Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

The Personal Loan Repayment Calculator is a powerful financial tool designed to assist individuals in understanding and managing their loan obligations effectively.

This user-friendly online calculator provides a straightforward way to estimate monthly loan payments based on key factors such as loan amount, interest rate, and loan term.

By inputting these details, borrowers can gain valuable insights into their repayment schedule, empowering them to make informed decisions about their finances.

In this post, we’ll be reviewing all you need to know about the personal Loan Repayment Calculator and how to make use of it.

Personal loans are like borrowed money that you don’t have to give any specific reason for using. You can use them for things like going on a trip or paying medical bills.

But, because you don’t put up any collateral, like a car or a house, the interest rates are usually higher. So, it’s important to plan ahead and figure out how much you can afford to pay back each month. That’s where personal loan calculators come in.

They’re online tools that help you figure out how much your monthly payments will be based on how much you borrowed, how long you have to pay it back, and the interest rate.

Read also:South Africa’s WeBuyCars Launches on Johannesburg Stock Exchange

Think of a personal loan repayment calculator as a handy device that does the math for you. When you’re considering taking out a loan, you might wonder how much you’ll need to pay back each month and how much extra you’ll pay in interest over time. That’s where the calculator comes in.

By entering the loan amount (the total you want to borrow), the loan term (how long you plan to take to pay it back), and the interest rate, the calculator gives you an idea of what your monthly payments will be and how much interest you’ll end up paying altogether.

It’s a useful tool for planning and budgeting before you commit to borrowing money.

Read also:DSCR Loan in South Africa: how to Apply

To figure out how much you’ll pay each month on your loan, you can use this simple maths formula:

EMI = [P x R x (1+R) ^N] / [(1+R) ^ N-1]

Here, ‘P’ is how much you borrow, ‘R’ is the interest rate, and ‘N’ is how long you’ll take to repay.

Doing this maths by hand can be slow and might lead to mistakes. Instead, you can use an online tool called a personal loan calculator. It’s quick, accurate, and saves you time.

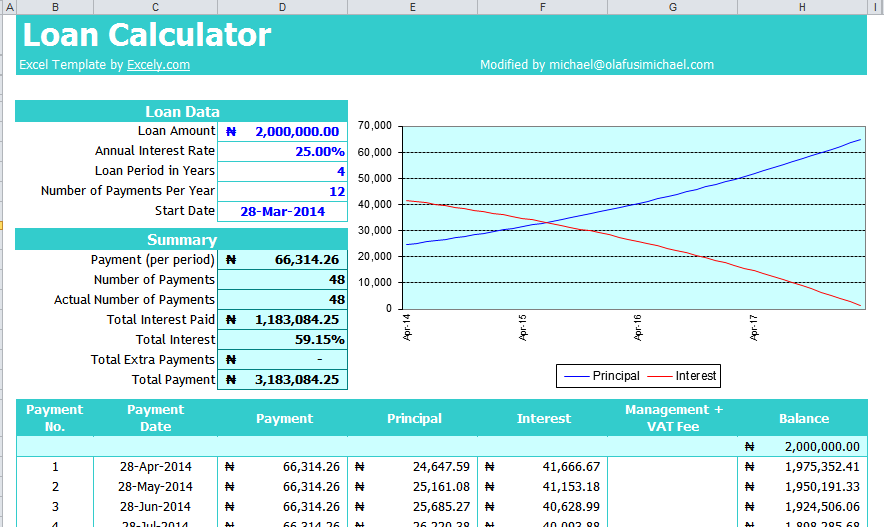

With this tool, you can try different amounts, interest rates, and repayment times until you find a monthly payment that works for you.

Your loan payments include both the amount you borrowed and the interest on that amount. At first, most of your payment goes toward paying the interest. But as you keep making payments, more of it goes toward paying back what you borrowed.

Some calculators can even show you how much of each payment goes toward interest and how much goes toward paying off the loan.

Read also:How to View and Remove Google Chrome’s Incognito History

Using a personal loan calculator is an easy process that can help you understand the financial implications of taking out a loan.

Below are steps to follow:

This is the initial sum of money you wish to borrow from the lender. It could be for various purposes like buying a car, paying for education, or covering unexpected expenses. For example, if you need $10,000 to buy a car, you would enter that amount.

The interest rate is the additional cost you’ll pay for borrowing the money, expressed as a percentage of the loan amount. Lenders determine interest rates based on factors like your credit score, income, and loan term. Let’s say the lender offers you an interest rate of 8% on your $10,000 loan.

Loan tenure refers to the duration over which you’ll repay the loan. It’s typically measured in months or years.

You can choose a shorter tenure for higher monthly payments or a longer tenure for lower monthly payments but more interest paid over time. For instance, you might decide to repay the $10,000 loan over five years.

EMI stands for Equated Monthly Installment, which is the fixed amount you’ll pay each month towards repaying the loan. The calculator will generate these details based on the principal amount, interest rate, and loan tenure you entered.

It gives you a clear picture of your repayment schedule and how much the loan will cost you in total.Take the time to review these figures carefully to ensure they align with your budget and financial goals.

