Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

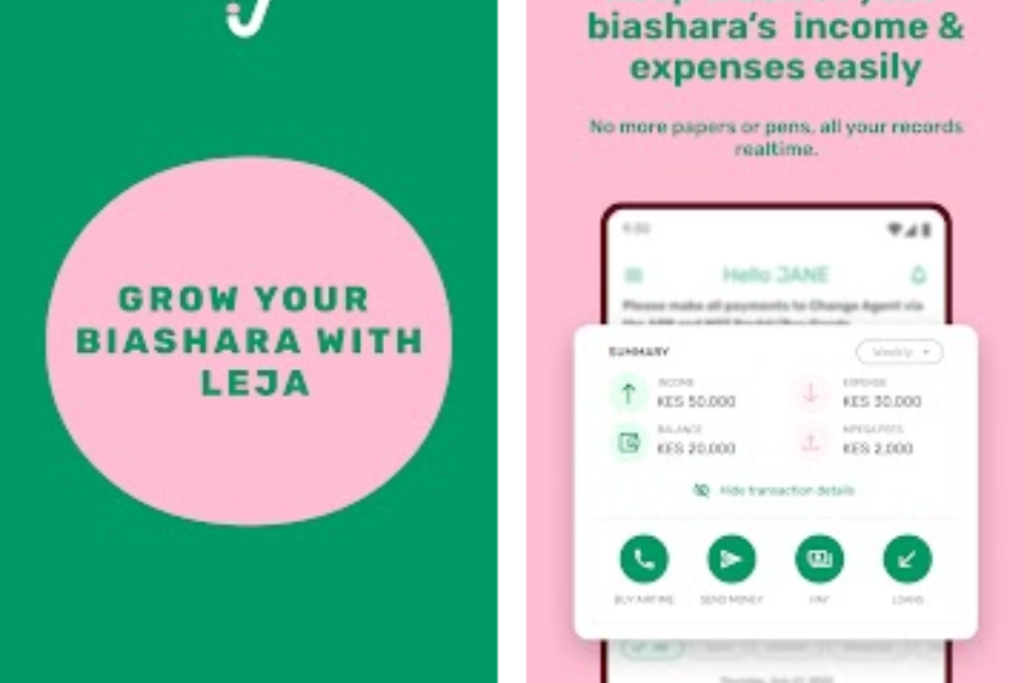

If you own a business in Kenya, you understand the importance of having a solid source of capital. Meet Leja Loans, a one-stop shop for loans, accounting, and insurance. Accessing funds through Leja Loan is as simple as a few taps on your phone.

Leja Loans Business App is not like other loan apps. It is a comprehensive platform that assists Kenyan business owners in managing their finances by providing various types of loans as well as bookkeeping services.

Individuals can rapidly apply for and obtain financial assistance by using the user-friendly Leja Loan app or a simple Leja loan USSD code.

Have you ever been caught in a cash pinch with nowhere to turn? Digital lending apps like Leja are transforming the way we get credit; it’s faster and easier than ever before.

In this article, we will look into the Leja loan and how to access it. Say goodbye to cumbersome documentation processes and boring waiting times; with Leja Loan, help is just a few clicks away.

Leja is a Kenyan fintech startup owned by Leja Limited and co-founded by Tekwane Mwendwa, who also serves as the CEO. The startup is involved in empowering micro, small, and medium enterprises (MSMEs) through the application of digital finance instruments.

Leja is also associated with Asilimia, the entity behind the Leja digital ledger app. Since its launch, Leja has processed over $2 billion worth of B2B payments and has over 1.4 million MSMEs, mostly youth- and women-owned businesses in Kenya.

The Asilimia Group, a respected financial services organization, owns and operates Leja. Leja is designed specifically for Kenyan business owners who want to organize their accounts and gain access to accessible lending choices.

Leja caters to small business owners by offering a combined financial management tool and microloan service. The Leja functions as a digital bookkeeping system, allowing businesses to track income and expenses, send and receive mobile money payments, and generate receipts for customers.

This streamlines financial organization for small business owners. Leja further supports these businesses by providing access to microloans.

Targeted specifically at active users of the Leja app (with a minimum three-month usage requirement), these loans likely address short-term business needs or gaps in cash flow. The maximum loan amount of 20,000 Kenyan shillings suggests they are intended for smaller financial needs.

Related – Okolea Loan: How to Apply and Access it

Leja Loan is a mobile app that enables Kenyan microbusinesses to manage their accounts and obtain loans. Here is a detailed explanation of how it works:

The key features include:

Leja promotes detailed record keeping, allowing users to track daily sales, spending, and liabilities. This will ensure that the business performance is well understood.

