Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Losing a phone in Nigeria can be terrifying, especially when it holds your digital wallet. It isn’t just an inconvenience—it’s a security emergency. If your device contains mobile banking apps like Opay, a stolen phone could give thieves access to your funds, personal data, and transaction history.

Acting swiftly to block your Opay account when your phone is stolen is critical to preventing unauthorized transactions.

In this comprehensive writing, we will explain exactly how to block OPay account when the phone is stolen, from the quick USSD code to in-app support, and explain what to do if you have no device or number.

OPay is a popular mobile payment app in Nigeria (CBN-licensed and NDIC-insured up to ₦5 million), but theft of your phone can put your funds at risk. But knowing how to block OPay account when your Phone is stolen, you can prevent thieves from accessing your money or performing unauthorized transactions.

Follow these steps immediately after realizing your OPay-linked phone is gone. Acting quickly can stop fraud:

Follow the on-screen prompts – you may be asked to confirm or enter your OPay PIN – and complete the process. Once done, OPay will reply with a confirmation that your account is blocked. No one will be able to access your account or make transactions.

Most operators have toll-free codes or service centers for SIM recovery. Doing this ensures the thief can’t use your phone number for banking or other services.

Alternatively, email customerservice@opay-inc.com or use OPay’s in-app chat (more below). Tell them you’ve lost your phone and request an account block.

Their team will authenticate your identity (via details like your registered phone number, email, or ID) and freeze the account.

The fastest way to lock your OPay account is using the official USSD code from any phone. This code was launched by OPay specifically for emergencies. It works even if your phone is lost – just dial it from a different device.

Using USSD code immediately cuts off all access, so no one (including yourself) can make payments or log in until you unlock it again with OPay support.

Step 1: Use any working phone (yours or borrowed). If you have your SIM card, insert it into a spare phone. If not, borrow a phone on the same network or insert a newly issued SIM with your number.

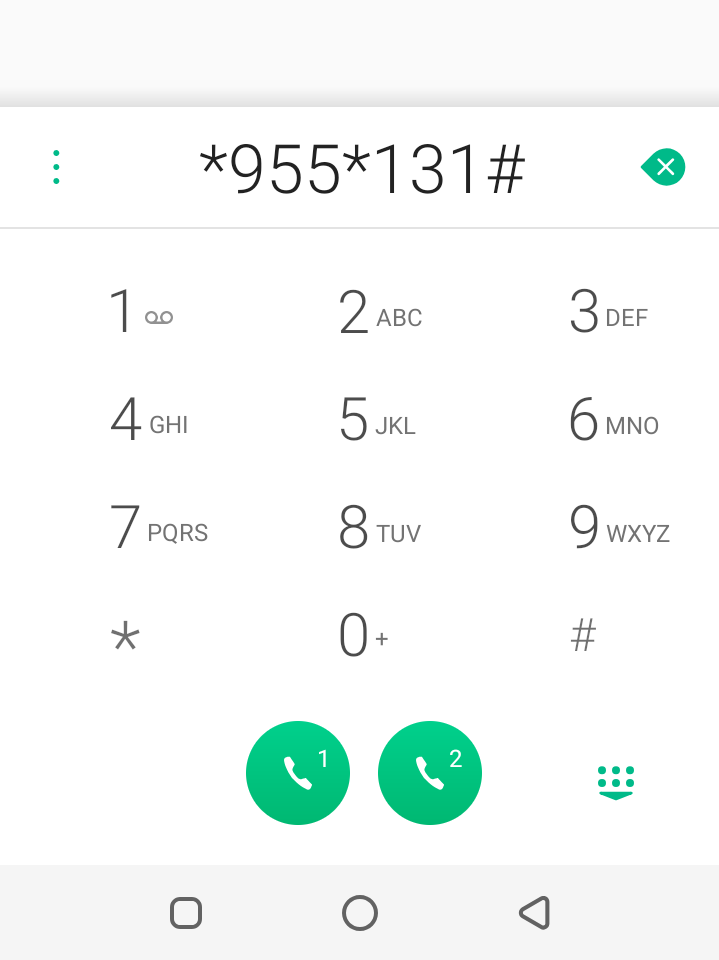

Step 2: Open the phone app and dial *955*131#. Press the call button.

