Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

If you find yourself short on cash before your next paycheck and need to cope with an emergency, it may be worth studying the best mobile loan app in Kenya.

Instant loans are becoming more popular in Kenya, particularly in times of emergency. Safaricom’s M-pesa is the country’s first mobile money transfer and loan application. It has spurred Kenyan banks and other financial institutions to adopt instant mobile lending apps, and some have even cooperated with them.

According to a report by Enwealth Financial Services and Strathmore University Social Security study group, only 24% of Kenyans save for emergencies, and the majority of people are from other financial institutions.

In this article, we’ll look at the top 15 mobile loan apps in Kenya for instant loans. There’s an app for that, whether you need a tiny loan to get by or a larger loan for a larger buy. Continue reading to learn about the top mobile loan apps for an instant financial boost!

In Kenya, mobile instant loan apps have proven to be a useful alternative for quick credit access, particularly for those who are unable to obtain regular bank loans. These apps employ mobile technologies and platforms like M-Pesa to speed up the procedure.

Prospective borrowers download the app, fill out basic information, and immediately enter the desired loan amount and repayment duration. Unlike traditional lenders, these applications use data analysis from users’ phones to evaluate credit, which makes them appealing to those with low financial backgrounds.

Upon approval, funds will be electronically placed into the borrower’s M-Pesa or bank account, providing near-instant access. M-Pesa, bank transfers, and credit cards are all available as repayment methods.

Even though these apps are quick and convenient, borrowers must exercise caution. High-interest rates and short payback times may cause budgetary concerns. Borrowers should completely grasp all loan terms, including interest rates and fees, and make comfortable repayments to avoid debt spirals.

Related – Zash Loan: how to Register and Apply

To qualify for an instant loan from the mobile loan apps in Kenya, you must consider having the following:

Before receiving cash, users are often required to consent to and comply with the lending app’s terms and conditions, which include interest rates, repayment schedules, and privacy policies.

Read Also – Lendplus Loan App: how to Download, Register, and Apply

Top mobile loan apps in Kenya offer a variety of features and incentives aimed at meeting users’ immediate monetary needs. Here’s a top-level perspective:

In a word, the combination of rapid loan, mobile money compatibility, no collateral requirements, flexible repayment options, and credit score building makes top mobile lending apps an attractive option for many Kenyans seeking immediate cash access.

If you are short on cash and in need of it, rapid loan apps in Kenya can provide you with emergency credit. The following applications have simple loaning processes and can provide large amounts.

