Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Being a customer, you may want to know how to borrow money from Access Bank, but if you don’t know how, don’t worry. We`ve got you covered in this article.

To borrow money from an access bank can sometimes be confusing and stressful if one doesn’t follow a proper guide on taking loans.

Access Bank has provided a platform for their customers to take loans through their Mobile Banking App, thereby cutting the whole stress.

This is not new as we have seen it from various loan apps and even advanced digital banks in Nigeria.

You can get a loan from the Access Bank app without visiting branches.

This article will guide you on borrowing money from the Access Bank app.

Also read – Google Offered 300% Hike in Salary to Retain an Employee

Before you can proceed to borrow money from Access Bank, the first thing you need to do is understand their loan types.

Access Bank offers different loans and repayment plans; we’ve decided to break down some loan types below.

To borrow money from the Access Bank app, you have to be a customer.

And it’s almost the same scenario with borrowing money from other banks in Nigeria.

You’ll need to meet up some requirements as well, they have all been highlighted below.

Also read – FNB Loan Calculator and how to Use it

There are over ten different types of loan offers on the Access Bank app. But we’ve highlighted the popular loan offers Access Bank customers usually take.

An Access Bank personal loan is the kind of loan one can take to sort out expenses.

This is, therefore, the best kind of loan if you are wondering how to borrow money from an access bank without a salary account.

The interest rate is good, and it comes with nice features.

Features

Requirements

Payday is yet another excellent loan package from Access Bank.

The entire process is pretty easy, unlike most loans, where you will need documents before you get approval.

Payday Loans may be applied via the mobile banking app or USSD from Access Bank.

Features

You do not need to go through any long process to take loans with Salary Advanced.

In case you’re in real need of money before your salary comes in, you can take Salary Advance.

You only need a Salary Account with Access Bank before obtaining loans.

Also read – How to Use the African Bank Loan Calculator

Features

Other types of loans on the Access Bank app include:

Before borrowing money from the Access Bank app, you must meet the following requirements.

You will pay monthly instalments for most of the products after about 30 days of receiving them.

The amount is usually deducted from your account every month to save you from the stress of visiting your banks.

Also read – Developing Countries Now Embrace Advanced AI Technology at a Faster Pace

Follow these steps to learn how to borrow money from the access bank app.

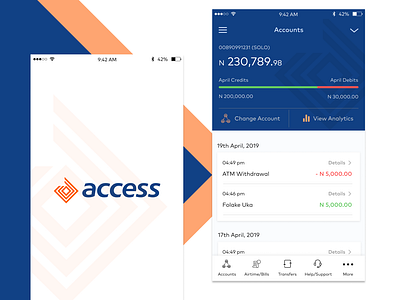

Step 1: Download the Access Bank App from the Google Play Store or Apple Store. If you have the App already installed on your device, skip this step.

Step 2: Start enrolling for mobile banking by clicking the sign-up button. Enter your Access Bank ATM card’s first six and last four digits. Input your password and log into your account.

Step 3: Log in to your account, then press Loans and Investments.

Step 4: You will be shown the amount you can borrow. Type it in and accept the terms and conditions of the loan.

Step 5: You can then submit, and if approved, you will have gotten your loan within 24 hours.

You can repay this loan from Access Bank in Nigeria through various methods, including the following:

1. Go to the nearest Access Bank branch: where you have taken your loan from. Let the customer service representative know you want to repay your loan. You will be given a loan payback form to fill out. Debit your account with the amount deposited, credit the amount into your loan account, and give a receipt.

2. Use the Access Bank USSD code: Dial *901# from your registered mobile number and follow the voice prompt to repay your loan.

3. You can use the Access Bank app: Log on to your Access Bank app, go to the ‘loans’ tab, and select ‘repay loan’. Following the on-screen instructions, fill in the details required, including the mode of payment, your bank account details, and the amount you want to repay. If you are

Please note that there is no specified time to pay back the loan.

You will agree to a loan repayment term of your choice upon taking the loan from the bank.

Most of the payments are made in monthly instalments, which depend on your loan amount.

Also read – Latest on How to Borrow Data on Airtel

In case you encounter any issues in when trying to borrow from the Access Bank app, do the following:

In case of any suspicious activity, report to the bank. Their security is tight, and they may close one’s account on necessary grounds. On any other issue, don’t hesitate to contact Access Bank for any other help.

*901*11*1# from your mobile device or *901*11*2# for a cash-backed loan. You can also use the code to get an instant loan

The method for receiving a loan from Diamond Access is similar to that of Access Bank. Dial *901*11#, download QuickBucks App or visit any of the branches of Access Bank.

You should be at least 18 years old. Your Access Bank account has to be active, and you must have proof of income.

Yes, a salary earner can apply for up to 200% or 400% net of their monthly salary as a loan.

The bank automatically removes the money from your account every 30 -31 days in instalments.

Yes, you can download the QuickBucks App to do so or contact the Bank’s customer care service by sending a mail to contactcenter@accessbankplc.com.

To check your Access Bank loan balance, dial *901*00#. This is the code to get the general Acce Bank balance.

Yes, you can get a loan from Access Bank without collateral. The bank offers a Payday Loan that allows you to borrow money at a low interest rate with no documentation or collateral needed.

That is the whole process you need to know if you want to borrow money from Access Bank.

We hope this guide has helped you on how to borrow money from Access Bank.

There are plenty of loan offers for you, make sure you meet their requirements and you’re good to go.

If you find this article helpful, kindly leave a comment and follow us on our social media handles.

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.