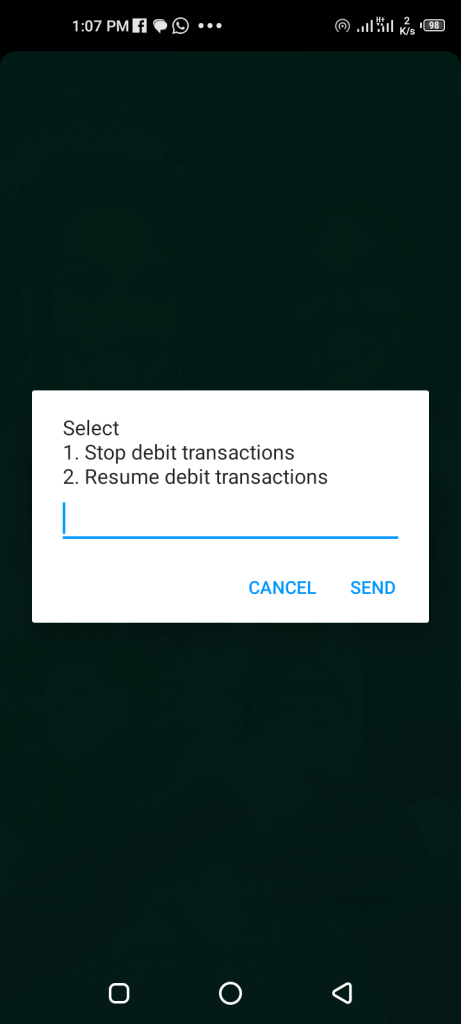

Step 3: The screen will show the prompts “Stop debit transactions” and “Resume debit transactions.” Select 1 to proceed.

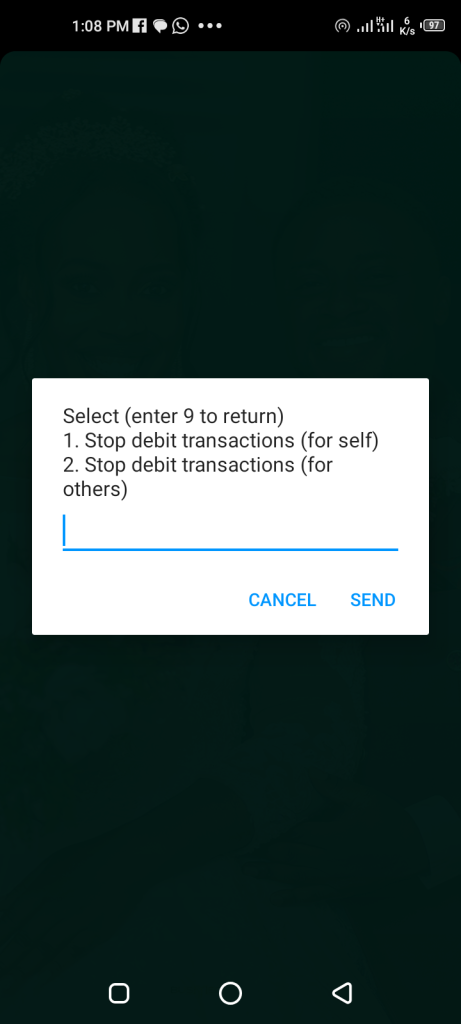

Step 4: The prompt “Stop debit transactions -For Self”. Select 2 to proceed.

