Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

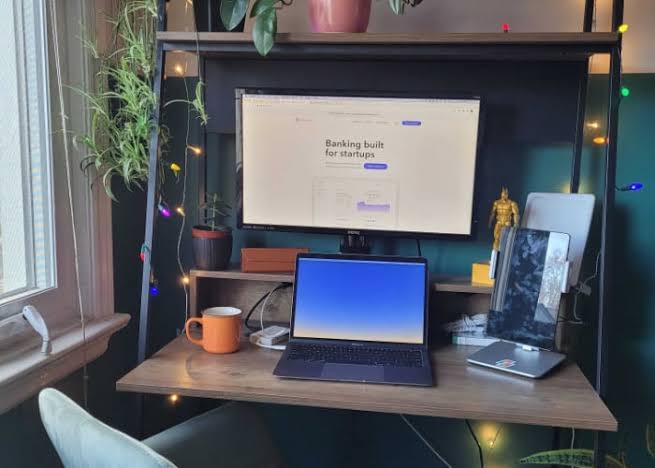

Following Mercury’s recent decision to exit the African market, local banks reacted to Mercury exit by stepping in to fill the void left for startups.

The San Francisco-based digital bank announced it would close accounts for businesses in 13 African countries, including Nigeria, effective August 22, 2024.

This sudden withdrawal has left many founders scrambling for alternatives, igniting a wave of local banking solutions.

The closure has sent shockwaves through the tech ecosystem, particularly in Nigeria, where many startups relied on Mercury for their banking needs.

Founders expressed frustration over the abrupt notice, which provided little time to transition to new banking options.

Oluyomi Ojo, co-founder of Printivo, lamented the lack of communication, stating that many were left without explanations or considerations for their unique circumstances.

In response to this disruption, local banks are stepping up to offer tailored solutions for startups.

Institutions are recognizing the urgent need for accessible banking services that cater specifically to the tech sector.

These banks are working to establish more flexible account options and streamlined processes to attract the displaced clientele from Mercury.

Mercury’s exit is partially attributed to increased regulatory scrutiny, particularly concerning its partner bank, Choice.

Reports indicated that the Federal Deposit Insurance Corporation (FDIC) raised concerns about the bank’s compliance practices.

This scrutiny, combined with Nigeria’s greylisting by the Financial Action Task Force (FATF), has created a challenging environment for fintech operations, prompting Mercury to tighten its account eligibility criteria.

Read Next: Lawmakers Advocate for Prompt Release of Detained Binance Executive

The departure of Mercury raises critical questions about the treatment of African startups in the global tech landscape.

Many founders have voiced concerns about discrimination, feeling that their businesses are unfairly judged compared to their counterparts in other regions.

Alexander H., founder of HRtech startup Synergyy, emphasized the detrimental impact of losing access to international banking services.

As local banks react to Mercury exit, they have a unique opportunity to support the burgeoning tech ecosystem in Africa.

By providing reliable and accessible banking solutions, these institutions can help mitigate the challenges faced by startups and foster a more inclusive financial environment.

The path ahead may be uncertain, but the resilience of African entrepreneurs and the commitment of local banks could pave the way for a robust recovery in the wake of Mercury’s withdrawal.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.