Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

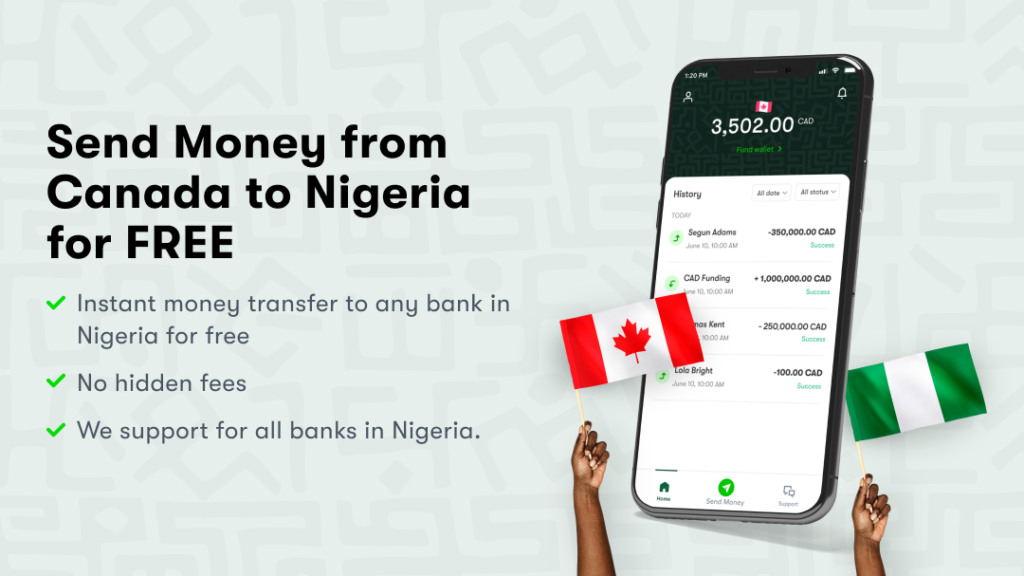

In 2024, navigating international money transfers from Canada to Nigeria requires a keen understanding of the evolving financial landscape and the most efficient channels available.

Sending money internationally involves considering factors such as speed, cost-effectiveness, reliability, and ease of use. Several methods have emerged as top choices for remittances from Canada to Nigeria.

Digital money transfer platforms have gained prominence for their convenience and competitive exchange rates. Services like Wise (formerly TransferWise) and Remitly offer transparent fee structures and swift transaction times, leveraging technology to streamline the process.

Additionally, traditional banks and dedicated remittance companies like Western Union and MoneyGram continue to play a vital role, providing extensive networks and familiarity to users.

Cryptocurrency, particularly Bitcoin, has also entered the scene as a decentralized and potentially cost-effective alternative for cross-border transactions.

The evolving financial technology landscape constantly introduces new options, making it essential for individuals to stay informed about the latest developments when selecting the best method tailored to their specific needs.

This comprehensive guide explores the evolving dynamics of sending money from Canada to Nigeria in 2024, shedding light on the most efficient and reliable channels for international remittances.

Read also – Just in: Flutterwave Shuts Down Disha Temporarily

WorldRemit stands out as a premier choice for transferring money from Canada to Nigeria in 2024 due to its commitment to convenience, transparency, and cost-effectiveness.

This digital money transfer platform has streamlined the international remittance process, offering users a seamless and user-friendly experience.

WorldRemit facilitates swift transactions, enabling recipients in Nigeria to access funds promptly. One of WorldRemit’s key strengths lies in its transparent fee structure, ensuring that users are well-informed about the costs associated with their transfers.

The platform often provides competitive exchange rates, allowing senders to maximize the value of their remittances. Furthermore, WorldRemit’s accessibility through both web and mobile applications caters to the diverse needs and preferences of users.

The security features integrated into WorldRemit’s platform enhance the overall reliability of transactions, instilling confidence among users when transferring money across borders.

