Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

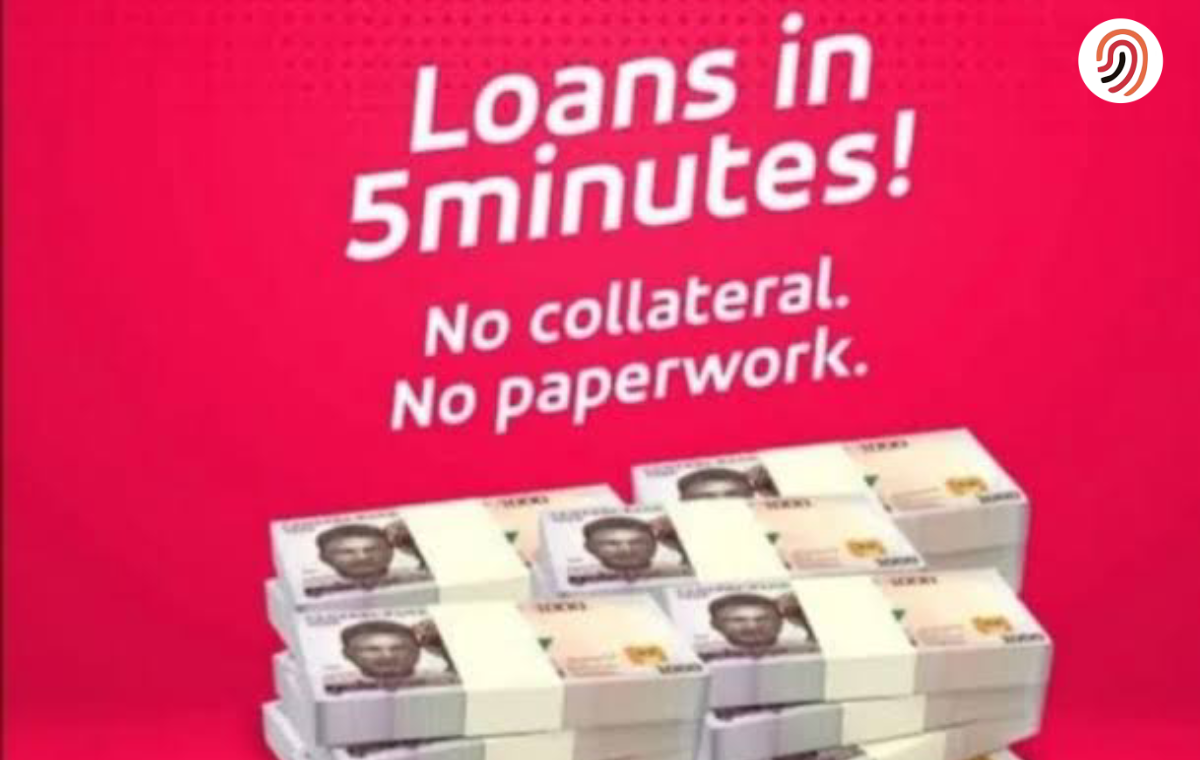

Getting a loan has become a common solution when facing financial challenges. Fortunately, obtaining a loan today can be discreet and efficient, without the hassle of visiting a bank, filling out lengthy forms, providing collateral, and enduring long approval times.

If you reside in South Africa, you’ve likely heard about instant cash loans that promise to deliver urgent funds within just 5 minutes. While this might sound too good to be true, these loans are indeed available and can be a valuable resource during times of need.

In this article, we’ll look into everything you need to know about instant cash loans and how you can leverage them effectively. Let’s jump right in and explore how these loans can offer a quick and convenient solution to your financial needs.

Instant cash loans are also known as payday loans or quick loans. They are meant to help people who urgently need money. They’re different from regular loans because they make it much faster to get the money you need.

In South Africa, these loans are designed to make applying for a loan easier and quicker, cutting down on the usual paperwork and delays. They’re all about getting you the money you need as soon as possible.

Based on your needs, there are different types of instant cash loans. and you need to have a clear understanding of them before you take one. Let’s consider some in this section.

These are for getting quick cash until your next paycheck arrives. You can check our article on payday loans to delve deeper.

This loan type gives you the flexibility to repay the money in fixed amounts over time.

These are loans designed for unexpected financial emergencies.

Easy-to-use online platforms allow you to apply for instant funds either via internet banking or loan apps.

Some loan services cater to people with bad credit. So, if you have a not-so-great credit history, these loans are for you.

You can get instant cash without needing to offer any assets as security. This is just like getting urgent cash loan without salary slip in South Africa.

Borrow a part of your upcoming paycheck in advance for a quick financial boost.

Use your vehicle’s title as collateral to borrow money if you have a valuable asset.

Read also: How to Qualify for Capfin Loan

Financial emergencies arise without notice, and this is where instant cash loans shine the most. They allow you to borrow money when you need them.

But they do much more than that. They offer several advantages that have now made them a popular choice for many people.

They are a lifesaver when unexpected expenses like car repairs or medical bills pop up, providing quick funds within an hour.

