Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Instant loan apps for iPhone allow the owners of an iPhone in Nigeria to have quick online loans from their mobile devices. Though popularly known that Android users use loan applications, iPhone users also utilize this simplicity in mobile lending.

However, it’s good to understand that the iPhone was designed with a closed ecosystem, meaning there is a minimal way through which fake loan application scams can be subject to users in Nigeria.

Therefore, although few, the number of lending applications for iPhones in Nigeria might be genuine and trusted. This article will walk you through the best options, showing you the best instant loan app for iPhone in Nigeria.

These have indeed revolutionized ways of borrowing money, considering that one could get quick cash without much hustle or stress.

Keep reading to see the list of instant loan apps for iPhone in Nigeria and find out what is the future of personal financing at your fingertips.

So, if you are faced with a sudden financial setback or looking to fund a major purchase, these instant loan apps for iPhone in Nigeria have got you covered.

Here is a list of the best instant loan apps for iPhones in Nigeria:

Also Read – Top 15 Mobile Loan Apps in Kenya For Instant Loan

Let’s talk about each one of these apps and how they work.

FairMoney is a pioneering loaning platform and one of the most sought-after instant loan applications for iPhones in Nigeria.

This instant loan app for iPhone provides quick, flexible loans directly from your device with attractive interest rates of 5% – 28%.

Some of the interesting features that make FairMoney unique are its efficient approval, flexible loan amounts ranging from N1,500 to N500,000, and multiple repayment options.

Carbon is another very popular instant loan app for iPhone in Nigeria. It was earlier known as Paylater.

This fast loan app offers loans within a short time frame, requiring no collateral or paperwork, and with interest rates between 5% and 15%.

In addition, Carbon provides flexible repayment terms, allowing users to repay loans in weekly, monthly, or annual installments, making it a great option for iPhone users seeking flexibility.

Branch is a reliable instant loan app for iPhone in Nigeria that has been developed to provide quick loans directly on your mobile device.

It is convenient, with loan amounts of up to N200,000 at tenures ranging between 4 to 40 weeks. The interest rates are varied; 14% and 28%, depending on the tenure of the loan.

Through Branch, loans are granted within minutes, while repayment can be made either weekly, monthly, or once. This has made it the darling of those who want convenience in borrowing.

Life’s shocking surprises are financially overwhelming; that is where OKash comes to your aid. This pioneering loan application for iOS users in Nigeria lends a hand monetarily to see through all of one’s last-minute needs.

With OKash, one gets to borrow between NGN 3,000 and NGN 500,000 at an interest rate starting from 5.5% of the loan amount, subject to the payment time taken accordingly.

Also, its flexible repayment plans allow you to return the borrowed amount in installments per your paying ability.

Sometimes, all you need is that little push financially. That’s where PalmCredit comes in-the best loan app designed to avail quick and effortless loans on your iPhone.

With the use of PalmCredit, you have an avenue to borrow from N2,000 up to N100,000 with an annual interest rate of 14% to 24%.

Well, because approval is super quick, the registration is simple, and the funds disbursement is in real-time, surely that generally makes it smooth.

Read Also – Direct Axis Loan: How to Apply

Aella Credit is a handy menu when one needs instant loan access. Interest rates from Aella Credit-as a trusted means for money-help-start as low as 4% every month.

Loan disbursal is prompt and smooth to help in meeting unexpected expenses effectively.

Moreover, their credit education, simplified loan management, and flexible repayment options make it a top choice.

Renmoney is a reliable loan app for iPhones designed to address your financial needs.

With loan amounts up to ₦6 million and competitive interest rates starting from 2.825% per month, Renmoney’s got you covered.

Ease of loan approvals, flexible repayments, and real-time tracking of loans have made it quite convenient and transparent.

Looking for cash on-the-go? QuickCash is a leading and award-winning loan request app on iOS Store for Nigeria. The good thing is, it enjoys very low interest rates running from 5% to 24%. This mobile app has been crafted in such a simple and lucid manner in each loan term.

Upon approval, the loan amount is credited instantly into your bank account. Also, repayment tenure options vary from 14 days to one year, based on the amount of loan and loan type.