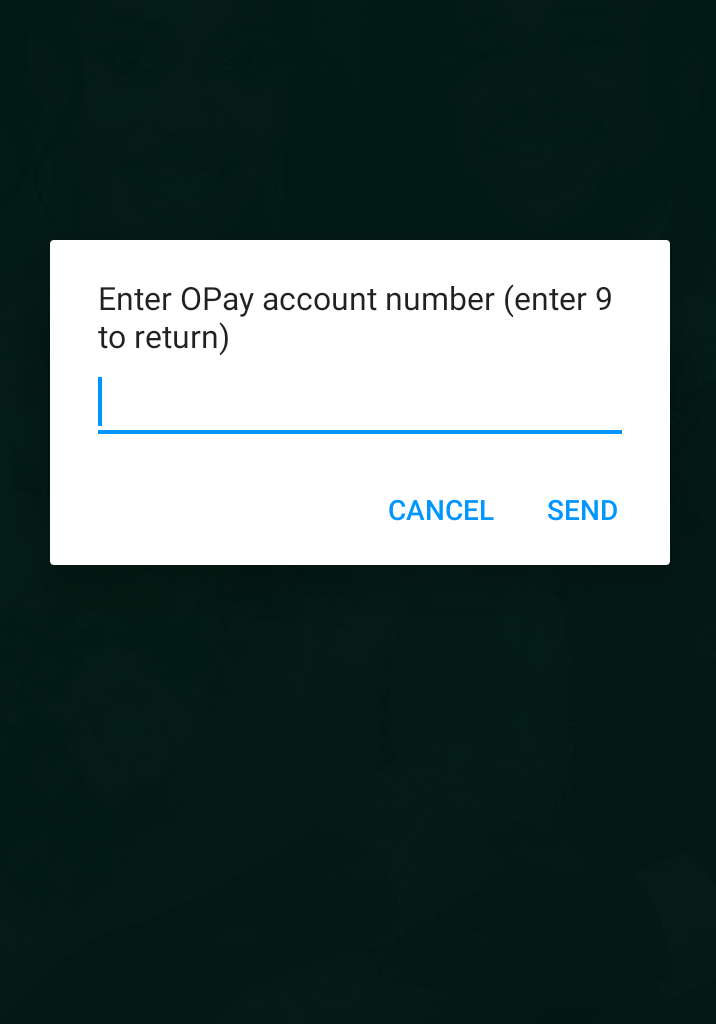

Step 5: You will be prompted to “Enter your Opay account number”. Type your Opay account number and hit Send to proceed.

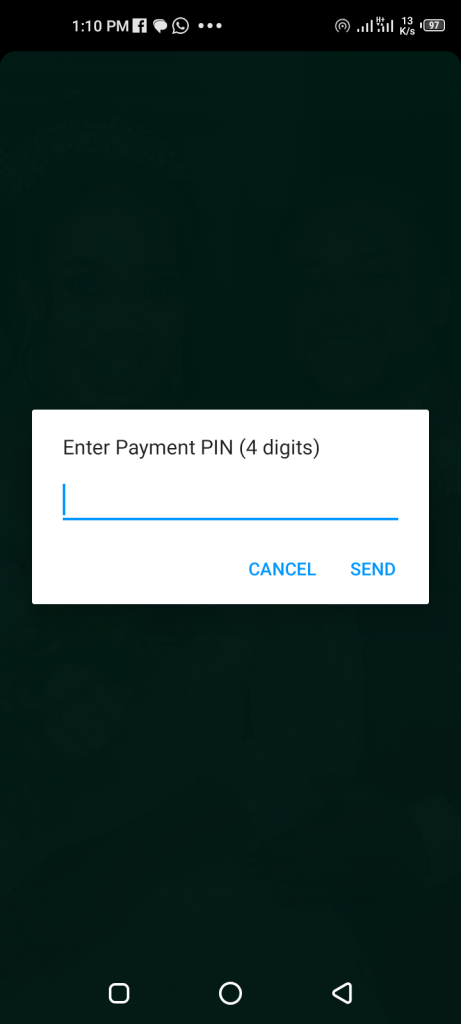

Step 6: You will be required to enter your Payment PIN

Step 7:

Wait for the confirmation message. Once you confirm, the system will lock your account immediately. You should receive a confirmation SMS like “Your OPay account has been locked.” Once you see that your account is locked, the process is done.

