Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

The field of emergency loan apps is already growing as financial emergencies arise unexpectedly. When this happens, you begin to scramble for quick solutions to get by.

But this should not be a worry, as there are lots of options craving your attention these days. Among them is the Hikash loan app. It serves as a reliable option, providing instant loans with minimal hassle.

So instead of worrying about solving your money problem, why not download the Hikash app and get the needed loan to get you going?

In this article, we’ll explore the entire process of applying for a Hikash loan. We will provide its features, eligibility criteria, requirements, repayment methods, and interest rates, to help you get started.

Hikash Loan App stands out as a popular instant loan application available on the Google Play Store. With over 1 million downloads and a respectable rating of 3.6 out of 5 stars, it has garnered a significant user base.

Hikash loan system is straightforward so you already know what ot expect while using the app. Unlike other loan apps, it offers just two types of short-term loans: a 7-day loan that ranges from Ksh1,000 to Ksh1,500, and a 14-day loan ranging from Ksh2,000 to Ksh30,000.

Read Next: KCB Mpesa Loan Limit

Thanks to the Hikash Loan app speedy disbursement, extended loaning periods, and customizable payment plans. it has become a preferred choice for those seeking reliable and convenient loan solutions. Here’s why many people prefer Hikash:

Hikash is aware of how urgent financial crises might be. It stands out for its instant access to cash, which makes it a great option for people who need money right now. Once your loan is approved, Hikash disburses your funds lightning-fast

Hikash provides extended loaning durations together with flexible payback alternatives, in contrast to certain other loan apps. This implies that you will not need to worry about paying back the loan quickly.

Alternatively, you can select a payment schedule that works with your budget and allows you to have the breathing room you require.

By letting borrowers choose the payment plan that best suits their needs, Hikash gives them more power. You will not experience any pressure to return your loan, resulting in a simple and easy payback process.

Furthermore, timely loan payback may eventually result in higher loan limits, offering even more financial flexibility.