With a focus on innovation and customer satisfaction, WorldRemit has become a trusted choice for individuals seeking a secure, efficient, and cost-conscious means of sending money from Canada to Nigeria.

As the financial technology landscape continues to evolve, WorldRemit remains at the forefront, offering a compelling solution for international remittances in 2024.

Read also – 2024 Latest Steps for Online PSiRA Renewal

WorldRemit has the lowest cost of sending money from Canada to Nigeria. WorldRemit’s average cost of transfers from Canada to Nigeria is low, which is less than that of their closest rival.

For the past three months, WorldRemit has, on average, been the least expensive method of sending money from Canada to Nigeria.

To inform you, the least expensive payment option was a bank transfer.

The mid-market exchange rate between Canadian dollars to Naira at the moment is 1117.32127.

Your total cost will depend on how quickly you transfer time. Sending money is often a little less expensive before costs when using WorldRemit, which, for the past three months, has averaged -0.06% below the mid-market rate.

The most popular method of transferring Canadian dollars to Naira is through bank transfer since it’s dependable, safe, and easy.

Remitly has been our top-rated provider for bank transfers of Canadian dollars to Naira for the previous three months, with recommendations made 74.5% of the time.

This is due to the fact that businesses such as Remitly use their own digital bank network instead of the SWIFT network, which allows for quicker and less expensive transactions.

Remitly’s transaction fees, for instance, have decreased on average within the last three months. Comparing this to the fees that banks charge, it is much less.

Read also – With 39% Share, Showmax Becomes Africa’s Biggest Streaming Platform Ahead of Netflix

Nigerian immigrants in Canada wondering how to send money back to Nigeria will need the necessary documents, recipient’s details and a way to pay.

To locate a money transfer company that sends money from Canada to Nigeria, read the article above. While one could work better for bank transfers, another might be better for cash collections. After selecting the ideal option based on your needs, click “Go to site”.

Your name, address, phone number, form of identification, and mode of payment will be required.

Enter the name and contact details of the recipient. You will need the account number, SWIFT or IBAN, and the address of their bank branch if you are paying directly to their Nigerian bank account.

After making sure the fees, currency rates, and transfer speed are acceptable to you, input the amount you want to send. Verify your recipient’s entire amount of nairas twice.

To track your transfer from Canada to Nigeria, make sure you have a copy of your transaction reference number. Your recipient could also require it.

Choosing the best money transfer company for Nigerian immigrants in Canada to send money to Nigeria involves careful consideration of several key factors to ensure a seamless and cost-effective process.

The unique needs of Nigerian immigrants often include a focus on speed, reliability, and favorable exchange rates.

Firstly, consider the fees associated with the money transfer.

Transparent fee structures are essential, allowing senders to accurately calculate the cost of their transactions.

Some money transfer companies, like Wise (formerly TransferWise), offer low and transparent fees, providing Nigerian immigrants in Canada with a cost-effective solution.

Exchange rates play a crucial role in maximizing the value of the transferred funds. It’s advisable to opt for money transfer companies that offer competitive and real-time exchange rates, ensuring that recipients in Nigeria receive the highest possible amount in their local currency.

Accessibility is another vital aspect in choosing a money transfer service that provides user-friendly online platforms or mobile applications, allowing Nigerian immigrants in Canada to initiate transactions conveniently.

WorldRemit is an example of a platform that emphasizes ease of use, catering to the diverse preferences of users.

Reliability and security are paramount when transferring money internationally. Prioritize money transfer companies with robust security measures, ensuring the protection of sensitive financial information.

Services like Remitly, known for their secure transactions, instill confidence in Nigerian immigrants sending funds to their home country. Consider the speed of transactions, as timely access to funds is often crucial.

Choosing the best money transfer company involves a comprehensive assessment of fees, exchange rates, accessibility, reliability, and customer reviews.

By prioritizing these factors, Nigerian immigrants in Canada can select a service that aligns with their specific needs, ensuring a smooth and efficient process for sending money to Nigeria.