If you’re on a network that doesn’t recognize *955 shortcodes, you can also call 0700-888-8328 to report an account block. However, the USSD is faster and works from any SIM.

If you still have access to your OPay app (for example, on another device after reactivating your SIM), you can use it to request an account block. Open the OPay mobile app and log in with your credentials. Then do the following:

· Install OPAY on a new device from the Google Play Store (Android) or App Store (iPhone).

· Tap “Login” and choose “Forgot the password” or “Can’t reach your account.”?

· Tap the “Me” or Profile icon (usually at the bottom right). In your profile menu, look for Settings or Security.

· Select “Stolen phone” and enter your registered phone number.

· If you see a “Help” or “Customer Service” option, select it.

· Send a support request saying your phone is stolen and you need to lock the account. The support team can instantly freeze the account remotely.

· Some OPay app versions have a “Lock/Block Account” button directly under Security settings. If you find this, tap it to freeze your account on the spot.

Pro Tip: Enable two-factor authentication (2FA) after recovering your account for additional safety.

Even OPay’s official site reminds users to use the in-app help center if needed: “visit our in-app customer service center” at any time. In short, use whatever block or support feature the app provides. After submitting the request, you will usually get confirmation either in the app or via SMS that your account is now locked.

If your phone (or the device you are using) runs Android, the process of blocking OPay is straightforward and similar to other devices.

· First, you can dial the USSD code from the Android dialer:

· Open the Phone app, enter *955*131#, and press call.

· Confirm any prompts to immediately lock the account. This is identical to any other phone – Android users have no special code.

Additionally, Android offers some helpful built-in security features to lock or wipe your stolen phone. While this does not block the OPay account itself, it prevents thieves from opening any apps.

Wipe your stolen phone from a distance:

· Go to Google find my device on the computer.

· Sign in with the Google account connected to your stolen device.

· Select the “Erase device” to remove all data, including the OPAY app.

Change Google Account Password:

Go to Google Account Recovery and reset your password. This prevents the thieves from accessing Opay if it’s connected to your gmail.

Inform OPAY via email:

· Email support@opay.ng with “URGENT: Block Stolen Accounts” in the subject line.”

· Include your full name, phone number and BVN for faster resolution.

For iPhone users, blocking your OPay account is largely the same process.

· Open the Phone app on your iPhone,

· Dial *955*131#, and press the green call button.

· If prompted, enter your OPay PIN or confirmation key. Follow the on-screen instructions. Once confirmed, your account will be locked immediately.

Within the OPay iOS app, tap the “Me” or profile icon at the bottom (usually right corner).

Go to Settings or Customer Service. iOS users should see similar options to Android – you can either find a “Lock Account” button or use the in-app support chat to request blocking.

If you cannot use your registered phone number at all, you may wonder how to block OPay. The USSD code (*955*131#) only works from a SIM that was linked to your account. If your SIM card is gone, do this: Immediately contact OPay support directly from any other phone. Dial 0700-888-8328 (or 020-18888-328) and explain that you lost both phone and number.

You can do this from any line. OPay will ask for identity verification (like your name, date of birth, or account details) and then manually lock your account. You can also email customerservice@opay-inc.com.

Alternatively, if you have already obtained a replacement SIM with the same number, simply dial *955*131# from that new SIM. If that’s not possible, use the above hotlines.

You should also visit an OPay service center in person if convenient. Show a valid ID at any OPay office (addresses are on opayweb.com) and they will assist in blocking the account.

Dial *955*131# to block your account

To disable your OPay account, you can either dial 955131# to lock your account or 955132# to block your OPay ATM card.

To recover your OPay account without a phone number, you’ll need to contact OPay’s customer support.

Protecting your money is the top priority when something as unfortunate as a stolen phone happens. But OPay has made these tools available precisely so that a lost or stolen phone doesn’t mean lost money.

With the steps above – using the USSD code, in-app support, and official hotlines – you can effectively block access to your OPay account even if your device is gone.