Kiakia is yet another great loan application for iPhone users in Nigeria that boasts speedy efficiency.

The Kiakia loan app gives loans in minutes to make sure you fulfill your financial needs without stress. The loan amounts are from N10,000 to N200,000 at single-digit interest rates starting from 5.5%.

It has a dynamic repayment plan from 7 to 30 days, a simplified process of loan application, and customer support 24/7.

Specta is a very handy and secure loan application for Nigerian iPhone users. This application is targeted at offering loans for personal and business purposes.

Specta gives loans up to N5,000,000 at an annual interest rate of 25.5%-28.5%, depending on the loan tenure.

What’s impressive is their loan processing time-about 5 minutes after a successful application submission.

Also Read – How to Access NowNowMoney Loan

Lidya is a great mobile application built for Nigerian Small and Medium Enterprises.

It is designed to help businesses grow; Lidya gives iPhone users fast access to unsecured loans of up to N10,000,000 at 3.5% monthly interest.

Among the important features of the Lidya app is its speedy disbursement of loans, often within 24 hours following a successful application.

Well, surprise expenses are indeed a source of stress, but now, with Migo to help, through its breakthrough personal loaning application.

The Migo application targets Nigerian iPhone users with loan offers between NGN1,500 to NGN 500,000 at flexible repayment duration that ranges from 14-30 days.

The APR ranges from 10% to 24% annually. You will be enjoying instant loan disbursement, seamless loan application, and ease of interface.

Sometimes, you need fast cash to finance your emergency or develop your business.

CreditVille is the best lending app for all iPhone users in Nigeria, providing financing up to NGN2,000,000 for up to 1-9 months.

CreditVille will give you options for cheaper loans. The annual interest rate in CreditVille varies from 4% up to 9%. You will be entitled to immediate approval, swift loan disbursement, and flexible repayment plans.

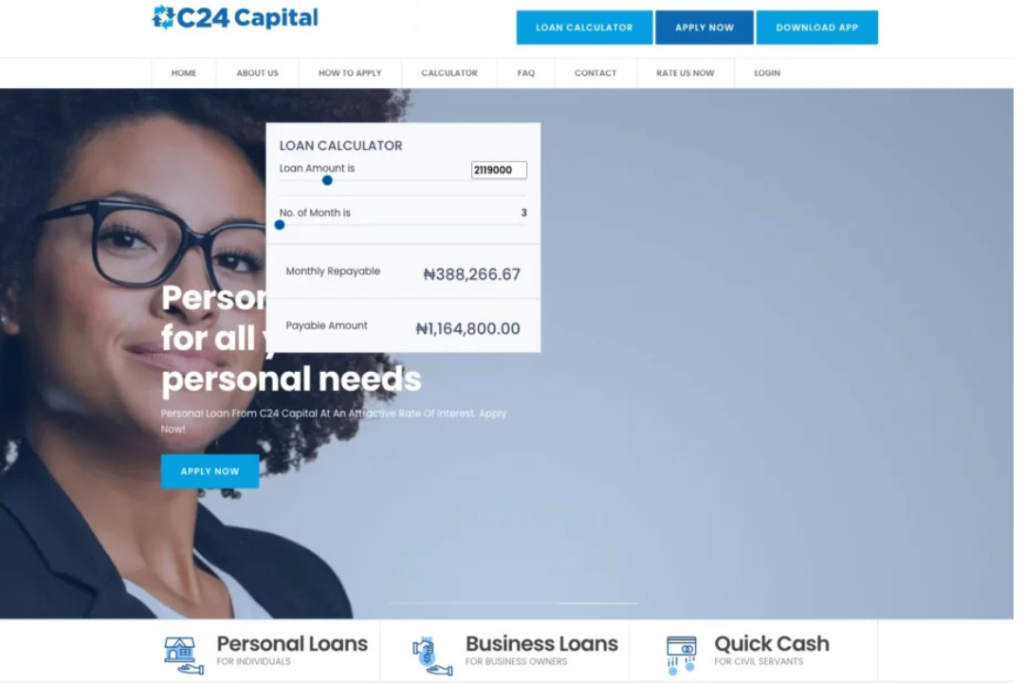

C24 Loan App is a financial one-stop-shop licensed to provide speedy and secure loans to individuals and small businesses in Nigeria.

