Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Getting a loan in Nigeria used to mean long lines at the bank, piles of paperwork, and waiting for days, sometimes weeks, for approval. But things have changed. Thanks to technology, getting quick cash is now just a tap away on your phone. Looking for loan apps with a low interest rate?

If you need money for school fees, business, rent, or an emergency, there are loan apps in Nigeria that can help you fast. But here’s the catch: not all of them are friendly with interest rates. Some can leave you paying back double what you borrowed.

That’s why we’ve put together this guide to show you the best loan apps with low interest rate in Nigeria. These apps won’t break your pocket, and they give you peace of mind when you need money the most.

When considering taking a loan, it is important to consider the interest rate because it is one of the key determinants of loan repayment. Opting for loan apps with a low interest rate potentially enables borrowers to be consistent with turning in their loan dues.

Oftentimes, borrowers evade their responsibility to repay their loans when they become overwhelmed with exorbitant interest rates. Intrinsically, it is mostly not always the will of these people to do so, but when the rate becomes higher than what they can afford, they tend to fail to keep their end of the bargain, which is prompt repayment.

Conversely, when the interest rate is minimal or relatively affordable, borrowers are potentially inclined to pay their dues when necessary.

Moreover, loan apps with a low interest rate also foster financial inclusivity, which is one of the cores of mobile lending platforms. The accessibility of this loan to wide base of users is one of the major factors that promotes these apps.

Loan apps with a low interest rate empower individuals who may have previously been excluded from traditional lending channels due to high interest rates or stringent eligibility criteria. A low loan interest rate ensures the accessibility of the loan to people of varying degrees of financial capacity.

Furthermore, low interest rates also help maintain a positive credit history. When borrowers are able to pay their loans in due time, it ultimately reflects a positive repayment behaviour in their credit history. All of these, collectively, emphasize the importance of seeking a loan with a low interest rate.

Without further ado, we will explore a curated list of the 20 best loan apps with a low interest rate in Nigeria in the ensuing paragraphs.

Below is a list of the 20 best loan apps with a low interest rate in Nigeria.

Let’s discuss each of these apps, and the features peculiar to them.

Also read: Access Bank Transfer Codes For Money Transfers and Bill Payments 2026

Carbon is one of the best loan apps with a low interest rate. It is an automated lending platform that makes loans accessible to Nigerians. Unlike traditional loan providers, the requirement is minimal.

To get a loan from the Carbon Loan app, all you need is your phone number and BVN during the application; there is no excessive paperwork.

To access the Carbon Loan, you need to provide valid bank details, your BVN (Bank Verification Number), and a complete online application form. Your application will be reviewed and approved by an AI (Artificial Intelligence) after you have made the provision.

First-time borrowers are offered loans starting at N1,000, and their chances of getting a higher amount increase as they pay off their loans on time. Here is an excerpt that describes the interest rate of the Carbon Loan:

Carbon implements a daily interest rate ranging from 0.1% to 1%, influenced by the borrower’s creditworthiness. As borrowers repay loans promptly, they often experience reduced interest rates. The daily interest rate translates to an Annual Percentage Rate (APR) ranging from 36.5% to 360%.

For instance, on a 91-day loan with a principal amount of NGN 3,000, the interest would be NGN 273, resulting in a total amount due of NGN 3,237. Monthly breakdowns reveal the interest and total amounts due, illustrating the financial commitment over the loan term. Follow the steps in the next section to get a loan from the Carbon Loan app.

Follow these steps to apply for a loan on the Carbon Loan app.

Fair Money is another mobile lending platform in Nigeria. It is one of the best loan apps with a low interest rate in Nigeria. It has a place in the list of the top fintech apps with an outrageous user base in Nigeria.

The interest rate of the Fair Money Loan app varies based on profiles, and ranges from 1% to 3% per month. Taking multiple loans with FairMoney and repaying them on time usually improves the loan rates. In addition to the interest rate, Fair Money charges a processing fee for every loan one gets.

Here are some facts about the Fair Money Loan app:

Another app on the list of our best loan apps with a low interest rate in Nigeria is the Branch Loan app. This app offers a monthly interest rate of 3% to 21%, and an annual rate of 15% to 34%. With the Branch Loan app, you can get a quick loan from N2,000 to N1, 000,000. Here are some facts about the Branch Loan app from their official website:

Formerly known as Kwikmoney, Migo is one of the loan apps with a low interest rate in Nigeria. It provides access to instant loans with interest rates ranging from 5% to 15%. Borrowers can enjoy the convenience of obtaining funds within 2 minutes, coupled with favorable repayment terms.

Also read: Top 10 Online Banking Apps in Nigeria 2026

PalmCredit offers instant loans, ensuring borrowers can effectively address their financial needs. The loan repayment timeline is between 3 and 6 months, and the interest rate is between 14% and 24%. It has a user-friendly interface and efficient services, and it is also a popular choice among Nigerians.

Alat, a product of Wema Bank, provides hassle-free access to loans with competitive interest rates. A loan of up to 2 million Naira can be borrowed from the app. The app is available for download on the Google Play Store.

Specta is owned by Sterling Bank, and it offers personal loans with attractive interest rates. A loan amount of up to N5,000,000 can be borrowed from Specta. It is not exclusive to only Sterling Bank users; users of diverse bank choices can also be beneficiaries. Borrowers can enjoy affordable financing solutions tailored to their needs.

PalmPay provides quick access to funds, typically within 5 minutes. However, it offers a short repayment period and a high interest rate for first-time borrowers. Both improve over time, provided the user pays up on time and never defaults on the loan agreement. PalmPay’s interest rate is between 15% and 30%.

Here are some things to know about the Aella app:

QuickCheck specializes in business loans, empowering entrepreneurs to access financing for their business goals.Here are some things to know about QuickCheck:

With Okash, borrowers can access loans without collateral, ensuring accessibility to funds without additional burdens. Some facts about Okash:

P2Vest distinguishes itself as a peer-to-peer lending platform, connecting borrowers with investors seeking better returns on their capital. With loan amounts ranging from N5,000 to N2,000,000, P2Vest provides an alternative financing option for individuals and businesses alike.

Also read: 8 Illegal Digital Loan Companies in Nigeria You Should Avoid 2026

JumiaPay, a product of Jumia, not only offers instant loans but also provides a one-stop solution for daily needs such as airtime, utility bills, and shopping. Users can download the JumiaPay app from Playstore for access to loans and other financial services.

Page Financials, licensed by the Central Bank of Nigeria (CBN), offers personal loans.

Blocka Cash is also among the loan apps on our list. It offers its loan in an easy and uncomplicated process. Moreover, quick loans of N5,000-N50,000 are available and can be accessed based on the user’s credit score.

It’s interest rate is up to 3.5% per month and 42% per year. Furthermore, as an eligibility criteria for the Blocka Cash loan, you need to be at least 21 years old and also provide a valid government ID. Blocka Cash is also available for Android and iOS users.

Kuda Bank is one of the most popular digital banks in Nigeria, with a significantly outstanding user base. It offers loans of up to N50,000 at a daily interest rate of 3%. You can increase your chances of getting a higher loan amount by increasing your usage of the app.

Kredi is one of the developing digital banks in Nigeria. The amount of loans users are eligible to, is dependent upon their customer tier level. Additionally, Kredi offers four kinds of loans:

YesCredit is an iPhone loan app available for all eligible persons in Nigeria. It grants a loan amount of up to N5,000-N50,000. It offers an interest rate between 4.5%-35%, while its equivalent monthly interest rate is between 5%-29%. Its Annual Percentage Rate (APR) is between 29% – 120%.

Additionally, borrowers have 60-180 days window to repay their loans. The loan limit of borrowers increases as they pay up their loans.

Irorun is another loan app you could consider. However, to be eligible for the Irorun loan, you must be at least 21 years old. Without meeting up with this requirement, your loan will not be granted. The loan tenor is between 60-90 days. It offers an interest rate of between 3%-5% per month, and an Annual Principal Rate (APR) of 36%.

