Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

What is the First bank quick loan code? Established in 1894, First Bank of Nigeria Limited is the pioneer bank in West Africa. Its awards and recognitions over the past 130 years of operation showcase it as a leading financial service provider in Nigeria.

First Bank caters to numerous financial needs of customers, such as cash management, payments and other banking transactions, intervention funds support, trustee services, instant loans, and more. Among all these, our discussion for today revolves around just one: First Bank’s instant loan service, known as First Credit.

First Credit is a system by which First Bank provides quick cash loans to its account holders. Want to know more about FirstCredit and how to successfully apply? Then let’s explore.

Also read: Best Loan Apps with Low Interest Rate in Nigeria

First Bank of Nigeria offers a quick loan option known as First Credit to its existing customers. The minimum loan amount is ₦1,000, and the maximum is ₦300,000. Any amount borrowed is payable within 30 days max.

The application process for a First Bank quick loan is completely digital, allowing customers to easily apply without necessarily visiting a bank branch. Simply apply via the bank’s website, or use the First Bank quick loan code. No documentation or collateral is required.

The First Bank quick loan has an 8% interest rate, with a 5% insurance fee on each transaction. Both fees are deducted upfront, as soon as the loan is disbursed. An additional 1% is charged in default of payment, plus a daily interest of 0.3% for every day of default.

As quickly as you need your funds, First Bank responds quickly to meet your needs. The application process is fast and secure; you can complete the entire process in ten minutes, max. Here is a step-by-step guide on how to go about it:

Imagine that you already gathered all the relevant documents for the credit. You have used the loan calculator to determine the total interest on the amount you want to borrow. You are more than ready for this.

Only for you to dial the First Bank quick loan code and realise that you do not even meet the eligibility criteria. Oops. What a waste of time, isn’t it? This is why the first step to any application is always to ensure that you are eligible. If you tick the boxes below, then you are 100% eligible to apply for First Bank quick loan:

You can also use a loan calculator to determine if you would be able to afford the interest rate, which is 8% monthly, payable within a month max. Considering the other service charges too, can you comfortably afford the quick credit without straining your finances? If yes, then let’s proceed to the second step.

Also read: Top 10 Online Banking Apps in Nigeria 2024

If you follow our blog posts frequently, you will know that one thing we always emphasize for any loan application process is preparation. In this case, note the relevant documents needed for the application and ensure you have them handy and ready to submit instantly. It’s even worse when you are applying through the code, there will be very little time to enter all relevant details.

So what documents or information do you need in your application for this credit? They are listed below:

You can apply digitally or in person. There are three ways to apply digitally; they are as follows:

The code is one of the most common ways customers apply for First Credit. It’s a quick offline solution to getting instant cash, perfect for emergency cases. The process is as follows:

Note that the First Bank quick loan code attracts a service fee of ₦6. You will be notified immediately when you dial the code.

Also read: 8 Illegal Digital Loan Companies in Nigeria You Should Avoid 2024

The FirstMobile app is an innovative technology that is user-friendly and easy to navigate. It’s another fast way of applying for a First Bank quick loan, especially if you are already registered on the app. Here’s what to do:

As good as the mobile app, the website has a smooth interface; easy to navigate. To apply for the quick loan on the bank’s website, follow the steps below:

Finally, you can apply for a First Bank quick loan at a bank branch. Click here to locate the nearest bank branch to you.

If you encounter challenges during your application process, you can seek assistance from the customer support centre. Contact them at +2347080625000 or +23414485500. You can also send an email: to firstcontactcomplaints@firstbanknigeria.com

Customers often wonder why they should apply for a FirstCredit loan over a regular personal loan. Here are some reasons:

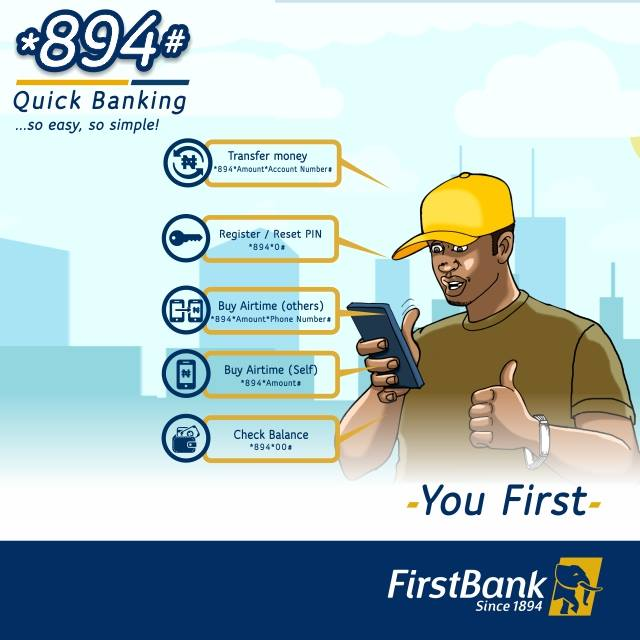

The First Bank quick loan code is #894#

The eligibility requirements for a quick loan are: active First Bank account which is at least six (6) months old; being 18 years of age or older at the time of application, and having a high credit score

First Bank’s quick loan request limit is ₦300,000, and the minimum is ₦1,000.

No. A First Bank quick loan is unsecured, meaning it does not require any asset as collateral before the loan is approved and disbursed. However, you will be required to provide proof of income, proof of residency, and other basic documents.

The First Bank quick loan interest rate is 8% flat.

First Bank of Nigeria is top in Nigeria, not just because of its traditional banking services but also because of its innovative developments. The First Bank quick loan meets the times, considering the economic hardships. Furthermore, it is easy to access.

Whether you are using the quick loan code, FirstMobile, or online banking, you are guaranteed a straightforward process, and your loan will be disbursed in minutes. So head on to the First Bank website and start your loan application process.

Follow us for more on X or Twitter, @SiliconAfriTech.