Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

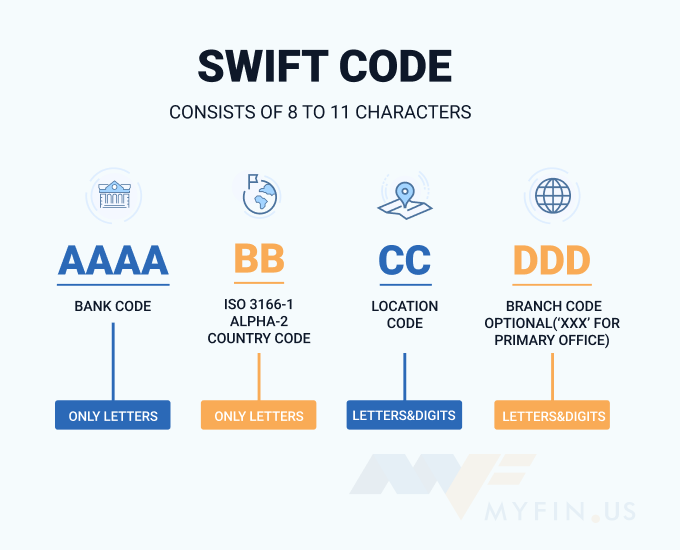

The First Bank SWIFT code is an exclusive alphanumeric code that is vital to cross-border financial transactions. This 8–11 character code is organized in a certain way to convey important details.

In order to make international money transfer money to a bank account, first-bank SWIFT codes are required. These guarantee that the money you send will arrive at its intended location securely.

The bank’s code, which identifies First Bank specifically, is represented by the first four characters. The country code, which follows, indicates the country in which First Bank is situated.

The location code, which gives information about the city or area of the bank’s headquarters, is the next two characters.

The final three characters of an 11-character code, which designate a particular First Bank branch, are optional.

Because of this organized system, every transaction is guaranteed to reach its intended recipient, making the SWIFT code a crucial component of international transactions. Every component of the First Bank SWIFT code will be explained to you in this article.

Read also – Moniepoint Commemorates IWD with Call for Applications into 4th Edition of Women in Tech Programme

A SWIFT code, also known as a BIC (Bank Identifier Code), serves as a unique identifier for financial and non-financial institutions worldwide. Comprising either 8 or 11 characters, it specifically denotes a particular bank branch and is primarily utilized for international wire transfers between banks.

When sending money globally, using a SWIFT code ensures that funds are routed accurately to the intended recipient’s account.

Although banks like First Bank traditionally rely on the First Bank SWIFT code for international transfers, this method is often associated with inefficiencies and high costs. Users may encounter unfavorable exchange rates and substantial fees, resulting in diminished value for their transactions.

As an alternative, TransferWise offers a more efficient and cost-effective solution. Renowned for its transparency and competitive rates, TransferWise typically delivers savings of up to 5 times compared to traditional bank transfers. By leveraging innovative technology and peer-to-peer networks, TransferWise facilitates seamless cross-border transactions while minimizing unnecessary expenses for users.

The first bank SWIFT code remains integral to international banking operations, opting for TransferWise presents a superior option for individuals seeking affordable and reliable cross-border money transfers. With TransferWise, users can enjoy greater value and peace of mind when conducting global financial transactions.

