Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Importing a vehicle into Nigeria involves significant paperwork and customs payments. Many buyers and importers need to verify that all duties were paid before completing a purchase.

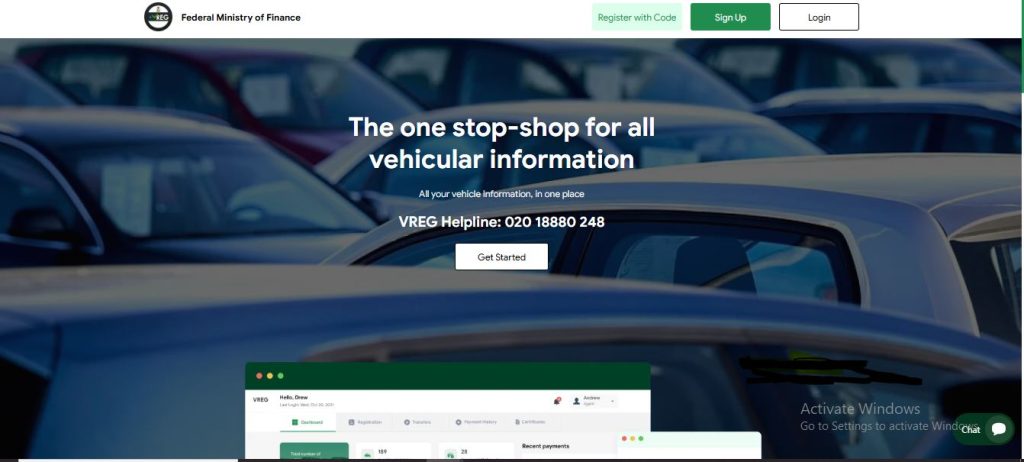

In recent years the Nigerian government created a central Vehicle Registration System (VREG) to track every imported car and curb duty evasion; thereby helping you know How to Check if Import Duty Has Been Paid on a Vehicle.

This means that each vehicle’s Vehicle Identification Number (VIN) is recorded along with its customs duty status. To avoid surprises (such as fines or seizures), Nigerian importers must confirm that Customs received payment for the car in question.

In this article, we explain how to check if import duty has been paid on a vehicle in Nigeria, using official channels like VREG and the Customs Single Window and review the current import duty rates on cars, how to calculate them and typical clearance timelines.

Nigeria’s Customs Service charges import duties based on the Common External Tariff (CET) under the Harmonized System. Passenger cars fall under Chapter 87, and the current duty rate on both new and used cars is 20% of the vehicle’s value, plus a 15% Vehicle Purchase Levy (NAC levy). These rates are uniform: both brand-new and foreign-used cars face the same 20% + 15% charge.

In addition to this base duty, importers pay other statutory taxes: 7.5% Value Added Tax (VAT), a 0.5% ECOWAS Trade Levy (ETL), and a 7% surcharge on the duty paid. In practice, these combined levies mean that the total import tax burden on a car can approach 50% or more of its customs value.

It is also important to note Nigeria’s import regulations: only vehicles up to a certain age may be imported. Originally, the age limit was 15 years, but Customs has tightened this. In 2022 the importable age dropped from 15 to 12 years under the new VIN Valuation policy.

As of mid-2025, only cars built in 2015 or later (a 10-year age limit) can be imported under standard conditions. Vehicles older than this are effectively barred or face huge penalties.

In other words, only modern vehicles (model year 2015+) are legally allowed entry. This context is vital because it means most imported cars will be relatively recent models, all subject to the standard 20% duty and associated taxes.