If the initial results seem unfeasible or if you’re exploring different scenarios, consider adjusting the loan amount, interest rate, or loan term using the calculator’s interactive features.

This allows you to compare various options and find the most suitable repayment plan for your needs.

Assess whether the estimated monthly payments are manageable within your current budget. Consider factors such as your income, existing financial obligations, and potential fluctuations in expenses.

It’s crucial to ensure that you can comfortably afford the repayments without jeopardizing your financial stability.

If you’re unsure about certain aspects or need clarification on complex financial terms, don’t hesitate to consult with a financial advisor or loan specialist.

They can offer personalized guidance based on your unique circumstances and help you make informed decisions regarding your loan repayment strategy.

With the listed steps above one can easily calculate how much he/she needs to pay for a given Personal loan

Read also: EU Begins Investigations on Apple, Meta and Google

Getting a personal loan is pretty straightforward. You can get one from regular banks, credit unions, online lenders, or even peer-to-peer lending platforms.

If your credit score isn’t amazing or if you’re just starting to build credit, credit unions might be more willing to give you a loan.

However, there are also online lenders who work with people who have less-than-perfect credit.

Usually, the process of applying for and getting approved for a personal loan is quick, and you’ll typically receive the money within a couple of business days.

Personal loans don’t require any collateral, so your credit score is super important. People with really good credit scores usually get the best deals.

But before you start applying, it’s a good idea to check your credit report for any mistakes and to make sure you meet the lender’s credit requirements.

It’s also important to think about why you need the loan before you pick a lender. For example, if you are borrowing money for home improvements, you might want to go with a different lender than if you’re consolidating debt.

While you can technically use personal loans for almost anything, some lenders offer better deals for specific situations.

Once you’ve narrowed down your options, compare the interest rates from different lenders. You can use an online calculator to see how much each option will cost you over the life of the personal loan. And don’t forget to check for any fees, like origination fees, prepayment penalties, application fees, or late fees.

Even though they might seem small, they can really add up and affect how much your loan is actually worth. So, make sure to read all the details carefully before you agree to anything.

Read also:Latest on How to Borrow Money from PalmPay in 2024

When you take out a personal loan to cover urgent expenses, like emergencies or unexpected bills, it’s really important to pay it back on time and in full.

Doing this not only helps you avoid getting into financial trouble but also improves your credit score. This is important because a good credit score makes it easier for you to borrow money in the future, like getting approved for a mortgage or a car loan.

One way to make sure you can manage your loan repayments is by looking at how much you earn each month and making sure that the monthly payments for your loan don’t take up more than half of that amount.

So, if you earn $2,000 a month, try to keep your monthly loan payments under $1,000. This way, you’ll have enough money left over for your other expenses, like rent, groceries, and bills.

Read also:Top 10 Loan Apps for Urgent Loans in Kenya

By providing a detailed breakdown of repayment amounts, a loan calculator promotes transparency, allowing borrowers to understand the cost implications of their borrowing decisions.

Utilizing a loan calculator facilitates effective financial planning by enabling borrowers to anticipate and budget for future loan payments accurately.

With the ability to input different loan parameters, borrowers can use the calculator to compare offers from multiple lenders and choose the most favorable terms.

Armed with comprehensive loan repayment information, borrowers feel empowered to take control of their financial situation and make informed choices that align with their long-term goals.

To calculate your loan payments, you use this formula:

EMI = [P x R x (1+R) ^N] / [(1+R) ^ N-1]

Where P stands for the loan amount, R is the interest rate, and N is how long you have the loan for.

A Personal Loan Repayment Calculator is an online tool for estimating monthly loan payments based on factors like loan amount, interest rate, and loan term.

You can figure out how much you need to pay for your loan using an online tool called a personal loan repayment calculator. These calculators, sometimes called EMI calculators, use your loan amount, how long you have the loan for, and the interest rate to find out how much you need to pay each month

Interest rates for personal loans can be anywhere from around 6 percent to 36 percent. It’s better to aim for the lower end of that range, but you also need to think about how long you’ll take to pay it back. The longer you take, the more extra money you’ll pay in interest over time.

Having bad credit can make it hard to get approved for a personal loan. However, there are some loan options made specifically for people with not-so-great credit histories.

A Personal Loan Repayment Calculator is an online tool for estimating monthly loan payments based on factors like loan amount, interest rate, and loan term.

Results are estimates; actual terms may vary slightly due to factors like interest rate changes.

Yes, input different parameters to compare offers from multiple lenders and choose the best terms.

In conclusion, a Personal Loan Repayment Calculator serves as a valuable tool for individuals navigating the complexities of borrowing and repaying loans.

By following the steps outlined in this article and using the benefits of a loan calculator, borrowers can gain clarity, make informed decisions, and embark on a path toward financial stability and success.

Remember, knowledge is key when it comes to managing your finances, and a personal loan repayment calculator puts that knowledge at your fingertips.

If you found this piece useful, kindly drop a nice comment .Also visit and follow us on Facebook @SiliconAfrica for access to more of our interesting contents.