Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

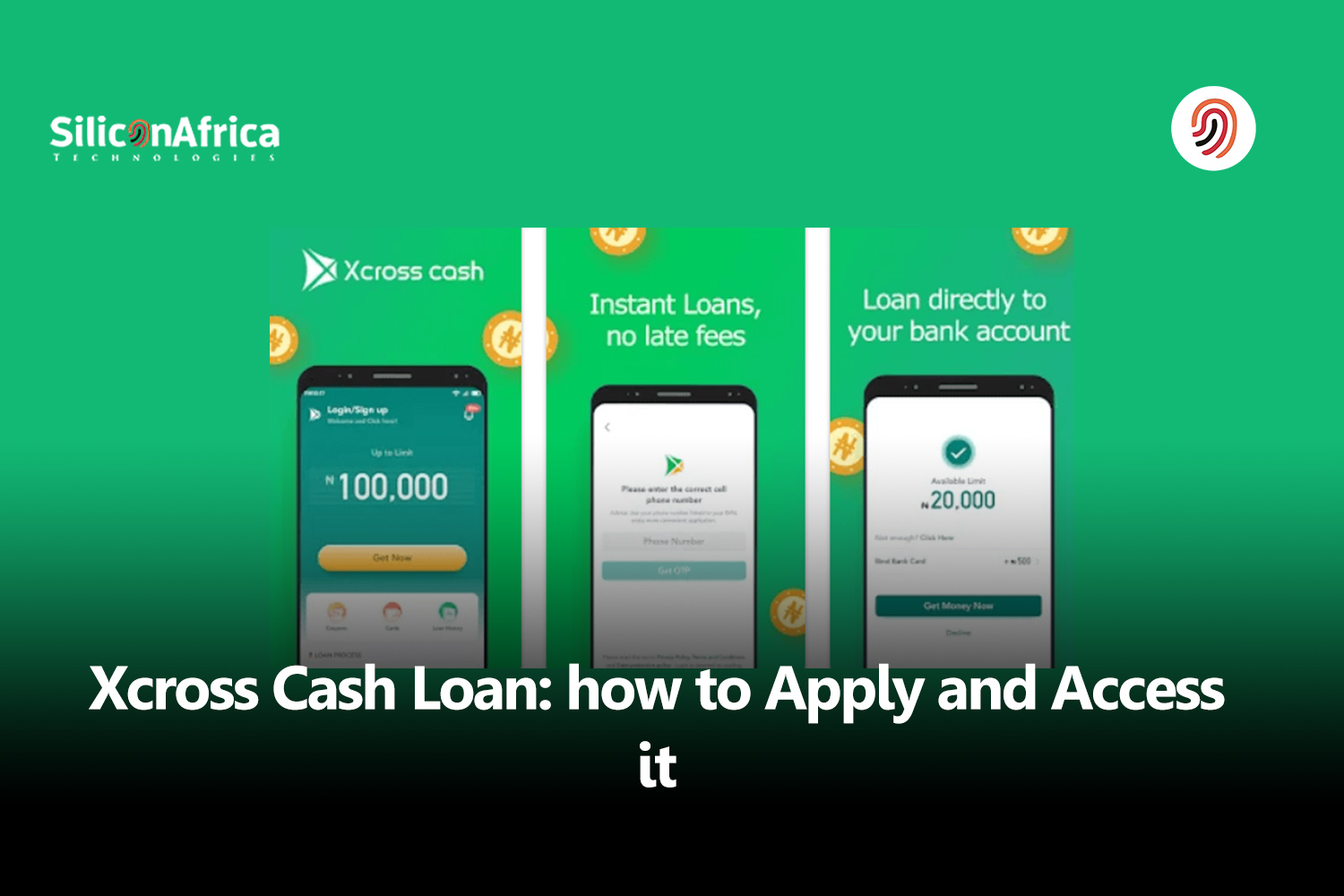

Xcross cash Loan is a lending platform that operates differently from others. And this is how it differs from other online lending services. Many internet lending platforms have emerged in response to the inadequacies of traditional banks.

Searching for a place to obtain a loan quickly? There’s no need to search any farther—XcrossCash Loan has you covered.