The Leja platform’s connectivity with mobile money accounts allows users to conveniently handle all business payments, increasing efficiency.

Leja does not charge transaction fees for money transfers and bill payments.

Leja users can track overdue payments and issue automatic payment reminders to clients, lowering delinquency.

Leja provides two types of loans that are specially designed for microbusinesses:

Are you eager to start? Here’s how to download and set up your Leja account in a few simple steps.

Read Also – Tala Loan app: How to Apply for a Loan

The Leja Loan Application Process typically involves the following steps:

To gain access to Leja Loan via USSD, you must normally follow a series of steps supplied by the Leja Loan service. Be advised that these processes can be location-specific and are subject to the terms and conditions of the service issuer.

Before using the Leja Loan USSD code to apply for a loan, be sure you meet all of Leja Loan’s standards. These should include characteristics such as age, employment reputation, and income level, among others.

Use your mobile phone to dial the Leja Loan USSD code provided by Leja Loan. This code, often in the format *429#, is unique to the Leja Loan service.

After dialing the USSD code, your screen will display a choice of alternatives from which you can choose. These options may contain loan amounts, terms and conditions, and directions on how to proceed.

Based on what is offered in the menu selections, select an option that implies a loan application. It might be expressed with a number or a keyword such as “Apply for Loan” or “Get Cash.”

Once you’ve decided to apply for a loan, you’ll usually need to provide some personal information. This could include your name, phone number, ID information, work details, and perhaps bank information.

After providing all relevant information, you may be shown the loan’s terms and conditions. Read these terms carefully to ensure that you understand them, including the interest rates, payback period, and any other charges.

If you accept the terms and conditions, you will be prompted to confirm your loan application. This may necessitate entering a PIN or answering with a specific term that indicates your agreement.

After submitting your USSD loan application, you should receive a response from Leja Loan. This could take several minutes or longer, depending on how quickly the service processes applications.

If your loan request is approved, the funds will often be transferred to your mobile money account or bank account associated with the phone number you provided throughout the application process.

It is critical to remember that obtaining a loan via USSD requires supplying personal and financial information; thus, choose a secure connection and a reputable service provider. Furthermore, borrow responsibly and only take out a loan if you are confident in your ability to return it on time.

Also Read – Update on LAPO Loans: How to Apply, Eligibility Requirements and Loan Packages

Even if all of Leja’s conditions and terms do not expressly mention the eligibility requirements for a loan, the following information is available:

You can repay Leja loans through the Leja Loan App that is designed to be simple. The app has an intuitive interface that helps users in the repayment process. Users can easily complete their loan payback by navigating to the “Pay Now” area of the Leja app and following the self-explanatory payment procedure.

On the other hand, borrowers can decide to pay back their Leja loan using M-Pesa which is widely used. To do so, borrowers can access their Safaricom menu, select “M-Pesa,” then choose “Lipa na M-Pesa.” From there, they can select the “Pay Bill” option and enter the business number 977888.

The registered phone number should be entered as an account number followed by the payment amount and M-Pesa PIN. After confirming the correctness of the details, payment can be submitted by pressing “OK.”

By providing several repayment options, the Leja Loan App ensures that borrowers will be able to choose what suits them best making the repayment process easier for everyone.

Read Also – Zash Loan: how to Register and Apply

Let’s be honest: who doesn’t like a decent bonus? Leja knows how to win an entrepreneur’s heart and offers a variety of perks and promotions to keep you entertained.

Leja’s friend referral scheme is the icing on an already tasty cake.

Leja periodically runs particular promotions, which are usually associated with holidays or special events. They could include lower interest rates, cash-back offers, and so forth.

As a result, Leja not only assists you with business finance management and financing but also offers tips to make your experience even more enjoyable.

Therefore, when you find yourself in a pickle, know that with just one tap or click, you can get help right away. Here’s how to contact Leja’s support team.

Accessing Leja Loan is simple either through their intuitive application or by using the Leja Loan USSD code on your phone.

With just a few taps or a single phone call, users can apply for a loan without any problems. Therefore, whether it is for emergencies or personal expenses, Leja Loan offers an easy solution.

Therefore, users can easily get the help they need by following the uncomplicated steps that are laid out in the application or through the USSD code. Leja Loan gives a smooth lending experience, making sure that all people can easily get financial support.

Leja is run by the Asilimia Group, a reputable financial services organization.

If you are a Kenyan business owner seeking a comprehensive finance solution, Leja is for you.

Leja offers low-interest airtime loans (the payment is sent immediately to the user’s registered MPESA number).

Borrow Loans. LEJA has partnered with money lending institutions, which use LEJA to provide consumers and micro businesses with low-interest loans.