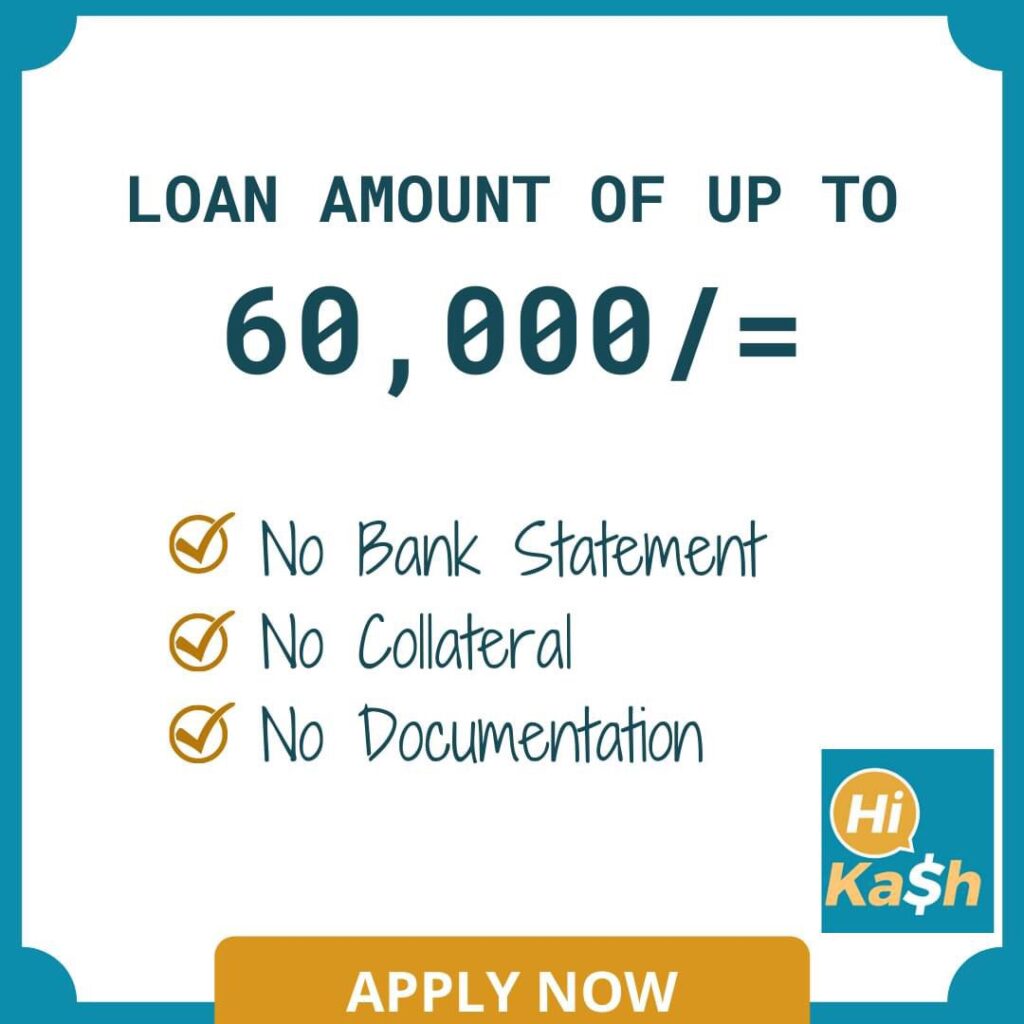

Hikash does not have a long requirement checklist for borrowing before you can get a loan. You do not need to tender proof of income or show evidence that you’re a salaried employee. The entire process is streamlined.

Therefore, to be eligible for a Hikash loan, applicants must meet the three basic criteria outlined below:

Read Next: How to Borrow Money from GTBank App in Nigeria | A Step-by-Step Guide

You can finish your loan application and get your funds in a couple of minutes on the Hikash loan application. Simply follow this guide:

Just like applying, repaying your Hikash loan is a breeze. And you can do this using M-Pesa

Read Next: How to Secure an Autochek Car Loan in Kenya

Hikash clarifies its interest rates before you go ahead with borrowing. To help you understand, let’s give an overview:

First, understand that while Hikash charges fees and interest rates, the app is free to use. This implies that there will not be any additional costs to you while applying for a loan. To make sure the loan will meet your demands financially, it is crucial to thoroughly read the terms and conditions before applying.

Hikash charges 18% interest on each loan. It means that you will pay an extra 18% in interest for each amount borrowed.

Unexpected financial difficulties may force you to make payments after the due date. Hikash levies a 2% daily late payback fee if you miss the repayment date.

Since this fee can build up quickly, you must make your repayments on schedule to prevent incurring more costs.

In addition, Hikash could impose a service charge for overdue or extended loans. This fee is typically applied to cover administrative costs associated with managing the loan.

Frequently Asked Questions

Yes, your Bank Verification Number (BVN) is required. It helps verify your identity and assess your creditworthiness. Without a BVN, you won’t be able to apply for or receive a loan from Hikash.

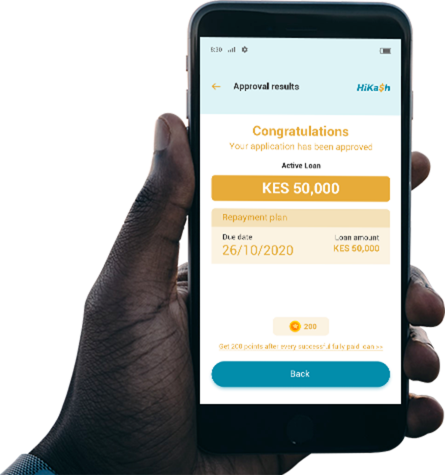

If your loan is approved, you will typically receive the funds within minutes to a few hours directly into your linked bank account. Delays may occur if there are network or verification issues.

Yes. Once you fully repay your current loan, you can reapply for another. Hikash may also increase your loan limit based on your repayment behavior.

As of now, Hikash does not offer a USSD code for loan applications. You must use the Hikash mobile app to register, apply, and manage your loans.

Hikash offers a simple application process, flexible loan options, and reasonable interest rates. And many more have made a go-to choice for many Kenyans facing unexpected expenses.

To avoid needless costs and penalties, it is essential to borrow wisely and make sure repayments are made on time.