Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Across Africa, fragmented financial infrastructure has long been an issue to business growth and regional trade. From Lagos to Nairobi, Entrepreneurs and Enterprises alike have struggled to manage cross-border payments, fragmented APIs, volatile exchange rates, and multi-country compliance hurdles.

For many African businesses, sending and receiving payments is not just a technical hurdle; it is a structural disadvantage. Local currencies are difficult to convert, banking APIs are inconsistent, and regulatory requirements vary from country to country. These challenges often force companies to delay international expansion or forgo global opportunities altogether.

According to Fintech News Africa, Africa’s payments market is valued at US$2.7 trillion, with projections pointing toward a US$3 trillion opportunity. Within this, cross-border B2B payments account for US$300 to 500 billion, yet they remain vastly underserved due to fragmented infrastructure and limited interoperability.

To unlock the continent’s full digital potential, Africa did not need just another payments app. It needed a comprehensive financial operating system built to manage complexity, ensure compliance, and scale with business growth. That system is Maplerad.com

Since its 2022 launch, Maplerad has processed over $100 million in transactions, an early but significant footprint in the continent’s broader payments ecosystem and the underserved cross-border segment.

With headquarters in the United States, Maplerad was born out of a vision to remove the deeply embedded structural roadblocks that limit African businesses from scaling globally.

While companies like Flutterwave built powerful gateways for processing payments, Paystack streamlined online checkout for merchants, and Wave revolutionized low-fee mobile money transfers, Maplerad set out to solve a different, deeper challenge—building the financial operating infrastructure itself.

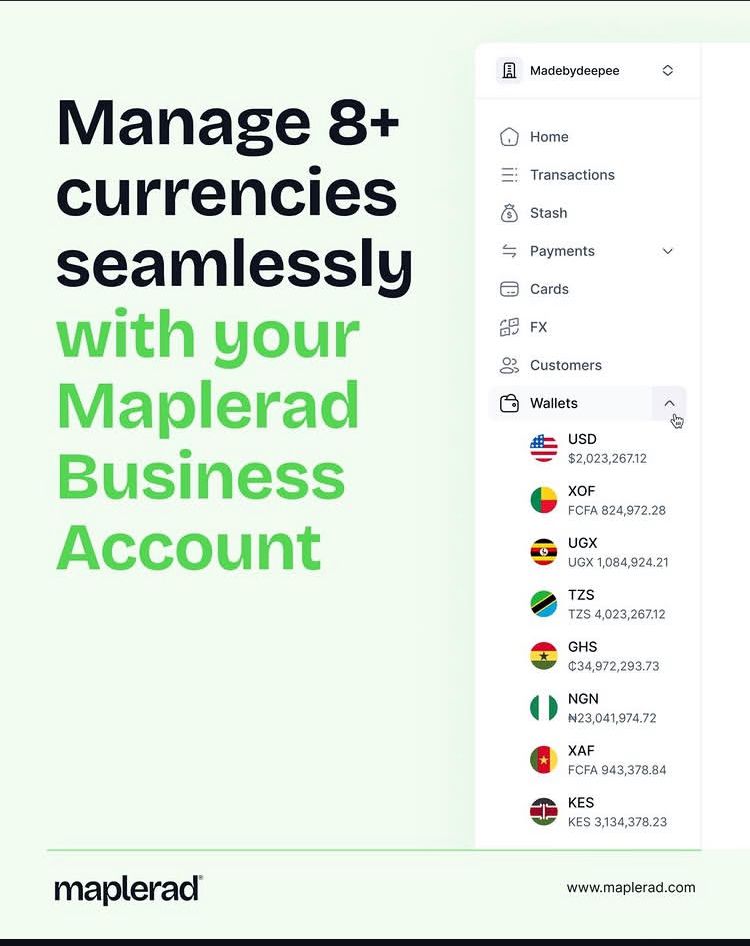

Rather than focus solely on payment front-ends or consumer wallets, Maplerad delivers the backend infrastructure—wallets, account creation, card issuance, compliance, FX, and payouts—required to launch and scale full-fledged financial products. This makes Maplerad not just a fintech platform, but the rails on which fintechs, marketplaces, logistics firms, and global enterprises can operate, expand, and innovate across Africa and beyond.

That vision was sparked by the founding team’s early work on Wirepay, a cross-border payments app launched in 2020 by Obinna Chukwujioke (Founder)and Miracle Anyanwu (Co-Founder). What started as a consumer-facing solution to send and receive money quickly evolved when the team recognized a deeper industry gap: most businesses lacked the infrastructure to launch and scale financial products efficiently.

In August 2022, they pivoted from consumer-focused payments to BaaS, opening up their technology stack to developers, startups, and enterprises. Maplerad’s modular Banking-as-a-Service (BaaS) platform allows businesses to launch fully compliant fintech products in under five minutes, a notable leap from the traditional months-long integration and licensing process.

Through a single suite of developer-ready APIs, companies can access wallets, account creation, real-time FX, card issuance, identity verification, and cross-border payouts. Compliance and licensing are embedded into the platform, eliminating barriers and accelerating go-to-market timelines.

Now active in five major African countries, Maplerad has partnered with regional banks and telecom giants like MTN and Orange to deliver seamless infrastructure at scale. It isn’t just enabling fintech—it’s redefining what’s possible.

At Maplerad, the mission is bold yet simple: to fuel ambition by enabling businesses to scale globally from day one. With a presence in five major African markets, Maplerad operates not just as a service provider but as a strategic launchpad for companies ready to expand beyond borders.

Its unique proposition lies in delivering all-in-one financial infrastructure—compliance, licensing, banking relationships, and developer-friendly APIs—bundled into a single, modular platform.

Unlike conventional providers, Maplerad eliminates the friction of fragmented systems by embedding regulatory interoperability, multicurrency capabilities, and scalable financial tools directly into its architecture. This allows businesses to focus on their core products while unlocking new revenue streams and entering new markets with speed and confidence.

Read Also: Africa Technology Expo 2025: The Future of Innovation

Recognizing that growth is never one-size-fits-all, Maplerad positions itself as a growth partner, offering tailored infrastructure that evolves with each business’s needs. Its timing couldn’t be more strategic.

Within three months of launching the BaaS platform, Maplerad secured a $6 million seed round led by Valar Ventures, with participation from Golden Palm Investments, Michael Vaughn (former COO of Venmo), and Babs Ogundeyi (CEO of Kuda).

In a TechCrunch interview, Miracle explained: “From day one, when we built Wirepay for our consumers, we knew the end move would be infrastructural. … So Maplerad is solving financial infrastructure problems for these businesses in Africa.”

Read This: Positive Signs for African Tech as Startups Sees a 50% Increase in Q2 of 2025

Today, Maplerad processes over $100 million in transaction volume and serves 3,000+ businesses and over 300,000 end-users across Africa. Companies like Chipper, Payourse, CredPal, Prospa, and Swerve rely on Maplerad to issue cards, manage wallets, automate payouts, and handle FX transactions—all through a unified platform.

Each of Maplerad’s Solution addresses a unique market need:

Powering all of these vertical solutions are Maplerad’s core financial products:

Maplerad is also preparing to launch Checkout APIs, Payment Links, and a full invoicing suite—making it even easier for businesses to accept and manage payments across borders.

Beyond infrastructure, Maplerad supports tech inclusion by donating laptops to youths learning programming, design, and digital skills—empowering the next generation of African innovators.

In under three years, Maplerad has become more than a service provider; it is the infrastructure partner powering Africa’s digital economy. For businesses eyeing global growth, Maplerad is the launchpad.