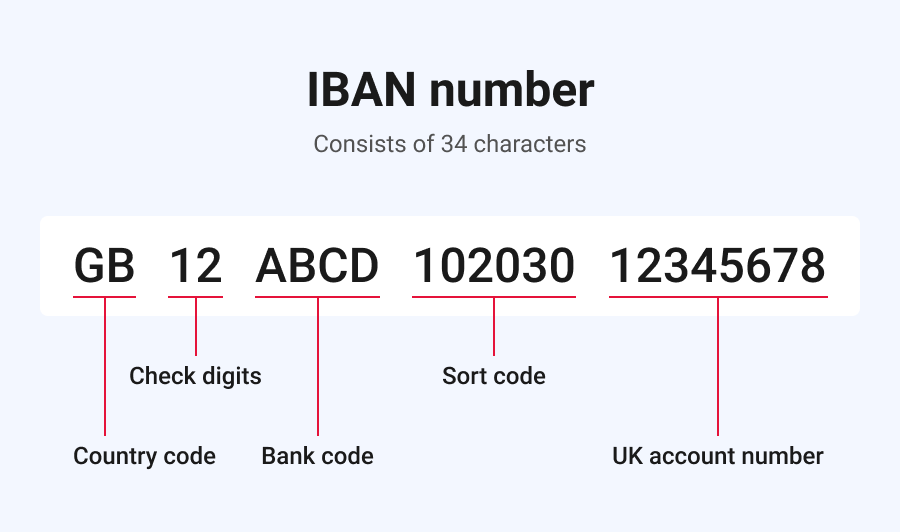

An IBAN (International Bank Account Number) code is a standardized international bank account identifier used in many countries worldwide. It serves as a unique identifier for individual bank accounts and facilitates secure and efficient cross-border transactions.

The first bank IBAN code typically consists of a two-letter country code, followed by two check digits, and a country-specific bank account number. In essence, the first bank IBAN code provides a standardized format for identifying bank accounts across different countries, ensuring accuracy and reducing errors in international payments.

It plays a crucial role in enabling seamless and reliable money transfers between banks and financial institutions globally.

When sending or receiving money internationally to First Bank of Nigeria Ltd. in Nigeria, it’s crucial to use the correct identifiers. The First Bank Swift code, also known as the Bank Identifier Code (BIC), uniquely identifies each branch of the institution worldwide.

This code ensures secure and accurate money transfers between institutions. To find the right First Bank Swift code, you can utilize specialized search engines like ours dedicated to providing accurate codes for financial institutions.

In addition to the Swift code, it’s important to confirm other details, such as the First Bank IBAN code (International Bank Account Number) and the recipient’s account information. These details further ensure the accuracy and security of international transactions. Always verify the correct code with the bank or recipient before initiating any money transfer to avoid errors or delays.

By using the correct First Bank Swift code, IBAN code, and account information, you can confidently send or receive money internationally, knowing that your transactions are processed accurately and securely.

| Swift code | FBNINGLAGCS |

| Swift code (8 characters) | FBNINGLA |

| Branch name | FIRST BANK OF NIGERIA LTD |

| Branch address | |

| Branch code | GCS |

| Bank name | FIRST BANK OF NIGERIA LTD |

| City | LAGOS |

| Country | Nigeria |

The First Bank Swift code, originally introduced by SWIFT (Society for Worldwide Interbank Financial Telecommunication), is now standardized as the Business Identifier Code (BIC).

This unique code is crucial for securing international money transfers between financial institutions. Typically, a Swift code comprises either 8 or 11 characters.

For most transactions, the 8-character Swift code suffices, consisting of the institution identifier (4 characters), country identifier (2 characters), and location identifier (2 characters).

However, in cases where transactions are processed through a specific branch, the 11-digit Swift code is necessary.

Read also – USSD Codes for Union Bank, Polaris, First Bank & Zenith

When making international money transfers involving First Bank of Nigeria Ltd, it’s essential to use the corresponding Swift code. These Swift codes are vital for securely sending or receiving funds across international borders.

Whether you’re receiving international remittances into your First Bank of Nigeria Ltd account or sending money to someone with a First Bank account in another country, the correct Swift code ensures accurate routing of transfers.

First Bank of Nigeria Ltd utilizes Swift codes to facilitate communication with other banks regarding international remittances and to direct international transfers to their intended destinations securely.

Therefore, whenever you need to engage in an international money transfer, you must provide the appropriate First Bank Swift code. Additionally, verifying other details such as the First Bank IBAN code (International Bank Account Number) and account information ensures the accuracy and security of your transactions.

By using the correct Swift code and account details, you can confidently execute international money transfers, knowing that your funds will reach their intended recipients safely and efficiently.

To locate FIRST BANK SWIFT codes, you have several options:

Your FIRST BANK OF NIGERIA LTD SWIFT codes may be printed on your checks or included in your account statements. Simply refer to these documents for the relevant codes.

The FIRST BANK OF NIGERIA LTD website offers comprehensive information about the SWIFT codes for all its branches. You can visit the bank’s website to access this information.

