Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

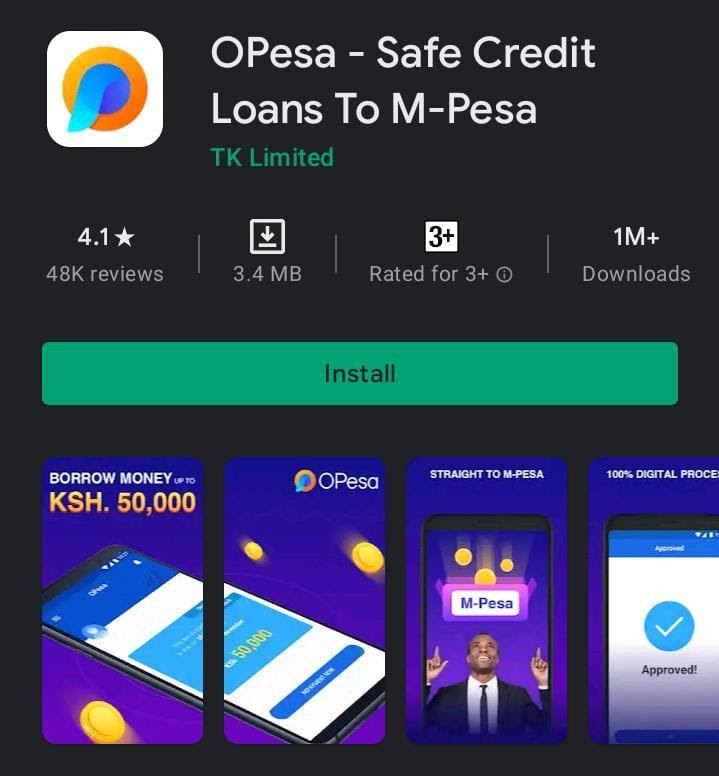

Opesa Loan has established itself as a trustworthy mobile lending app in Kenya during this era of mobile lending. Tenspot Kenya Limited introduced the Opesa loan app. The business is located in Apollo Centre along Ring Road in Parklands.

With over 500,000 downloads on the Play Store since its launch earlier this year, Opesa is a reputable microlender offering loans between Kenya Shillings 500 and $30,000.

Opesa loan is designed to provide hassle-free borrowing experiences. Opesa offers instant loans to users through a user-friendly mobile application.

In this article, we’ll explore everything you need to know about accessing Opesa loans, understanding your Opesa loan limit, and utilizing the Opesa loan app to its full potential.

Read also – Latest on How to Borrow Data on Glo

Opesa loan is a leading digital lending platform that leverages technology to provide instant loans to individuals in Kenya. Operating under the umbrella of Tenspot Kenya Limited, Opesa aims to bridge the gap between financial institutions and borrowers by offering accessible and transparent lending solutions.

With Opesa loan, users can apply for loans directly from their mobile devices, eliminating the need for lengthy paperwork and traditional bank visits.

Read also – Zenka Loan App: How to get Mobile Loan in 5 Minutes

Similar to other digital lending platforms, Opesa loan imposes loan limits on its users to manage risk and ensure responsible borrowing practices.

Your Opesa loan limit is determined by various factors, including your repayment history, creditworthiness, and financial behavior. Initially, new users may have lower loan limits, which can increase over time as they demonstrate responsible borrowing habits.

To check your Opesa loan limit, simply log in to the Opesa loan app and navigate to the loan application section. Here, you’ll find details about your available loan limit and eligibility criteria.

Understanding your opesa loan limit is crucial for planning your borrowing needs and maximizing the benefits of the Opesa platform.

Accessing Opesa loans is a straightforward process, thanks to the intuitive design of the Opesa loan app. Here’s a step-by-step guide to applying for an Opesa loan:

Start by downloading the Opesa loan app from the Google Play Store for Android users or the Apple App Store for iOS users. Install the app on your mobile device and complete the registration process to create your account.

To apply for a loan, you’ll need to provide some basic personal and financial information, including your name, phone number, national ID number, and employment details.

Opesa may require you to verify your identity through various means, such as providing a copy of your national ID or linking your social media accounts.

Once your account is set up and verified, you can proceed to submit a loan application through the app. Specify the desired loan amount and repayment duration before submitting your request.

Opesa will evaluate your application based on its internal credit scoring algorithms. If approved, the loan amount will be disbursed directly to your mobile money wallet, usually within minutes.

Give Opesa permission to access your location, phone number, text messages, mobile data, and photo from the app’s main screen. By giving Opesa this authorization, you let them use your phone to make calls and send texts.

Fill in the required fields below to continue with the registration process. This comprises;

When you accurately enter your personal information, the app will provide a confirmation code for you to enter; if not, you can manually enter it to allow the app to validate your information before approving your loan.

Opesa Loans offer several advantages that make them an attractive option for individuals in need of quick financial assistance. Here are some of the key advantages of Opesa Loans:

One of the primary advantages of Opesa Loans is the ability to access funds instantly. Once your loan application is approved, the funds are disbursed directly to your mobile money account within minutes, allowing you to address urgent financial needs promptly.

Opesa Loans can be accessed conveniently from anywhere, at any time, using the Opesa Loan app on your smartphone. There’s no need to visit a bank branch or fill out lengthy paperwork, making the borrowing process quick and hassle-free.