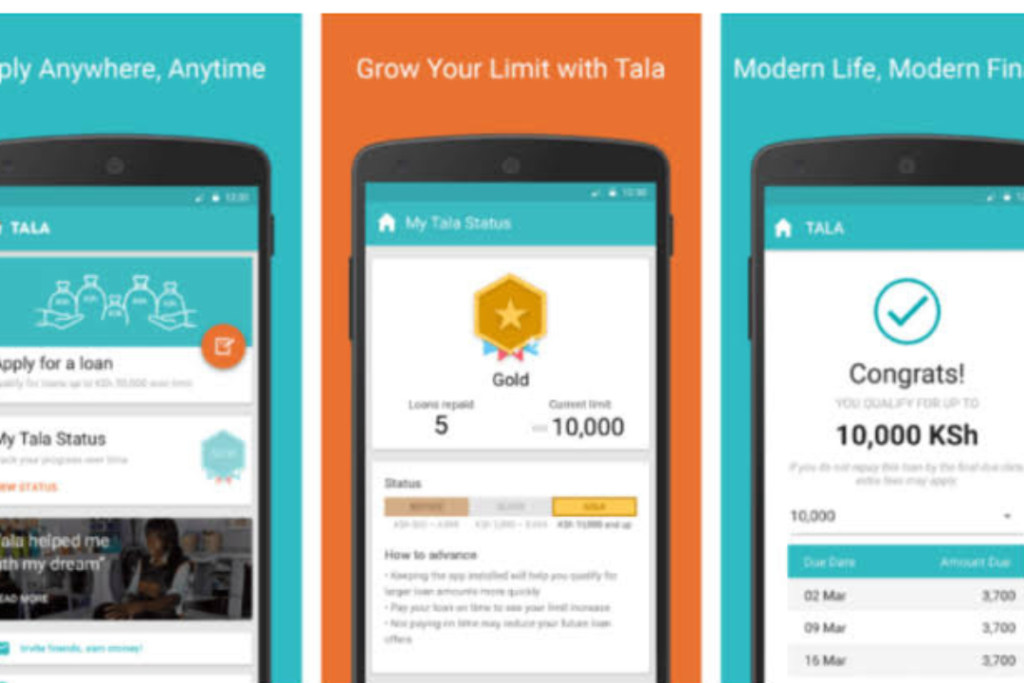

Tala is one of Kenya’s most popular non-CRB loan apps. The software has received numerous downloads and high ratings from users. Apply once and borrow from your credit limit of up to KSH 50,000 as needed.

To apply for loans, download the Tala app from the Google Play Store and register. During the registration procedure, the app verifies your information before transferring the loan to your M-Pesa account. You can repay the loan in whole or in installments by using Mpesa Xpress or Pay bill 851900.

M-pesa Africa was founded in April 2020 and operates in seven countries, including Kenya (Safaricom). Safaricom’s M-pesa app is one of Kenya’s most extensively used mobile loan services. Mshwari mobile banking offers both savings and credit options.

M-Shwari loans (from Ksh. 1,000 to Ksh. 1 million) are only available to Safaricom customers who have a registered line. Your credit history determines the maximum limit. The yearly interest rate for the loans is 9%, with a one-time cost of 7.5% and an excise duty levy of 1.5%.

Meanwhile, Mshwari’s deposits yielded a fair yearly interest rate: 3% for Ksh. 1–20,000, 5% for Ksh. 20,000–50,000, and 6% for sales of more than Ksh. 50,000.

Branch International developed the Branch loan app. The app employs data-driven technologies to evaluate your creditworthiness and provide loans that are targeted to you. The loan app gives financing up to Ksh.30,000.

You do not need to fill out any lengthy paperwork to obtain the loans. The branch examines your smartphone data to determine your financial habits. This means that more people can get loans, even if they’ve never used credit before.

The Branch App’s monthly interest rate (1.7% – 17.6%) is likewise reasonably low, although it changes depending on several factors, including repayment behavior after taking out a loan. Furthermore, the loan length is adjustable, ranging from 9 to 52 weeks, depending on the amount borrowed.

Aside from lending money, the Branch also provides ground-breaking budgeting and savings solutions. It offers high-yielding savings products, Flexi Savings and Target Savings, with annual interest rates of 9% and 15%, respectively.

Zenka offers you the possibility to get a 61-day quick loan for a single processing fee ranging from 9 to 30%. Zenka’s unique zero-interest offer for first-time app users distinguishes it from competitors.

Zenka provides a flexible loan limit ranging from Ksh. 500 to Ksh. 20,000 to accommodate a variety of financial needs.

The unique Zenka Flexi option benefits customers with good credit and payback records by allowing them to prolong loan repayment for up to 12 months.

Read Also – iPesa Loan App: How to Download and Apply For Loan

Patron is the finest lender app for consumers with terrible credit who need small loans to cover minor needs. This advance app allows you to receive loans ranging from Ksh500 to Ksh7,000 at a daily interest rate of 1%.

Even better, Patron offers a reasonable repayment period of 60 days for short-term funding and 90 days for long-term loans. Furthermore, loan deposits to Mpesa are rapid, making it an excellent choice for people who require immediate cash assistance.

Patron loan application Kenya is owned by Russian businessman Mikhail Lyapin, a cloud technology expert from Murmansk, the world’s largest city beyond the Arctic Circle and located in the northwestern section of the world’s largest country.