Alternatively, you can utilize an online SWIFT code checker. These tools allow you to search for and verify SWIFT codes for specific banks, including FIRST BANK OF NIGERIA LTD.

By employing any of these methods, you can easily obtain the necessary SWIFT codes for conducting international transactions with FIRST BANK OF NIGERIA LTD. Whether you prefer checking physical documents, accessing the bank’s website, or using online tools, you’ll have the information you need to send or receive money securely across borders.

Read also – Latest Standard Bank Branch Code in South Africa 2024

Before initiating an international wire transfer to FIRST BANK OF NIGERIA LTD, it’s essential to confirm the accepted codes for such transactions. IBAN codes, primarily used in European and European Union member countries, may not be as prevalent in countries like the U.S. and Canada. However, SWIFT codes enjoy widespread support across almost all countries.

To ensure a smooth transfer process, verify whether FIRST BANK OF NIGERIA LTD supports IBAN codes, SWIFT codes, or both.

Utilize this information to provide the correct identifiers when conducting international wire transfers. By confirming the accepted codes, such as the First Bank Swift code or IBAN code, you can ensure that your funds are routed accurately and efficiently to the intended recipient’s account.

Read also – How to Transfer Data on MTN, GLO, 9Mobile and Airtel

Before initiating an international wire transfer to FIRST BANK OF NIGERIA LTD, it’s crucial to note that the bank may have multiple SWIFT codes, indicating that different branches may use distinct identifiers. Therefore, it’s essential to verify the specific SWIFT code associated with the account you intend to send funds to.

Ensuring accuracy in providing the correct SWIFT code is vital for the successful and secure routing of your international wire transfer. Be diligent in confirming the SWIFT code corresponding to your recipient’s account to avoid any delays or errors in the transfer process.

Read also – Explicit AI images of Taylor Swift Goes Viral, X Blocks Searches for Her

When transferring money internationally through First Bank, utilizing the First Bank SWIFT code is a reliable method. The SWIFT code serves as a unique identifier for each branch, ensuring accurate routing of funds. While the bank may also support IBAN codes, especially for transactions within European and European Union member countries, the SWIFT code remains widely accepted across almost all countries.

Using the First Bank SWIFT code guarantees seamless communication with other financial institutions regarding international remittances, thus facilitating the secure transfer of funds to the correct destination. While IBAN codes are prevalent in certain regions, they may not be as universally recognized as SWIFT codes, especially in countries like the U.S. and Canada.

Moreover, relying on the First Bank SWIFT code simplifies the transfer process, as it eliminates the need to navigate differing code systems across various countries. By ensuring the accuracy of the SWIFT code associated with the recipient’s account, senders can confidently initiate international wire transfers, knowing that their funds will be safely and efficiently routed to the intended account.

Therefore, leveraging the First Bank SWIFT code represents a robust and effective approach to transferring money internationally, providing peace of mind and reliability for both senders and recipients.

The SWIFT code for First Bank may vary depending on the branch. It’s essential to verify the specific SWIFT code associated with the account you’re sending funds to.

You can find the SWIFT code for a specific First Bank branch by checking your account statements, contacting the bank directly, or visiting the bank’s website.

While First Bank may support IBAN codes for certain transactions, it’s crucial to confirm the accepted codes for the specific type of transfer you’re initiating.

You’ll typically need to provide the recipient’s name, account number, and the relevant SWIFT code for the First Bank branch.

First Bank may impose fees for international wire transfers. It’s advisable to check with the bank for details on applicable fees.

The processing time for international wire transfers to First Bank accounts may vary depending on factors such as the sender’s bank and the destination country’s banking system.

Yes, you can typically track the status of your international wire transfer by contacting your bank or the sender’s bank and providing the relevant transaction details.

If you encounter any issues with your international wire transfer, it’s recommended to contact your bank or the sender’s bank promptly for assistance.

In conclusion, initiating an international wire transfer to First Bank requires attention to detail and accurate information, particularly regarding the specific SWIFT code associated with the recipient’s account.

While First Bank’s services offer a reliable avenue for international transactions, it’s essential to verify all details and potential fees beforehand.

By adhering to the guidelines provided and promptly addressing any issues that may arise during the transfer process, customers can ensure a smooth and efficient experience when transferring funds internationally to First Bank accounts.