Opesa offers flexible loan limits tailored to each individual’s financial situation. Your loan limit is determined based on factors such as your creditworthiness, transaction history, and repayment behavior, ensuring that you can borrow an amount that suits your needs and financial capacity.

They come with competitive interest rates compared to traditional lenders and informal borrowing options. This helps borrowers save on interest costs and makes loan repayment more affordable.

Opesa is committed to transparency in its lending practices, ensuring that borrowers fully understand the terms and conditions of their loans upfront. There are no hidden fees or charges, allowing borrowers to make informed borrowing decisions.

Responsible borrowing and timely repayment of can help build your credit profile over time. As you demonstrate a positive repayment history, you may become eligible for higher loan limits and better terms in the future.

This kind of loans are unsecured, meaning you don’t need to provide any collateral to qualify for a loan. This makes them accessible to a wide range of individuals, including those who may not have valuable assets to pledge as security.

By providing access to quick and convenient loans, Opesa empowers individuals to take control of their finances and address financial emergencies effectively. Whether it’s covering medical expenses, paying bills, or seizing business opportunities, Opesa Loans provide the financial flexibility needed to navigate life’s challenges.

Overall, Opesa Loans offer a range of advantages that make them an attractive option for individuals seeking convenient and affordable access to credit. By leveraging these advantages responsibly, borrowers can effectively manage their financial needs and achieve their goals with confidence.

Read also – Hustler Fund Loan and How to Apply

While Opesa Loans offer several advantages, it’s important to consider the potential disadvantages associated with borrowing through this platform:

While Opesa Loans may offer competitive interest rates compared to some traditional lenders, they can still be higher than other forms of credit, especially for borrowers with lower credit scores.

High-interest rates can increase the overall cost of borrowing and may make loan repayment more challenging for some borrowers.

Opesa Loans typically have limits on the amount you can borrow, which may not always meet your financial needs, especially for larger expenses.

If you require a substantial amount of money, you may need to explore alternative lending options or consider combining it with other sources of financing.

They often come with short repayment terms, requiring borrowers to repay the loan within a relatively brief period, usually a few weeks to a few months. This can put pressure on borrowers to come up with the funds quickly, potentially leading to financial strain or the need to take out additional loans to cover the repayment.

The ease of access to funds through Opesa Loans may tempt some borrowers to overborrow, taking on more debt than they can comfortably repay. Overborrowing can lead to financial stress, missed payments, and ultimately, a cycle of debt that is difficult to break.

Failure to repay an Opesa Loan on time can result in late payment fees and penalties, increasing the overall cost of the loan. Borrowers must be diligent about making timely repayments to avoid accruing additional charges and damaging their creditworthiness.

While responsible borrowing and timely repayment can help build your credit profile, defaulting on your loan or making late payments can have the opposite effect, negatively impacting your credit score. A lower credit score can make it more difficult to qualify for loans or credit cards in the future.

They rely on mobile technology and internet connectivity for loan applications, approvals, and repayments. Borrowers who do not have access to smartphones or reliable internet may face challenges in using the platform effectively or may be excluded from accessing loans altogether.

Unlike traditional banking services, Opesa Loans lack the personal interaction and guidance that borrowers may receive from bank representatives. This can be a disadvantage for individuals who prefer face-to-face interactions or who require assistance navigating the borrowing process.

Overall, while Opesa Loans offer convenience and accessibility, it’s essential for borrowers to carefully consider the potential disadvantages and weigh them against their financial needs and circumstances before applying for a loan. Responsible borrowing and prudent financial management are key to making the most of the benefits while minimizing the risks associated with borrowing through this platform.

Read also – Loan Calculator and How to Use it

To make the most of your loan experience, consider the following tips:

While Opesa offers convenient access to funds, it’s essential to borrow only what you need and can afford to repay. Avoid taking out multiple loans simultaneously to prevent overburdening yourself financially.

Timely repayment is key to building a positive borrowing history with Opesa. Ensure you repay your loans on time to improve your creditworthiness and potentially qualify for higher loan limits in the future.

The Opesa loan app may offer features and tools to help you manage your finances effectively. Take advantage of budgeting tools, loan calculators, and repayment reminders to stay on track with your financial goals.

Keep yourself updated on Opesa’s terms and conditions, interest rates, and any changes to its lending policies. Being informed will empower you to make sound financial decisions and navigate the borrowing process with confidence.

It is a digital lending platform that provides instant loans to individuals in Kenya, offering quick and convenient access to financial assistance through a mobile app.

To apply, download the app from the Google Play Store, register an account, and follow the prompts to complete the loan application process within the app.

They typically requires basic personal information such as your name, phone number, and ID details to process your loan application.

Once your loan application is approved, the funds are usually disbursed directly to your mobile money account within minutes, providing instant access to the loan amount.

Opesa loan limit is based on various factors, including your creditworthiness, transaction history, repayment behavior, and other proprietary algorithms used to assess your financial profile.

Yes, as you demonstrate responsible borrowing behavior and timely repayment of Opesa loans, you may become eligible for higher loan limits, allowing you to access larger loan amounts in the future.

Opesa may charge nominal fees for loan processing and servicing. These fees are typically disclosed upfront, and there are no hidden charges or penalties.

Opesa Loans offer a convenient and accessible solution for individuals seeking quick access to funds.

By following the steps outlined in this article and managing your loans responsibly, you can leverage their loans to address financial needs effectively and achieve your goals with confidence.

Remember to borrow only what you need and repay on time to unlock the full benefits of Opesa’s flexible lending platform.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.