Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Graph has emerged as a promising alternative to Mercury Bank, which recently faced a ban in Nigeria.

This development comes as many entrepreneurs on the continent seek reliable banking solutions to support their ventures.

As the startup ecosystem in Africa continues to grow, the need for accessible financial services becomes increasingly critical, and Graph is stepping up to fill this gap.

Mercury Bank, a popular choice among startups for its user-friendly digital banking services, has recently been banned in Nigeria due to regulatory issues.

This decision has left many African founders scrambling for alternatives, as they rely heavily on efficient banking systems to manage their finances, facilitate transactions, and support their growth.

The ban has raised concerns about the stability of digital banking platforms in the region, prompting a search for reliable substitutes.

Also Read – Graph is Offering African Founders an Alternative after Mercury Bank Ban

Graph, a financial technology company, is positioning itself as a viable alternative for African entrepreneurs affected by the Mercury Bank ban.

With a focus on providing tailored financial services, Graph aims to address the unique challenges faced by startups in Africa.

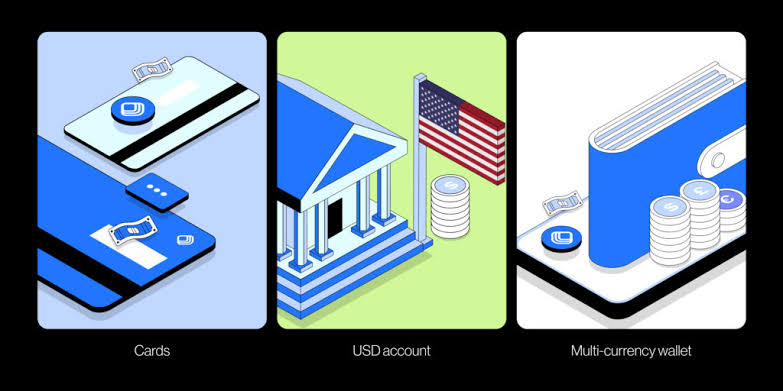

The platform offers a range of features, including multi-currency accounts, seamless payment processing, and integration with various financial tools, making it an attractive option for founders looking to streamline their banking operations.

Graph’s commitment to supporting African founders is evident in its user-friendly interface and robust customer service.

The platform is designed to cater to the specific needs of startups, allowing them to manage their finances efficiently without the complexities often associated with traditional banking systems.

This focus on simplicity and accessibility is crucial for entrepreneurs who may not have extensive financial backgrounds.

For African founders, having access to reliable banking solutions is essential for the growth and sustainability of their businesses.

Many startups operate in a challenging environment where access to capital and financial services can be limited.

The recent ban on Mercury Bank has highlighted the vulnerabilities within the digital banking sector, underscoring the need for alternatives like Graph that can provide stability and support.

Moreover, the ability to conduct transactions in multiple currencies is vital for African founders who often engage in cross-border trade.

Graph’s multi-currency accounts enable entrepreneurs to transact in various currencies, reducing the friction associated with international payments.

This feature is particularly beneficial for startups looking to expand their reach beyond their local markets.

Read Next: Local Banks Step Up After Mercury Pulls Out

In addition to its banking services, Graph is actively fostering a community of African founders.

The platform recognizes that entrepreneurship is not just about financial transactions; it is also about building networks and sharing knowledge.

Graph is creating opportunities for founders to connect with one another, share experiences, and collaborate on projects.

This community-oriented approach is essential for nurturing the entrepreneurial spirit in Africa.

By offering resources such as workshops, mentorship programs, and networking events, Graph aims to empower African founders to succeed in their ventures.

This support system is crucial in a landscape where collaboration can lead to innovative solutions and shared success.

Also Read – Canadian Giant Acquires South African Company, Argon

As the African startup ecosystem continues to evolve, the demand for reliable banking solutions will only grow.

Graph’s emergence as an alternative to Mercury Bank is a positive development for African founders seeking stability and support in their financial operations.

By prioritizing the unique needs of entrepreneurs, Graph is not only filling a gap left by the ban but also contributing to the overall growth of the startup landscape in Africa.

The recent ban on Mercury Bank has created challenges for African founders, but Graph’s innovative approach offers a promising alternative.

By providing tailored financial services, fostering community support, and facilitating networking opportunities, Graph is poised to become a key player in the African fintech space.

As more entrepreneurs turn to Graph for their banking needs, the future looks bright for startups across the continent.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.