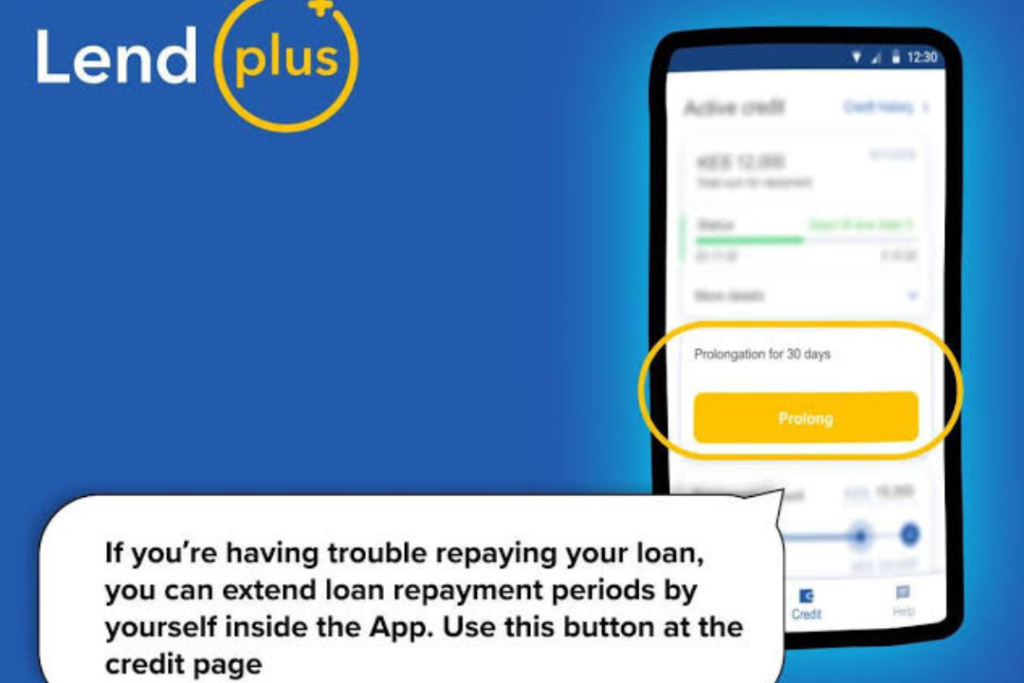

LendPlus is a fintech startup that provides personal loans ranging from Ksh500 to Ksh 30,000, with maturities ranging from five to thirty days with a daily interest rate of 2%. This interest rate may be exorbitant, but LendPlus allows you to prolong your loan term as long as you pay the accrued interest on your borrowed amount.

Furthermore, there are no origination or processing fees when borrowing with LendPlus, making it even easier to obtain emergency finances.

Aventus Technology Limited of the Aventus Group, a Lithuanian investment corporation led by Andrejus Trofimovas, operates LendPlus.

