Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

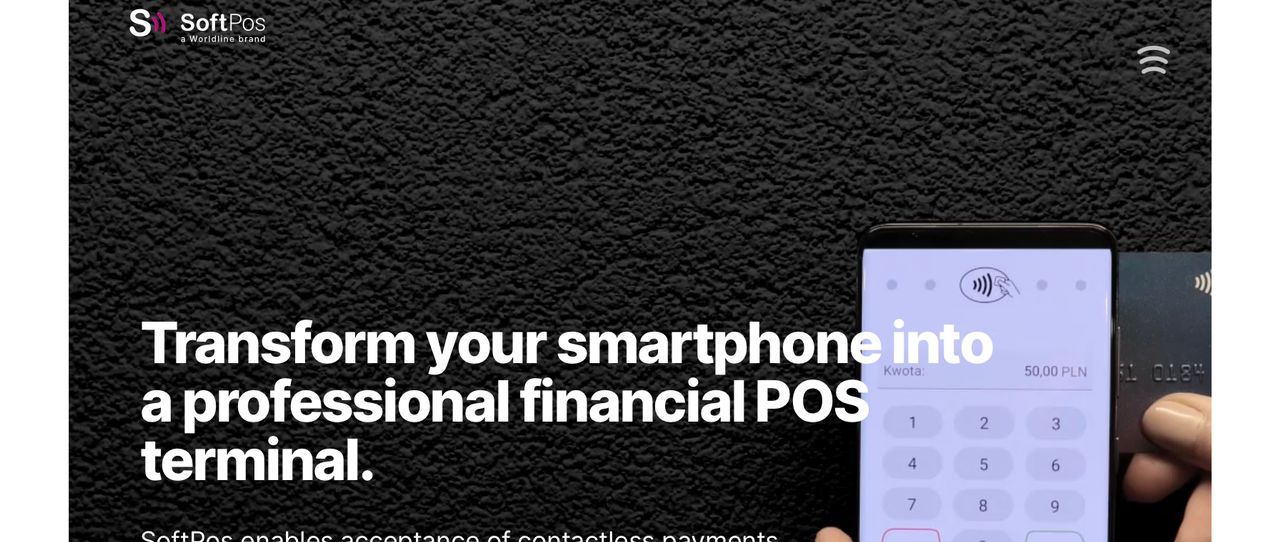

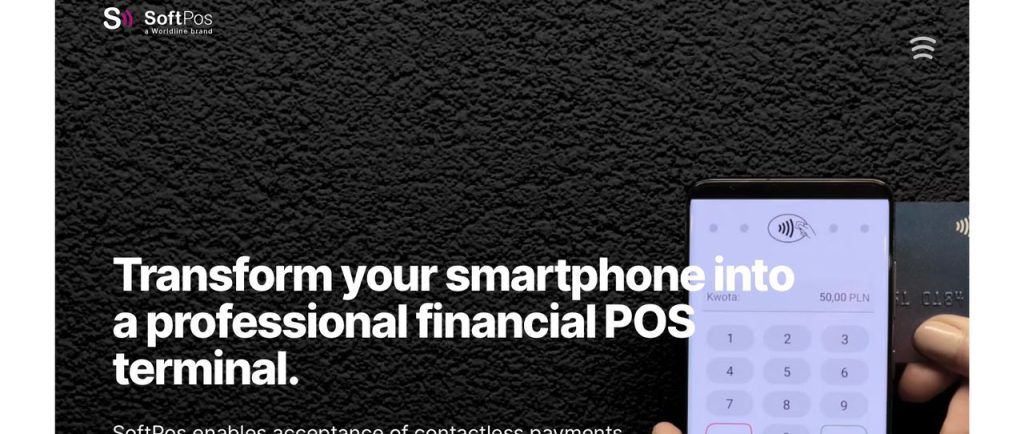

SoftPOS growth to address funds transfer issue: Stakeholders in e-commerce have called for broader adoption of SoftPOS; a payment system that enables financial transactions without physical machines.

According to the stakeholders, it had the potential to solve financial transfer issues.

Stakeholders, including bankers, fintech companies and e-commerce platforms made the call at a gathering recently, tagged ‘ Accelerating Contactless Adoption: A Collaboration Approach to Overcoming Adoption Barriers’, held in Lagos.

SoftPOS is a software-based POS that runs on a smartphone or tablet without the need for additional hardware or systems.

Contactless payments work via a type of wireless data transfer called near-field communication (NFC), which permits the sharing of information independent of an internet connection.

This is what allows card terminals to read the chip on a debit or credit card, for example, or to accept mobile wallet payments.

SoftPOS works by virtue of the fact that smartphones’ NFC capabilities are a two-way street: The devices can both send and receive signals. Merchants simply download a smartphone app that enables contactless payment acceptance, and customers tap their contactless payment cards to the retailer’s device to initiate payments.

Wole Faroun, the convener of the event and CEO of NetPlusDotCom, emphasized that while SoftPOS has made significant strides in enhancing payment accessibility and convenience, it has yet to achieve widespread adoption.

SoftPOS is powered by Near Field Communication (NFC) technology, allowing users to make payments without physical contact.

He stated that, “SoftPOS technology transforms smartphones into payment terminals, eliminating the need for traditional Point of Sale hardware.”

Also Read: Minister Investigates NIN Data Breach, Proposes N100 Solution

As a financial innovation, SoftPOS has been recognized for its potential to revolutionize payment systems. NetPlusDotCom has been at the forefront of this NFC innovation in Nigeria, partnering with major commercial banks such as Providus, Zenith, FCMB, Wema Bank, and First Bank.

Participants at the event identified several challenges hindering the adoption of contactless payment systems, including a lack of education about the technology, poverty, and the unavailability of internet services in some regions of the country.

Kayode Sangoleye, Group Head of e-business at Providus Bank, highlighted the bank’s development of Providus SoftPOS, which was launched in 2023 in partnership with Mastercard.

He noted that the drive for SoftPOS stemmed from the need to find a more profitable business model compared to traditional POS machines, which banks typically provide to merchants for free despite their $100 purchase cost.

Frank Atat, Divisional Head of Payment and Solutions at FCMB, pointed out that the high cost of NFC-enabled smartphones is a significant barrier, as many Nigerians cannot afford these devices.

The stakeholders concluded that there is a critical need for collaboration to develop a more profitable business model for SoftPOS that benefits both commercial banks and digital financial service providers.

Enhanced education on SoftPOS technology and improved infrastructure could also play crucial roles in overcoming these adoption barriers, ultimately improving financial transactions and economic activity in Nigeria.