This easy-to-use app works with an interest rate of approximately 4%-6.5% per month, depending on the loan tenure.

You might borrow as much as NGN 5 million, depending on your credit score and income, and enjoy simplified lending processes without paperwork, guarantors, or collateral.

Page Financials is one of the best financial services providers in Nigeria, offering low interest rates of 3.76% monthly on loans.

You can borrow from Page Financials from 200,000 to 5 million Naira and enjoy flexible repayment periods within 3 to 12 months.

This app allows you to manage your funds and loan account from your iPhone, thus enabling fast and seamless financial transactions.

Read Also – Top 10 Loan Apps for Urgent Loans in Kenya

CrediPal is a new iPhone app that targets the Nigerian marketplace. Through this loaning application, users are afforded loans in the most accessible way. The interest rates applied by the platform vary between 4% and 6% per month.

Its value proposition is the ‘Buy Now Pay Later’ service, whereby customers can buy goods from specific vendors and pay them in installments.

Repayment, on the other hand, is flexible and can be scheduled over a period of 2-3 months.

PayConnect is an excellent loan app and can easily be your instant financial companion in Nigeria.

This application provides loan amounts, which are based on your profile and offers loan solutions with no collateral.

PayConnect offers a competitive interest rate of as low as 5%, and repayment can be done within 3 to 6 months. The app features an efficient loan-tracking dashboard and an interactive interface.

QuickCheck is among the top financial applications in Nigeria, purposed to provide users with instant loan services.

With QuickCheck, you can quickly get loans without going through the hassle of paper work or collateral.

The AI algorithm used predicts the behavior of the users, thereby allowing qualified users to get loans within minutes. The interest rate ranges from 2% – 30%, depending on the loan terms.

SnapCredit is a valid loan application for iOS users in Nigeria. It offers short-term loans as a means of presenting financial solutions.

The application provides loans that range from NGN 2,000 to NGN 1,000,000 without collateral. SnapCredit provides flexibility with regard to repayments; loan tenures can be up to 3-12 months.

SmartCredit is among the most trusted loan apps in Nigeria; it was created for iPhone users who want to get fast funds for different needs.

It provides easy short-term loans of NGN 1,500 to NGN 500,000 with no collateral or guarantors.

With its intuitive design, the application has made it easy to apply for, approve, and disburse loans quickly.

Also Read – Tala Loan App: How to Apply for a Loan

With so many instant loan apps for iPhones in Nigeria, it’s getting difficult to identify which app best suits one’s needs. Here are points to consider:

Here go the 5 most important points to consider:

1. If the app is reliable or not

2. Interest rate comparison

3. If it is easy to use the application

4. Check on the speed to get the loan

5. Good customer service

These factors put into consideration will help you find the best instant loan application for an iPhone in Nigeria that suits your financial needs.

Read Also – How to Access Fuliza Mpesa Loan

Whether you need a little extra money for home improvements or hope to consolidate debt, applying for a loan has never been easier than it is with the technology in your pocket.

If you are an iPhone user, then there are a variety of mobile banking and lending applications through which you can make the process easy and quick.

Here’s how to go about it:

1. Choose a loan app that best suits your needs

2. Download the app from the Apple App Store

3. Sign up and create an account

4. Provide loan information: amount, purpose, repayment period

5. Link a bank account for fund transfer and repayment

6. Allow for a soft credit score check

7. Review and submit your application

8. Approval and disbursement

Most instant loan apps give access to money in minutes to 24 hours, and this is usually with just your BVN and phone number for approval.

No, most of the loan apps in Nigeria give collateral-free loans and do not require any guarantors.

Yes, some reputable apps, such as FairMoney, are designed with advanced security features, including facial recognition and card blocking capabilities.

Getting an instant loan just got a whole lot easier! With top-notch instant loan apps for the iPhone in Nigeria, you can get quick cash whenever you need it.

Just remember to choose wisely, considering interest rates and loan limits.

Find the best instant loan app for the iPhone that works for you and breathe easy, knowing you’ve got a financial safety net.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.