With the help of instant cash loans, you can avoid paying late fees and penalties to pay bills on time.

Unlike traditional loans that can affect your credit score significantly, instant cash loans have less impact, making them a safer option for your credit rating.

You don’t have to deal with piles of paperwork. Instant cash loans require minimal documentation, which makes the application process simplified.

Even if your credit score isn’t perfect, you can still qualify for these loans, making them inclusive for people with varying credit backgrounds.

Applying for these loans online is easy and convenient. You can do it from home or work, saving time and effort.

You can choose the loan amount you need and customize repayment terms that suit your financial situation.

The eligibility requirements are straightforward, typically requiring South African citizenship or residency, a valid bank account, and being of legal age.

While instant cash loans offer quick solutions, there are some downsides to consider:

It’s essential to monitor your credit reports regularly to catch any errors and correct them promptly. Mistakes could affect your ability to get loans in the future.

The convenience of getting money quickly with instant cash loans can mean higher interest rates compared to traditional loans. This can add up to more costs over time.

Compared to verified loan apps and due to the fast processing and approval, instant cash loans usually come with a limited loan. And since they can be significantly lower, you might need to turn to other sources if you need a substantial amount.

Read Next: Update on LAPO Loans: How to Apply, Eligibility Requirements and Loan Packages

Now that you know the pros and cons of instant cash loans, let’s briefly consider some cogent factors you might have to consider before you jump right in.

Since these channels do not require documents here are some important things to think about to help you make the best and most informed choices:

Explore multiple sources before choosing one. Also, ensure that you compare different lenders to find competitive rates and clear fee structures to avoid overpaying.

Some of these lenders can demand unfavorable repayment plans, so this is where you negotiate. Bargain and choose the repayment schedule that fits your budget without causing financial stress.

Even though these loans may be available with any credit score, late payments can harm your credit, so be diligent.

We already talked about this. So check if the loan amount offered is enough for your needs to avoid taking on unnecessary debt.

Let’s also touch briefly on the no-documentation aspect and what it might mean for you:

To be eligible for an instant cash loan without collateral, you generally need to meet these criteria:

Getting an instant cash loan takes a process. Here is a step-by-step guide to help you:

The first thing to do is to research lenders. Research the best options and compare the best. Your basis for comparison should be transparent terms, reasonable interest rates, and positive customer feedback.

Collect necessary documents like proof of address, ID, and income proof. Even though requirements are minimal, having these ready ensures a smooth application process.

These lenders use different platforms which may be online, mobile apps or through instant cash loan ussd codes, depending on the lender. So use the lender’s online platform, ussd codes or mobile app to apply. Fill in accurate details and submit for processing.

Although documentation is minimal, the lenders might still need proof of income. Go ahead to provide details about your job and income. Other lenders may ask for proof like recent pay stubs or bank statements instead.

Enter your bank details accurately to receive approved funds seamlessly.

Specify the amount you need and choose repayment terms that suit you. Remember to review interest rates, fees, and the repayment schedule before finalizing.

Lenders use digital methods to verify information quickly, usually within minutes.

Upon successful verification, get instant approval. Funds are transferred directly to your bank account, often within an hour.

Getting loans should not be a bother in this digital age. Yes, you should be able to get access to necessary funds with reasonable repayment schedules without hassle. If this has been difficult for you, you may consider turning to instant cash loans.

Ensure you review the conditions of these apps before going ahead, also make sure you have a repayment plan on the ground to avoid piling up debts and adversely impacting your credit score.

If you find this article helpful, kindly share your thoughts in the comment section and follow us on our social media platforms on X (Silicon Africa (@SiliconAfriTech)), Instagram (SiliconAfricaTech), and Facebook (Silicon Africa).

Borrowers can access loan sums ranging from R100 to R5000 with instant cash loans in 5 minutes without collateral or any paperwork. These loans are designed to help people in times of need, especially those without official employment verification documentation or a consistent source of income.

No, they don’t. Instant cash loans defy convention by not requiring applicants to have excellent credit scores to be eligible. All people having credit histories can access them, even those with bad or low credit scores. The criterion for employment verification is missing, which further removes the need to check borrowers’ credit scores.

Yes, they are. One notable element of 5 minutes loans in South Africa is skipping employment verification and extensive credit checks. These loans prioritize swift access to funds over such prerequisites, making them more accessible, especially for those without a job. However, they still assess income and repayment capability to ensure responsible lending practices.

With repayment periods ranging from 2-4 weeks to 6 months, instant cash loans without collateral or documentation have comparatively short payback periods. This offers a reasonable payback plan in line with future payments. Before taking out the loan, you must read over and comprehend these terms.

Inform your lender in advance if you expect to be behind on your payments. Overdue payments may result in higher interest rates and other costs. Notifying your lender in advance may lead to possible support or other arrangements.

The primary goal of an instant cash loan is rapid fund disbursement. In many cases, funds can be in your account within an hour of loan approval. However, exact time frames may vary based on lender policies and external factors.