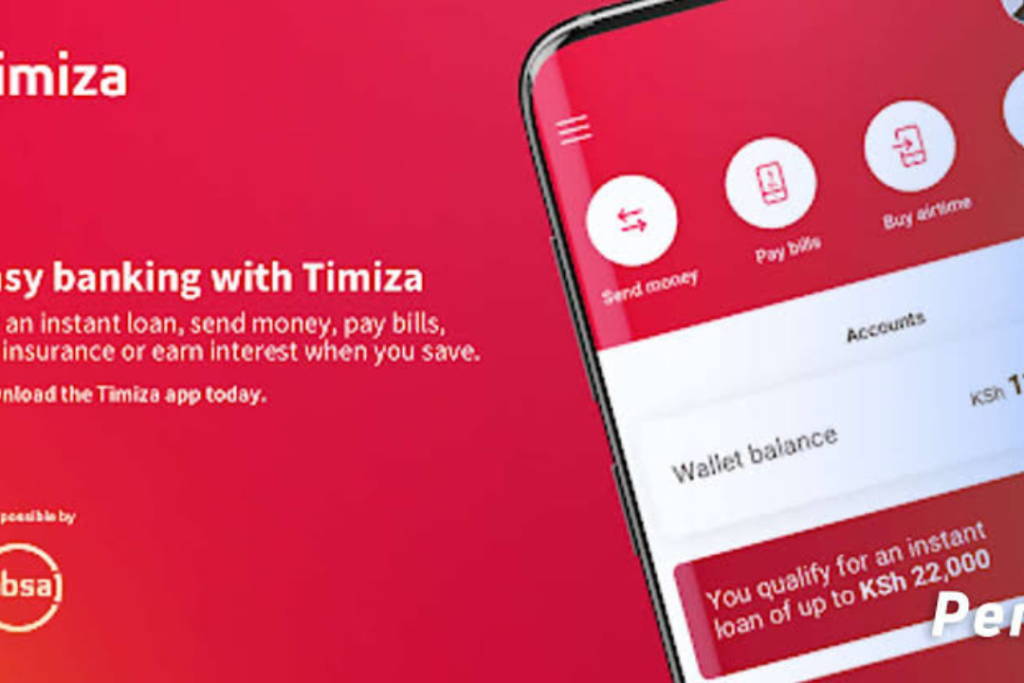

Unlike most of the money-borrowing applications on this list, the Timiza loan app allows you to pay bills, make insurance payments, and fill up your airtime, in addition to offering loans of up to Ksh 150,000 to borrowers with poor credit.

Timiza is an Absa Bank product that is available through mobile applications from various app markets or by dialing *848# on your phone. Timiza loans feature a 1.56% monthly interest rate, a 5% origination charge, and a 30-day repayment period.

If you fail to make loan payments, your loan period will be extended by one month, but you will be charged a 5% fee based on your outstanding debt.

Zash Loan App is Zillions Credit Limited Company’s consumer lending platform, giving personal loans ranging from Ksh500 to Ksh 50,000 with minimum credit score restrictions.

This app is one of the greatest and most trustworthy lending applications in Kenya since it promises and delivers emergency loans with a 1% daily interest rate.

Zash’s discount marketing strategy includes redeemable coupons that increase loan limits during loan applications and repayment coupons that reduce loan amounts after loan settlement.

Furthermore, if a borrower fails to pay the loan by the due date, they can negotiate for an extension with the Zash Loan team, and the outstanding debt will not accrue interest during the grace period.

However, defaulting on Zash loans without contacting the creditor results in a 2% penalty fee on the unpaid loan for the first 15 days after the due date, increasing to 3% on subsequent days.

Also Read – Meta Loan App: How to Download and Apply For a Loan

KCB M-pesa is now easily accessible to registered M-Pesa users thanks to a relationship between the two companies. There is no need to download or install the app; it is already available on your mobile device.

To apply for a loan, simply click on the KCB Mpesa button under loans and savings and enter the loan amount you need. No further registration or personal information is required.

KCB M-Pesa provides seamless loan distribution directly to your M-Pesa account, cementing its position as one of Kenya’s leading online M-Pesa loan providers.

Mkopo Haraka prides itself on being one of Kenya’s fastest loan disbursement systems. It is an app with a user-friendly UI and cutting-edge technology that makes loans simple, quick, and handy for anyone in need of cash right away.

This platform efficiently serves a broad spectrum of borrowers by lending up to Ksh 50,000 as a credit limit.

Mkopo Haraka seeks to provide secure and convenient online or cash loans while safeguarding the protection of its customers. It enables borrowers to meet their financial obligations with ease.

This app offers various payback plans, ranging from 91 days to one year (365 days). As a result, it assures that borrowing is appropriate for one’s economic situation. Mkopo Haraka is accessible to Kenyans because it offers trustworthy lending alternatives ranging from KSh 500 to KSh 50,000.

iPesa is a quick lending application that allows Kenyans to receive funds quickly and without the need for CRB approval. The software allows users to acquire loans of up to Ksh 50,000 with repayment terms of either 91 or 180 days.

Interest rates on iPesa’s offers start at 36% and rise to a maximum of 72%; however, the company charges no service costs upon successful receipt of money. To be eligible for an iPesa loan, you must be at least 18 years old and have a valid M-Pesa account.

The application process is quick and simple, and the app provides immediate feedback on whether the request has been accepted or refused. People in Kenya can easily acquire funds for personal or business purposes thanks to the iPesa service.

Okash is a mobile loan application that provides customers with fast, unsecured loans. A proprietary algorithm evaluates creditworthiness. Okash offers payback terms of up to 14 days and affordable interest rates.

The Okash loan platform allows you to acquire personal and business loans of up to Ksh. 60,000 after downloading and installing the app from the Google Play Store and registering to access immediate loans.

