchase insurance, file claims, and receive payouts via their phones.

This is particularly effective in regions where mobile penetration is high but access to traditional insurance services is limited.

Additionally, insurtech firms utilize data analytics and artificial intelligence to tailor products to local markets’ specific needs and risks, enhancing customer relevance and satisfaction.

Insurtech companies use mobile technology and digital platforms to make insurance accessible to more people, especially in remote and underserved areas.

Insurtech companies offer a range of products including health, life, auto, and agricultural insurance.

They use data analytics, artificial intelligence, and machine learning to analyze customer data and tailor products to specific needs.

Partnerships with telecom operators, banks, and other fintech companies help insurtech firms expand their reach and integrate insurance services into broader financial ecosystems.

Insurtech companies are driving competition and innovation within the traditional insurance market.

Insurtech companies are revolutionizing Africa’s insurance sector by harnessing technology to overcome traditional barriers and improve accessibility.

Through mobile platforms, data analytics, and strategic partnerships, they offer innovative, tailored, and affordable insurance products to a broader population, including underserved communities.

This digital transformation is fostering greater financial inclusion, resilience, and economic growth across the continent.

As Insurtech companies continues to evolve, it not only enhances customer experiences but also drives competition and innovation within the traditional insurance market, promising a more dynamic and inclusive future for insurance in Africa.

These Are the Top 6 Seed-Stage Insurtech Startups in Africa

mTek, a Kenyan Insurtech Startup, Secures $1.25M to Expand Across East Africa

Bolt Rewards Programme: Bolt Nigeria is Offering Drivers Fuel and Insurance Discounts

Internet Blackout in Sudan: Two Months After, Telcos Struggle to Restore Mobile Coverage

Loan Calculator and How to Use it

Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2024

Interact with us via our social media platforms:

Facebook: Silicon Africa.

Instagram: Siliconafricatech.

Twitter: @siliconafrite.