Read also – Apple Employs Over 23,000 Kenyan Remote Workers From Nairobi

For Nigerian immigrants in Canada seeking the best exchange rate when converting Canadian Dollars to Naira, several strategies can be employed to maximize the value of their currency exchange.

Firstly, staying informed about the latest market rates is crucial. Utilizing reputable financial news sources, currency converters, or checking with local banks can provide real-time information on exchange rates.

Comparing rates across multiple currency exchange platforms is another effective approach. Various online platforms, banks, and money transfer services may offer different rates and fee structures.

It’s essential for Nigerian immigrants in Canada to explore these options to identify the most favorable terms. Consider using specialized currency exchange services that often provide competitive rates compared to traditional banks.

Wise (formerly TransferWise) and other online currency exchange platforms may offer lower fees and better rates, optimizing the amount of Nigerian Naira received.

Timing is also a key factor. Exchange rates fluctuate, and monitoring trends can help Nigerian immigrants in Canada identify opportune moments to convert their Canadian Dollars.

Utilizing limit orders or forward contracts with currency exchange services may enable them to lock in favorable rates for future transactions.

Ultimately, finding the best exchange rate involves a combination of research, comparison, and strategic timing.

By staying informed and exploring various options, Nigerian immigrants in Canada can make informed decisions, ensuring they receive the most value when converting their Canadian dollars to Naira.

Typically, you will need identification documents such as a valid passport, proof of address, and sometimes additional verification documents, depending on the money transfer service.

Transfer times vary among money transfer companies. Some offer quick transfers within minutes, while others may take a few business days. Consider the urgency and choose a service accordingly.

Yes, money transfer services often have limits on the amount you can send in a single transaction or within a specific time frame. Be sure to check the limits with the chosen service.

The cost-effectiveness depends on factors like fees, exchange rates, and transfer speed. Comparing services and considering online platforms like Wise, Remitly, or WorldRemit can help identify the most cost-effective method.

Cryptocurrency transfers, particularly using Bitcoin, can be an alternative. However, consider factors such as volatility, conversion fees, and the recipient’s ability to convert the cryptocurrency to local currency.

Researching current market rates, comparing rates across multiple platforms, considering online currency exchange services, and monitoring trends for strategic timing are effective ways to find the best exchange rates.

Prioritize reputable money transfer services with robust security features. Avoid sharing sensitive information on unsecured platforms and use two-factor authentication where available to enhance security.

Both traditional banks and online platforms offer money transfer services. However, online platforms like Wise or Remitly often provide more competitive rates and lower fees, making them a preferred choice for many.

It’s advisable to be aware of any tax implications related to international money transfers. Consulting with a tax professional can provide insights into potential tax obligations associated with remittances.

Exchange rates are subject to fluctuations. Nigerian immigrants should be mindful of these changes and consider utilizing tools like limit orders or forward contracts to mitigate the impact of adverse rate movements.

Money transfer services may operate on specific schedules. Considering time zone differences and business hours is essential, especially for urgent transfers, to ensure timely processing of transactions.

Check the customer support options provided by the chosen money transfer service. Look for platforms offering accessible customer service through phone, email, or online chat to address any queries or concerns.

Most money transfer services provide tracking features. Utilize online tracking tools or contact customer support for real-time updates on the status of your transfer to Nigeria.

Some platforms offer loyalty programs or incentives for frequent users. Explore such offerings to potentially benefit from reduced fees or promotional rates for consistent money transfers.

In summary, Nigerian immigrants in Canada sending money to Nigeria face a multitude of considerations.

Choosing the right documents, understanding transfer times, and exploring cost-effective methods are crucial. Online platforms often offer competitive rates, while security and tax implications demand attention.

Strategic approaches to exchange rate fluctuations and considerations like customer support and loyalty programs add to the complexity.

Staying informed and adapting to the evolving landscape ensures a seamless and optimized money transfer experience.