Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

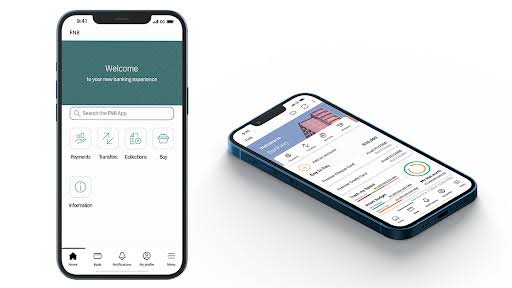

In South Africa, the personal details of 88 South African home loan applicants were accidentally leaked after a technical glitch in the First National Bank (FNB) mobile app in 2023.

The county’s Information Regulator found this out after some preliminary investigation results.

Analysis revealed that the glitch originated from a problem of access permissions allocated to FNB staff.

It was mistakenly characterized as 3,173 authenticated users, whereas those were FNB home loan clients themselves.

Thus, these customers were wrongly termed “unintended recipients” and were given access rights they were not supposed to have because of a classification mistake.

Read: How to Choose the Best Fast Charger for your Android

The technical error resulted in a significant privacy breach for the 88 home loan applicants.

Due to the misplaced access permissions, the unintended recipients (misidentified customers) could potentially view the full names, identification numbers, and potentially other sensitive details of the affected individuals.

The report by the Information Regulator sheds light on the extent of the data breach.

While 3,173 customers received unintended access due to the glitch, only a portion of them (approximately 696) discovered the ability to view the in-progress home loan applications of the 88 impacted individuals.

While details regarding FNB’s specific actions to address the glitch are not available in the current reports, it is expected that the bank will be required to implement corrective measures.

These measures could include improved access control protocols within the app, communication with impacted customers regarding the data breach, and potentially credit monitoring or identity theft protection services.

Also, see: Top 40 African Fintech CEOs and their Companies

This incident underscores the critical importance of robust data security measures in banking applications.

With the increasing reliance on mobile banking for financial transactions and sensitive information management, banks have a responsibility to ensure the highest levels of security to protect customer privacy.

Read More: South Africa’s Corporate Registration Breached by Hackers

The Information Regulator’s investigation into the FNB app glitch sets a precedent for data security in South Africa’s financial sector.

The final findings of the investigation could result in regulatory action against FNB, including potential fines or other penalties. This incident serves as a reminder for all financial institutions to prioritize data security and adhere to data protection regulations.

The data breach raises concerns for the 88 affected home loan applicants. Their personal information, including identification numbers, being exposed puts them at potential risk of identity theft or other forms of financial fraud.

These individuals should remain vigilant and monitor their financial accounts for any suspicious activity.

The FNB app glitch serves as a cautionary tale for the South African financial sector.

This incident highlights the need for stricter data security protocols, improved customer communication regarding data breaches, and potentially even legislative revisions to further strengthen data protection laws in the country.

By prioritizing data security, financial institutions can regain customer trust and ensure the safety of sensitive financial information.

Was this information useful? Drop a nice comment below. You can also check out other useful content by following us on: