Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Life can be unpredictable. Suddenly, your car needs urgent repairs, your fridge demands expensive indulgences, or your bank balance seems to vanish. It’s in these moments of financial uncertainty that short-term loans come into play. Enter Wonga, not the shining knight but a reliable ally in times of need.

Let’s get a hang of what Wonga offers. It provides short-term loans where you borrow a small sum and repay it with interest within a brief timeframe.

Think of it as a financial trampoline: it catapults you out of emergencies but isn’t designed for long-term comfort.

Also read: Capfin Loan and how to Apply for it

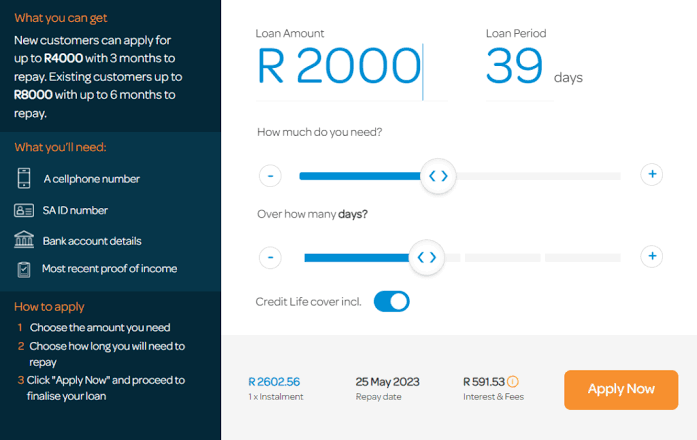

To access Wonga loans, start by visiting their website. Click on the button indicating your intention to apply for a loan. Wonga, similar to Boodle, offers an interest calculator to help you estimate costs before applying, empowering informed borrowing decisions.

When filling out the application, have your personal details, employment information, and bank account details ready.

Wonga may request proof of income, so ensure you have your recent payslip or bank statement handy. Just be cautious not to accidentally include that selfie from your karaoke night.

After submitting your application, it’s a waiting game. Wonga will inform you of their decision, and if everything goes smoothly, your loan will be deposited into your account within minutes.

Also read: How to Apply for Capitec Loan in South Africa

To increase the number of loans repaid on time, Wonga offers automatic repayment. When applying for your loan, you register a debit card, and on your repayment date, the money is automatically deducted.

If there are insufficient funds in your account on the due date, Wonga can attempt to take the payment again.

Wonga loans do not have early repayment fees. You can repay your loan early, reducing the amount of interest paid. Interest is only charged for the days you had the money before clearing your debt.

Late repayments incur a small charge (on the third day after the loan’s repayment deadline). Interest continues to accrue for up to an additional 30 days. At most, you’ll be asked to repay double the value of the loan taken out. Total repayment amounts will never exceed this cap.

Also read: Capfin Loan Application: how to Access Capfin Loan

Wonga is a short-term loan provider that offers financial assistance for emergencies or unexpected expenses.

To apply for a loan, visit their website and click on the button to apply. You’ll need to provide personal details, employment information, and bank account details.

You may need proof of income, such as a recent payslip or bank statement, to support your loan application.

No, they do not have early repayment fees. You can repay your loan early to reduce interest charges.

Yes, you may be asked to repay double the value of the loan taken out, but total repayment amounts will never exceed this cap.

Also read: Finchoice Loan Application Online: how to Apply

In conclusion, Wonga offers a reliable solution for short-term financial needs, providing quick access to funds without early repayment fees. Their automatic repayment option and transparent fee structure make it convenient for borrowers to manage their loans effectively.

However, it’s important to borrow responsibly and ensure timely repayments to avoid additional charges. With Wonga, borrowers can navigate financial challenges with ease and confidence, knowing they have a trusted partner for their short-term financial needs.

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech