Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

TymeBank, the South African digital bank with R4 billion ($222 million) in customer deposits, is set to expand its footprint in Southeast Asia by launching operations in Indonesia by the end of 2024.

This move marks the bank’s third market entry in the region, following its successful launches in the Philippines in October 2022 and Vietnam in January 2024.

With a focus on small and medium enterprises (SMEs), TymeBank aims to leverage Indonesia’s vast market potential.

In its initial phase in Indonesia, TymeBank will not seek a banking license but will introduce its lending product, Merchant Cash Advance, specifically targeting SMEs.

This approach mirrors the strategy employed in Vietnam, allowing TymeBank to establish its brand without the lengthy and costly process of obtaining a full banking license.

Coen Jonker, chair of Tyme Group, emphasized the significant profit potential in the small business lending sector within Indonesia and the broader Southeast Asian market.

He noted, “We see a massive opportunity with good profit potential in the small business lending space in Indonesia and the region.”

Indonesia, with its population of over 270 million and more than 60 million SMEs, presents a lucrative opportunity for TymeBank.

Many of these small businesses struggle to access traditional financing options, creating a gap that TymeBank aims to fill.

The bank has already disbursed $100 million to over 60,000 small businesses in South Africa, showcasing its capability and commitment to supporting SMEs.

The decision to focus on SMEs aligns with TymeBank’s foundational mission, which targets low-income earners and small businesses.

Since its inception in 2018 by Coenraad Jonker and Tjaart van der Walt, TymeBank has raised $316 million in funding, backed by notable investors such as Tencent and British International Investment.

Currently, the bank is in the process of raising an additional $150 million in a Series D funding round, with plans to list on the New York Stock Exchange by 2028.

Read Next: TymeBank Expands to 172,000 Spaza Shops

While TymeBank has ambitious plans for growth, it faces challenges.

Its operations in the Philippines reported a loss of 2.47 billion Philippine pesos ($42 million) in 2023, marking its first full year of operations.

However, Jonker remains optimistic, stating that the bank aims to break even in the Philippines by 2025 and achieve full-year profitability in South Africa by the end of 2024.

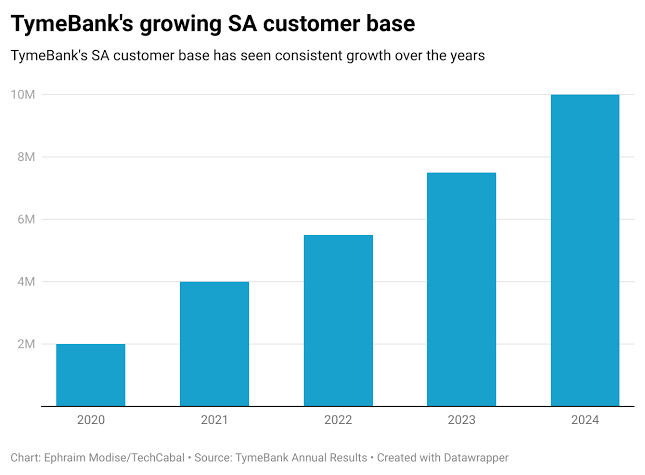

TymeBank has set a target to reach 10 million customers in South Africa and 5 million in the Philippines by October 2024.

Jonker highlighted the rapid growth in the Philippines, noting that the bank has achieved half of its total customer base in just two years, compared to six years in South Africa.

This growth trajectory underscores the bank’s potential to scale effectively in new markets.

The favorable regulatory environment in Southeast Asia, combined with the region’s expansive market potential, has prompted TymeBank to prioritize its operations in this area.

Jonker indicated that while the focus is currently on Southeast Asia, the bank does not rule out future expansion into Africa, stating that it is a question of “when and not if.”

As TymeBank prepares for its launch in Indonesia, the bank is poised to make a significant impact on the SME lending landscape.

By leveraging its experience and adapting its strategies to meet local needs, TymeBank aims to establish itself as a key player in Indonesia’s financial ecosystem, providing much-needed support to small businesses and contributing to the region’s economic growth.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.