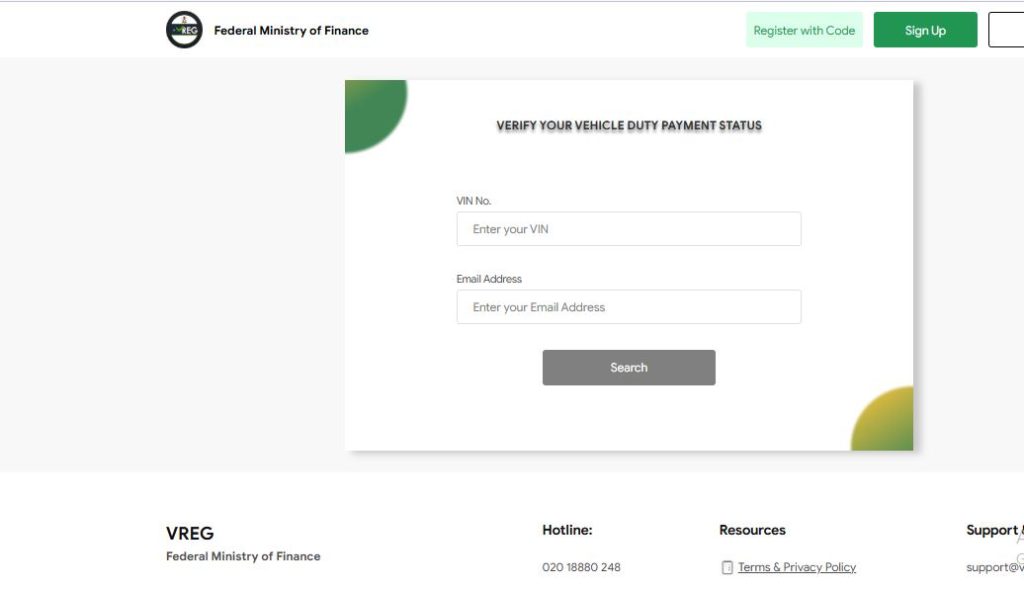

If you are buying an imported car, you should verify that the Nigerian Customs Service (NCS) received the duty payment. The key is to use official records tied to the vehicle’s VIN (chassis number). Here are the main ways:

VREG will display the vehicle’s registration record. If the car was properly cleared through Customs, the VREG entry should show that the VIN is registered and valid. Otherwise, the VIN may not be found or may indicate a hold. For example, on the VREG VIN entry page you will see fields for VIN, Brand, Model, Year, etc.

The official VREG portal’s VIN Verification page, where importers input a vehicle’s VIN, make, model and year to check registration and duty status.

By checking this, you confirm the vehicle is in the national database. If the VIN is not found, it may indicate the duty was not paid or that the car never went through official clearance.

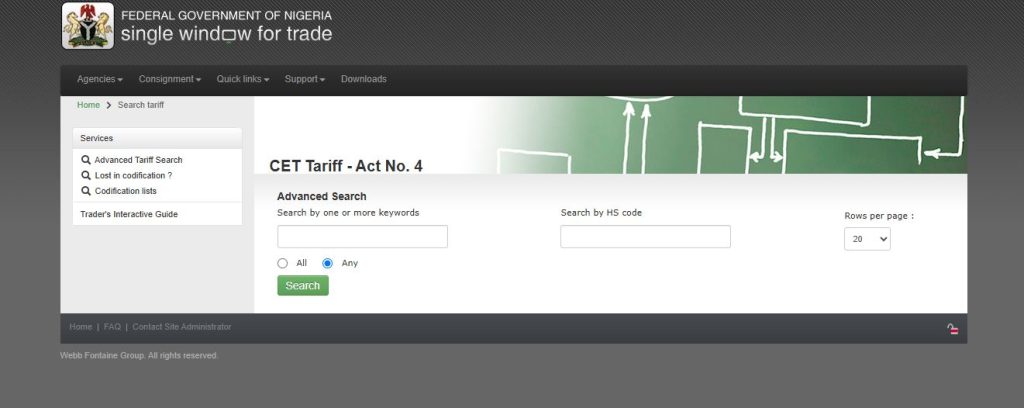

2. Check the Customs Single Window (NICIS) Portal. If you have access (for example, as a clearing agent) log in to the Nigeria Single Window trade portal or NICIS II system.

Enter the vehicle’s Customs Reference Number (C-Number) or declaration to retrieve the Single Goods Declaration (SGD). The SGD will show the assessed duty and whether payment was recorded. This requires knowing the official reference number from the clearance documents, which the seller or clearing agent should have.

3. Use the NCS Mobile App / VIN Tracker. Nigeria Customs introduced a mobile “Webbtracker” app for real-time VIN checks. Any user with NICIS II login (typically agents) can install it. By inputting the vehicle’s VIN, the app will validate the customs declaration and payment status for that car. So if you have the VIN, the app can tell you if Customs recognizes it as cleared.

