Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

We are all aware of how life can occasionally throw us for a loop. That is why being able to obtain fast, dependable loans becomes crucial. And what do you know?

The day is saved by Zuri Cash! For millions of Kenyans, it provides easy access to loans; it is like a bright light of hope.

We will delve deeply into the entire Zuri Cash loan application process in this article. This article will cover everything you need to know, including the prerequisites, eligibility, interest rates, loan and repayment options, So let’s get started.

Zuri is a fast-growing loan app in Kenya reducing the loan application process for borrowers. This fintech loan company gives access to quick cash anywhere and anytime without the long process of application.

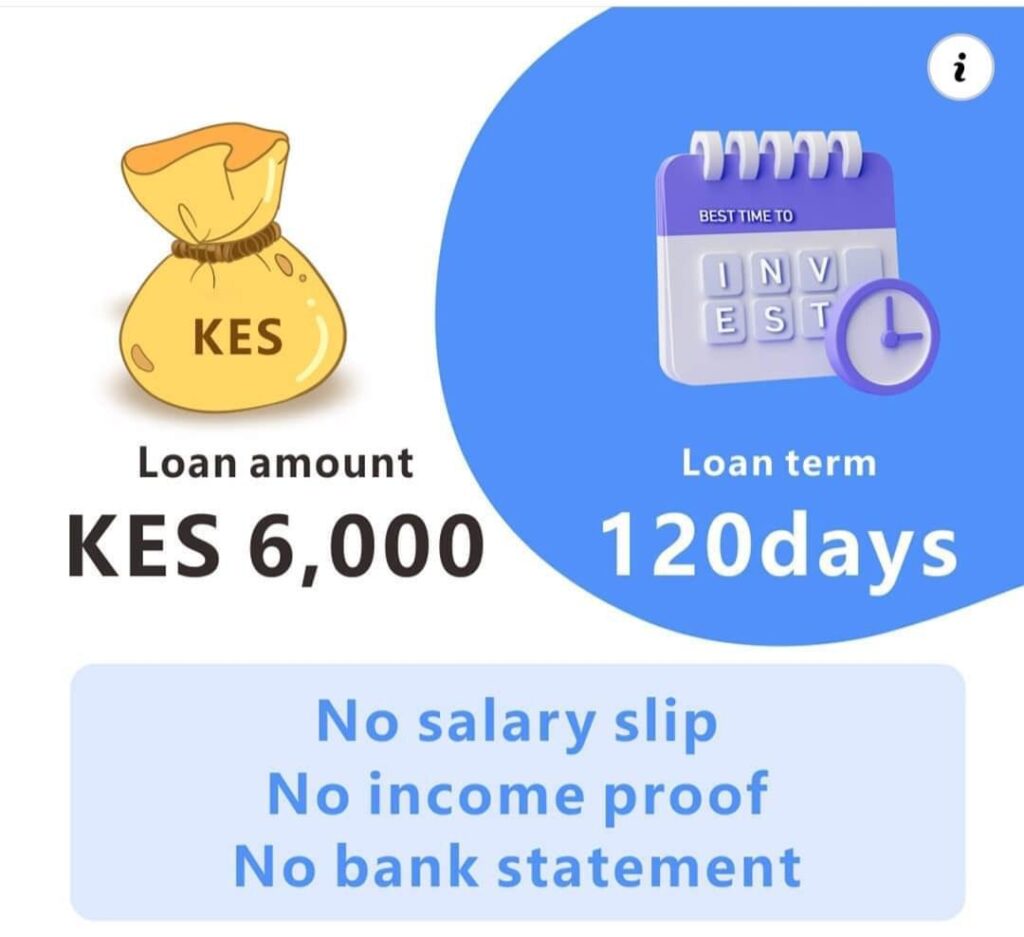

The good thing about Zuri is that you don’t need to be a salaried employee to get a loan.

This means that the app does not require to submit your payslips, bank statements or proof of income to approve your loans.

So if you have tried other options and you do not seem to meet their requirements, Zuri can be the ideal option for you.

Additionally, beyond easy loan access, Zuri rewards you with higher credit when you repay pending loans on time.

Remember, you will not be required to provide any collateral, and there are no fees or charges for using Zuri. You can get loans ranging from 500 Ksh to 50,000 shillings, with the loan term ranging from 91 days to 360 days.

Loan amounts and rates totally depend on the customer’s credit score and the amount of money the customer can repay.

See also: Fair Cash Loan: How to Access It

The application process for Zuri Cash is refreshingly simple. Unlike traditional lenders, Zuri Cash doesn’t require burdensome documentation such as previous payslips, proof of income, or bank statements.

Instead, all applicants need to do is provide their name and phone number to initiate the loan process.

Zuri Cash maintains a flexible eligibility framework, ensuring that individuals from diverse backgrounds can access loans with ease.

While specific criteria may vary, the following are the basic criteria to borrow from Zuri:

You can get Zuri cash loan in a few minutes if you follow the steps below:

Downloading the Zuri Cash app for android from the Google Play Store is the first step.

To continue with the Zuri loan application process, install the application on your smartphone and login.

Open the Zuri Cash app on your smartphone after the installation is finished.

When registering with Zuri Cash, you must enter basic details such as your phone number and name. Fill out the application form provided within the Zuri Cash application.

This form typically requires essential details such as identification information and the loan amount desired.

Determine the desired loan amount by taking into account your ability to repay the loan and your financial needs. Keep in mind that interest rates and repayment conditions may vary depending on the loan amount.

Once the application form has been filled out, check the information to make sure it is accurate. Use the Zuri Cash application platform to submit the application.

Zuri Cash will review your application after it is submitted.

Based on the data you submit, Zuri Cash assesses your profile to determine your eligibility and credit limit.

If your application is accepted, the loan amount will be sent straight into your Zuri Cash account.

A message verifying the loan’s successful distribution will be sent to you.

See also: Senti Loan App in Kenya: How to Download and Activate

It is essential to comprehend interest rates in order to borrow responsibly. Competitive interest rates catered to individual credit profiles are available from Zuri Cash.

For example, if you were to borrow 6,000 Ksh and have a 120-day loan term, you would have to repay 6,660 Ksh. In a same vein, those who repaid 8,000 Ksh would do so with 8,880 Ksh, and those who repaid 10,000 Ksh would do so with 11,100 Ksh.

With no processing fees and a maximum loan amount of 12,000 Ksh, Zuri Cash guarantees clear and reasonable borrowing choices.

See also: Best Phone Loan Apps in Kenya

Repayment is a vital aspect of the borrowing journey. Zuri Cash encourages timely repayments, rewarding borrowers with increased credit limits.

Through the Zuri Cash application, borrowers can conveniently manage repayments, fostering financial responsibility and creditworthiness.

Processing times are variable but speedy approval and disbursement of loans are the norm.

You may usually repay your loan in advance. But do check whether there are any prepayment fees.

See the loan terms regarding other fees such as origination fees or late fees.

You can contact Zuri Loan for further details regarding extensions and charges.

Zuri Cash is a trustworthy ally for people negotiating monetary uncertainty.

With its simple application procedure, open interest rates, and focus on on-time repayments, Zuri Cash gives borrowers the tools they need to reach their financial objectives.

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).