Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Need quick cash but tired of long bank queues and paperwork? Mobile loan apps like Cashbus Loan APK are changing how Nigerians borrow money. Promising fast approvals, easy applications, and zero collateral, Cashbus has become a buzzword among people looking for quick loans.

But what’s the real story behind this app? Is it safe? Does it truly deliver what it promises?

In this guide, we’ll look into Cashbus Loan Nigeria reviews, explore the services they offer, and help you decide if this loan app is worth your time or better avoided.

Downloading the Cashbus loan app is a straightforward process for Android users.

To get started:

Pro Tip: Always download from official sources to protect your personal information and ensure app security.

Read Next: 5 Trusted Loan Apps to Watch Out In 2025

The Cashbus loan login process is designed for maximum user convenience.

Here’s what you’ll need:

The registration typically takes just a few minutes, with the app guiding you through each step of verification and profile creation

The Cashbus loan application involves several critical steps for potential borrowers:

Preparation Requirements

Step-by-Step Application

1. Download and Install

2. Account Registration

3. Information Submission

4. Additional Verification

5. Loan Evaluation

*Important Caution: The app requires extensive personal data access and has aggressive collection practices.

Read Next: Top 8 Easy Loan Apps in Nigeria

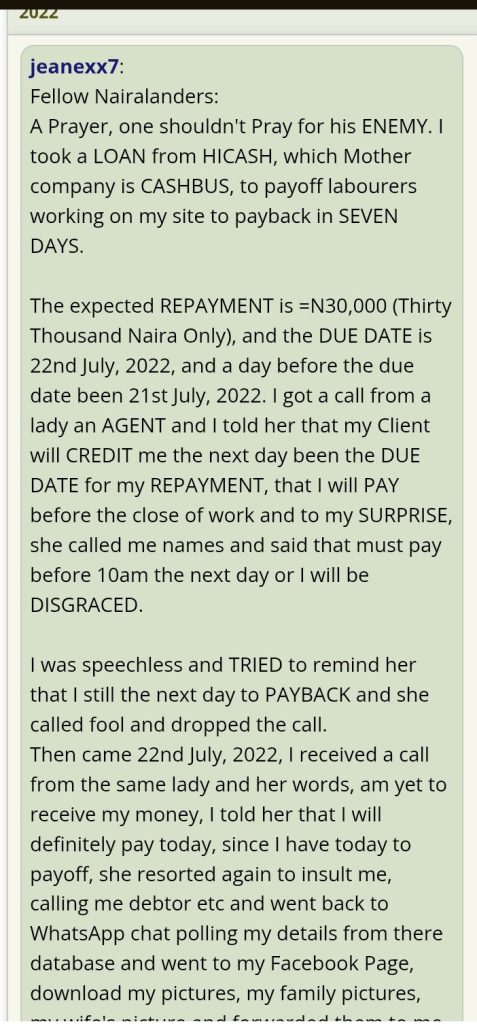

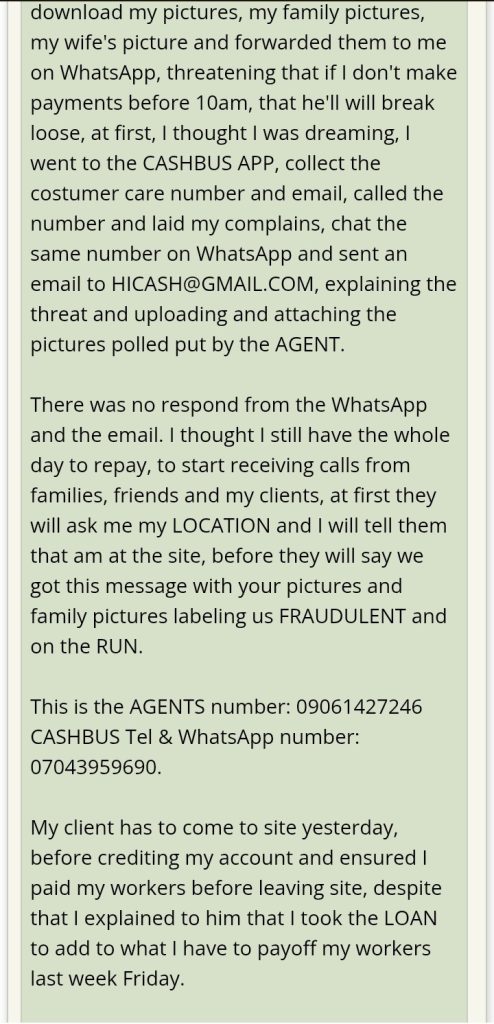

Unlike friendly, supportive loan apps, Cashbus loan Nigeria has developed a reputation for aggressive and threatening collection tactics. Their approach goes way beyond standard loan recovery we’re talking about:

Interest Rates and Loan Terms:

Users have reported nightmare scenarios, including:

Cashbus typically:

Danger Signs:

Read Also: Loan Apps With Low-Interest Rates in Nigeria 2025

Most forum discussions strongly recommend avoiding Cashbus completely. Users like jeanexx7 and GURUSBEST have shared traumatic experiences involving:

Recommended Steps:

Instead of Cashbus, consider:

These loan apps operate in a gray legal area. While they provide quick cash, their methods often cross ethical boundaries.

The Nigerian financial regulatory environment is still catching up with digital lending practices.

While registered, their practices are highly questionable and potentially predatory.

Typically within minutes, but with extremely high hidden costs.

Basic ID, bank details, and personal information.

The regulatory framework is still developing, offering limited protection.

Cashbus Loan Apk stands out as one of Nigeria’s go-to platforms for fast, no-fuss loans. From instant approvals to flexible repayment terms, it’s clear why many users are giving it a try. But as with any financial service, it’s important to read the fine print, borrow wisely, and only take what you can comfortably pay back.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.