Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Guaranty Trust Holding Company (GTCO), the parent company of GTBank, has made history by becoming the first bank to cross the N100/share mark on the Nigerian Exchange (NGX). This milestone was achieved during the trading session on July 16, 2025, marking a significant achievement for the Nigerian banking and capital market sectors.

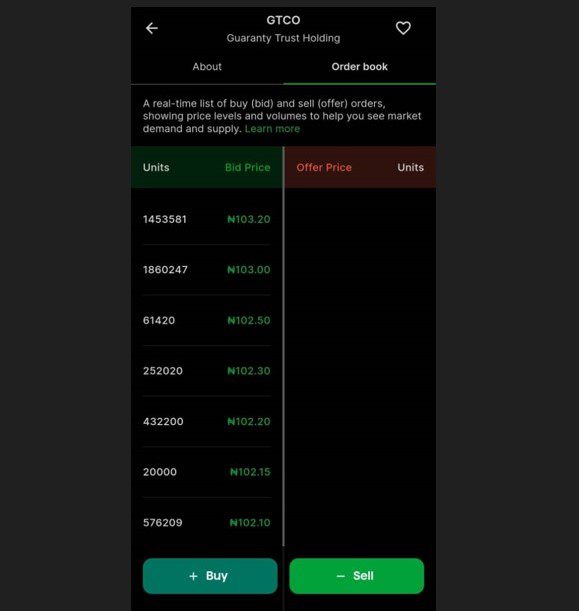

GTCO’s stock surged past the N100 level after an impressive run fueled by strong investor confidence. Over the past month alone, the stock price increased by more than 27%, moving ahead of its closest rival, Stanbic IBTC Holdings, which currently trades around N99 per share. This jump reflects a broad positive trend for banking stocks on the NGX, with the Banking Index gaining over 22% in July, showing renewed optimism in the sector. The latest performance confirms GTCO as the first bank to cross N100/share mark on Nigerian Exchange, underscoring its position as a leading stock on the exchange.

Read Next: Vodacom Business Teams Up With NAVIC To Fight Crime In South Africa

This breakthrough follows GTCO’s recent landmark listing on the London Stock Exchange (LSE) on July 9, 2025, where it became the first Nigerian bank to list on the LSE. This dual listing — first on the LSE and then on the NGX a day later — boosted the company’s visibility internationally and attracted new investors. The company admitted 2.29 billion ordinary shares on the London market and listed an additional 2.28 billion shares on the Nigerian Exchange. This move increased liquidity and significantly raised GTCO’s market capitalization, which closed at about N3.004 trillion shortly after these listings.

The capital raised through this process was part of a strategic effort to strengthen GTBank Nigeria’s financial position. GTCO aimed to recapitalize its Nigerian banking subsidiary to meet the Central Bank of Nigeria’s new minimum capital requirement of N500 billion for international commercial banks. The planned equity offering was designed to raise $100 million (around N154 billion), with the net proceeds dedicated to support GTBank Nigeria’s capital base in line with GTCO’s long-term growth plans.

GTCO’s outstanding performance is also underpinned by its strong financial results. The company announced a record-breaking profit after tax of N1.017 trillion for the 2024 financial year, an 88.4% increase from the N540 billion recorded in 2023. This exceptional earnings growth has boosted investor confidence and helped propel GTCO’s stock to new heights on the NGX.

According to GTCO’s Group Chief Executive Officer, Segun Agbaje, this milestone is a pivotal moment for the company. He emphasized that the listing on the LSE and the subsequent crossing of the N100/share mark is a reflection of GTCO’s transformation into a forward-thinking African financial services institution. The listings enhance the company’s global profile, provide easier access to capital, and open new opportunities for expansion and innovation across the markets it serves.

The positive investor sentiment is also tied to GTCO’s reputation for solid corporate governance and a healthy dividend history. Analysts point out that these traits make the stock attractive to a wider range of investors who value both profitability and consistent returns over time.

Read Next: Morrisons and Google Cloud Launch AI-Product Finder App

This achievement makes GTCO a trailblazer on the Nigerian Exchange and a benchmark for other banks on the market. As the first bank to cross N100/share mark on Nigerian Exchange, GTCO not only reflects its own strong performance but also signals a bullish outlook for the Nigerian banking sector as a whole in the coming months.

GTCO’s crossing of the N100/share mark on the Nigerian Exchange is a historic event driven by its strong financial performance, successful dual listing, and strategic recapitalization efforts. It places GTCO at the forefront of the Nigerian banking industry and highlights the growing strength and appeal of Nigerian financial institutions on the global stage.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.