Your borrowing limit and repayment plan on the Okash app are set based on your registration details and a rigorous analysis performed upon application submission. All loans have an annual interest rate of 14%.

The Hustler Fund of Kenya was established on November 30, 2022, to provide its people with an annual pool of Ksh. 50 billion for five years or more, allowing them easier access to financial possibilities. This initiative provides individuals with financial loans of up to Ksh.50,000 apiece.

To obtain loans, download the Hustler Fund app from the Google Play Store or dial *254# on the Safaricom network.

The app assesses creditworthiness and offers flexible payback choices based on alternative data. Furthermore, Hustler Fund provides borrowers with business growth help, guiding them on their entrepreneurial route to success.

Are you aware of Fuliza? M-Pesa includes an innovative solution that allows customers to use overdraft facilities when their account balance is inadequate for a transaction. Isn’t it fascinating? This function allows you to borrow up to Ksh 70,000 through Fuliza.

To activate the Fuliza M-Pesa service, call *234# and select it. However, before that, you must have an active Safaricom M-PESA line, be registered on the platform, and opt into the Fuliza service.

Remember that any residual balance will be charged a 1% interest rate plus a maintenance fee.

Opesa, a mobile loan application in Kenya, is well-known for offering consumers fast, unsecured loans. The app’s flexible repayment terms allow consumers to secure loans of up to Ksh 30,000.

Furthermore, Opesa gives clients financial education to help them improve their credit scores. The app’s user-friendliness enables a quick and simple loan application process, with funds instantly sent into the borrower’s mobile wallet.

Also Read – Kashway Loan App: How to Apply

According to Reel Analytics research, 55 out of every 100 Kenyans surveyed had borrowed from digital lending services. According to the State of Digital Lending Report, the majority of digital lending platform users (66%) live in cities, with the majority of subscribers aged 30 to 34 years old.

Most Kenyans favored digital platforms since they were easier to use and allowed them to remit loans faster.

In the report, Kenya has over 45 digital credit providers. However, some Kenyans have fallen prey to fraudulent loan apps. The India Times published methods for identifying them.

One method for identifying phony loan applications is to look for their physical address. Fake loan applications do not have a proper address. Others share non-existent physical addresses. Before borrowing, make sure the app is legitimate.

Fake loan apps never consider if the borrower would repay their loans. As a result, they aim to obtain as much personal information from them as possible to utilize it for blackmail.

Illegal lending apps typically want access to borrowers’ personal information, such as images and phone contacts. They will utilize them to contact potential borrowers.

Before disbursing the loan, the apps will request a registration fee’. Others promise to reimburse the money when the loan is processed. Legal apps subtract the borrowing charge immediately from the loan amount borrowed.

While some experienced fraudsters have websites, it is important to check how the Uniform Resource Locator (URL) appears. The URL should be https, not http. Http indicates that fraudsters can take your information if you log into their websites.

The bulk of fraudulent internet lenders make loans at exorbitant interest rates, mostly targeting cash-strapped and financially desperate populations. Typically, these loan applications authorize loans quickly without verification. Checking online reviews and ratings will allow you to identify fakes.

Now you have an idea of the top mobile loan apps that could be helpful in case of a sudden financial need or for personal development purposes.

While these apps are very handy, it is crucial to take note of responsible borrowing. It is important to understand the terms, interest rates, and repayment schedules before taking any loan.

Borrow only what you need and make sure you can afford to pay back the money easily. Well, try out these mobile loan apps and tell me how it goes with you.

Eligibility criteria vary between special cell loan apps but typically require that you be a Kenyan citizen or resident, have a valid national ID, be of criminal age (18 years or older), have an active cellular cash account, and have a good repayment history on previous loans, if applicable.

The pace with which loans are disbursed varies per app and is determined by criteria such as your creditworthiness and verification technique. Nonetheless, several of those apps provide quick or near-instant loans, with the funds being transferred to your cell cash account within minutes of acceptance.

Many mobile lending apps have different interest rates and repayment lengths, with only a few offering affordable rates and flexible fee schedules. It is critical to carefully study the terms and conditions of each app before borrowing to understand their interest rates, pricing, and charge due dates.