4. Review the Vehicle Clearance Certificate (VCC). After payment, Customs issues a VCC (also called VIN Valuation Certificate) for each vehicle. When buying, ask the seller to provide the original VCC. This document lists the duty paid, VAT and other charges. If they cannot provide it, or if it looks fake, that is a red flag.

5. Consult a Licensed Clearing Agent. Clearing agents have direct access to Customs systems. Hire one to confirm the duty status. They can check the VIN on VREG and NICIS on your behalf, or query the C-Number. Using a reputable, licensed agent helps avoid fraud – they must be registered with the Nigeria Customs License Board.

When you engage the following steps, you can be confident a car’s import duties were paid before finalizing the sale. This protects you from legal penalties and ensures the vehicle can be legally registered for road use.

As of 2025, the import duty on cars in Nigeria is 20% of the vehicle’s customs value. In addition, there is a 15% Vehicle Purchase Levy imposed on imported vehicles (often called the NAC levy). These charges together mean the basic customs tax on a car is 35% of its value (CIF). This 35% covers the Customs duty plus the NAC levy.

It is important to note that both new and used cars pay these same rates. The government no longer gives preferential rates for older cars – whether the vehicle is fresh off the line or several years old, it still pays 20%+15%.

This uniform rate was introduced to simplify the system and reduce undervaluation. Currently, there is a 20% import duty and 15% levies for used and new cars” alike.

Besides the base duty and levy, you must add standard taxes. After calculating the 20% and 15% on CIF, Customs also charges 7.5% VAT on the total (CIF + duty + levy + surcharge + ETL) and 0.5% ECOWAS Trade Levy on CIF.

There is also a surcharge of 7% on the import duty amount. In short, after duty and levy (35%), the additional taxes (VAT, ETL, SUR) bring the total closer to roughly 45–50% of the car’s base price.

For budgeting purposes, it is safe to assume an imported car will attract about half its value in total duties and taxes. For example, an inexpensive used sedan might pay ₦4–6 million in taxes on a $5,000–$7,500 vehicle.

Calculating Nigeria’s import duty involves several steps. You need the vehicle’s Customs-assessed value (in dollars or foreign currency) and the official exchange rate. The general procedure is:

This is the total customs charge on the car. In our example (CIF ₦9.6M), the sum of all taxes is ~₦4.53M.

For a different example: a 2015 Toyota Corolla valued at $7,500. At ₦1,600/US$, CIF = ₦12,000,000. Then

Adding those: 2,400,000 + 1,800,000 + 60,000 + 168,000 + 1,232,100 ≈ ₦5,660,100 in total taxes.

Thus, a $7,500 Corolla would pay roughly ₦2.4M + ₦1.8M + ₦60k + ₦168k + ₦1.23M ≈ ₦5.66M in import duties and taxes. Similarly, a 2012 Honda Accord worth $6,000 (CIF ₦9.6M) incurs about ₦4.53M total as shown above. These calculations align with official formulas.

Customs clearance times can vary, but with all documents and payments in order, a vehicle can usually be cleared in about 1–7 days. In simple cases, clearance can be done in as little as one day after arrival, especially if all forms, Form M and PAAR approvals, and payments are ready.

In practice, expect around 3–7 days for a compliant vehicle. Delays beyond this typically occur if there are documentation issues, inspections by multiple agencies, or port congestion.

For example, after paying duties at the bank and submitting the Exit Notice request, a customs officer will inspect the vehicle – a process that “may vary from 1-7 days depending on the type of consignment”.

Once inspection is cleared, the exit note is issued and the car is released. In summary, factor in about one to two weeks for full customs clearance of a car in Nigeria. Engaging a good clearing agent can expedite this, as they can swiftly handle paperwork and coordinate inspections.

To check the custom clearance status of a vehicle in Nigeria, you can use the Nigeria Customs Service (NCS) verification system or the National Vehicle Identification System (NVIS).

Get in touch with the Nigeria Customs Service

about a week

Importing a car into Nigeria requires careful planning, especially around customs duties. Always verify duty payment before finalizing a purchase. Use official tools like the VREG portal and Customs Single Window, and consult a licensed clearing agent if needed.

With the step-by-step checks above — verifying the VIN, checking the declaration status, and reviewing the clearance certificate — you can avoid buying a vehicle with unpaid import duties. Proper due diligence will ensure your imported car is fully cleared and legally eligible for Nigerian roads.