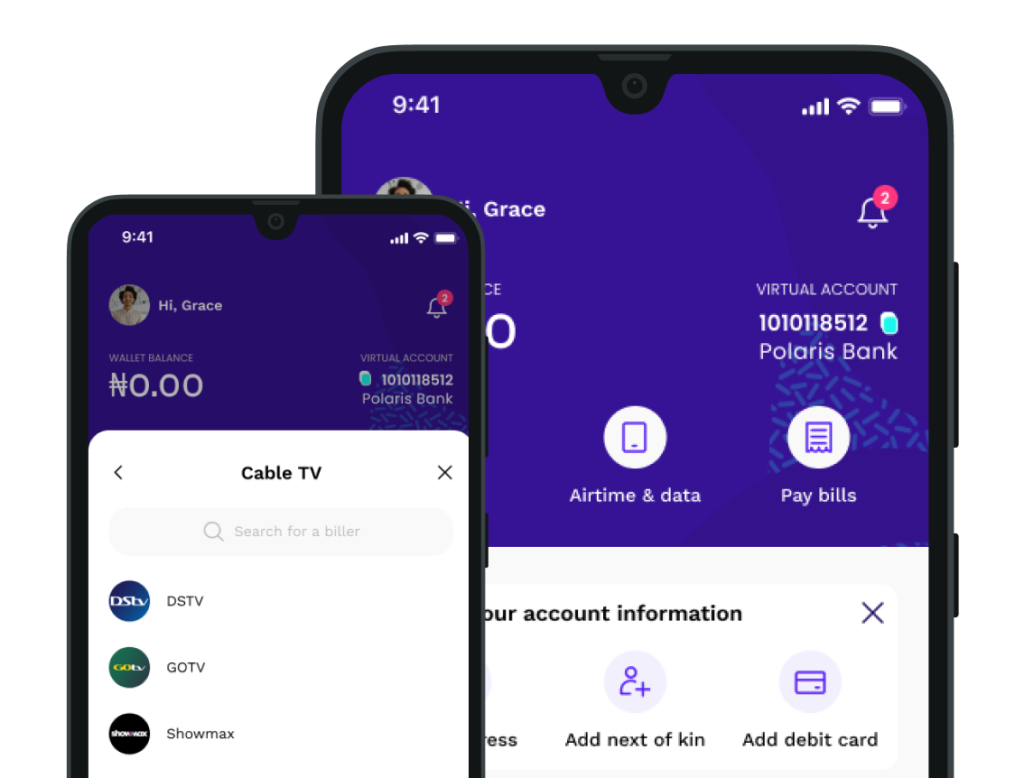

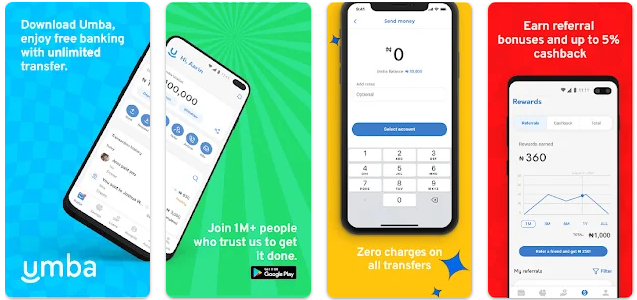

Umba loan app is one of the new digital banks gaining popularity in Nigeria. It offers loans from the range of N1,115 Naira to N89,182. It’s interest rate is between 10%-21%. Additionally, it offers a loan tenor of 62 days.

That brings us to the end of this piece. It is true that the essence of loan apps cannot be undermined especially in the Nigeria of today where the prices of essential commodities are on an insane rise without any restraint.

These loan apps help to save the day in periods where unexpected financial needs arise. However, the importance of interest rate cannot be overstated because it holds a key piece in every borrower’s loan repayment endeavour.

When the interest becomes too exorbitant, defaulting becomes an imminent response from borrowers. Nonetheless, with this exhaustive piece, we believe that the next time you consider taking a loan, whether it is for your business, personal needs, emergencies, or simple petty needs, you have been armed and furnished with the requisite knowledge in determining loan apps with a low interest rate in Nigeria.

To access other useful information such as this one, stay connected with us and also follow us on our Twitter handle, @SilicoAfriTech, a platform where valid pieces of information are shared non-stop.