People look to financial aid during a financial crisis in order to meet their financial necessities. XcrossCash lending stands out as a beacon of light, offering a variety of lending solutions to people in easy access who need quick cash.

We are going to examine Xcross cash loan in detail in this post, including its operation, loan application process, and other key features. As we descend, make sure to continue reading.

see also – How to Register & Use the New NIMC Self Service Portal in 2025

People who satisfy the qualifications and criteria can apply for quick personal loans with Xcrosscash, an online lending platform based in Nigeria.

Through its website and application, Xcross cash assists borrowers of short-term loans in meeting their personal demands.

Xcross cash offers loans up to N50,000. Their services are easy to use, stress-free, and have fewer obstacles.

Anyone with a source of income is eligible to borrow money via Xcross cash loan. Once more, since starting out as a lending platform, it has upheld a respectable reputation and fulfilled client expectations without a shred of theft.

see also – How to Redeem a Gift Card in 2025

Among the main characteristics of Xcross Cash Loan are:

To approve your Xcross cash loan, it doesn’t require any collateral, guarantors, or even an excessive amount of time.

Prior to considering applying for a loan from Xcrosscash, you must first register with them. And by signing up, we mean registering for a user account before using the app to apply for loans.

Xcross Cash made it simple for consumers to borrow between N10,000 and N50,000 to satisfy people’s financial requirements and lessen barriers to rapid loans between customers and banks.

The flexible Xcrosscash repayment plan, which has a period of three to six months, makes it easy to stick to.

see also – Easy Loan: How to Easily Apply

In fact, Xcross cash does not require property records in order for you to secure a loan; the prerequisites are listed below.

Be aware that your loan application will be denied if these conditions are not met. These are the prerequisites:

You must be a resident of Nigeria in order to be eligible to receive Xcross cash loans.

You must, in fact, reside in Nigeria. This is predicated on the fact that Xcross Cash operates exclusively inside the borders of Nigeria and maintains its head office there.

Being a resident of Nigeria is insufficient; you must be between the ages of 22 and 55.

Although it is reasonable to think that someone should be well-off by the time they are 22 years old, it is acceptable to acknowledge that this isn’t always the case for people who are 55 years old.

It’s also very important to have your bank account number, which you can open with any commercial bank in Nigeria.

When accepted, the only place your loan funds can go is your bank account. Get a bank account as soon as possible if you don’t already have one.

In order to be eligible for a short-term personal loan from Xcrosscash, you must have a working phone. You will be able to get security and verification codes by using your phone number.

Recall that the phone number needs to be connected to your National Identity Number (NIN) and active.

Just as crucial as your bank account is your BVN. Every account holder has a unique code that is the same for all banks.

Xcrosscash loans will be able to verify your information and banking history with your bank verification number, as well as make sure you have no outstanding loans from previous applications.

Furthermore, the Bank Verification Number (BVN) plays a crucial role in the monitoring of financial offenses.

Paying back debts is a different matter entirely from taking them out.

When you are certain that you are unemployed or do not have a reliable source of income, it is preferable not to take out loans from Xcrosscash. By doing this, you protect yourself from fines and humiliation.

You must own a smartphone in order to apply for loans with Xcrosscash loan. It should be possible for your smartphone to download the Xcrosscash loan app and browse the internet.

These are the prerequisites in order to apply for a loan from Xcrosscash. It doesn’t end there, though. If after going through the requirements and you are sure you are fit for getting an Xcrosscash loan, proceed to download the Xcrosscash loan app.

If you would rather not use the official website, you can apply for loans through the Xcross cash loan app.

Since it launched, the Xcross cash loan app has been nothing short of fantastic. Indeed, the incredible features of the Xcrosscash lending app set it apart from other loan apps.

Regretfully, Android users can only get the Xcrosscash loan app from the Google Play Store. Users of Windows and iOS cannot access it.

Highest rated is Xcross cash. Approximately 25,000 users, 500,000 downloads, and 4.5 out of 5.0 ratings.

The Xcrosscash loan app’s tiny size is the cherry on top. You can download the programme from the Google Play Store for no more than 12 MB. Once you have downloaded the loan app, the next great step to take is to create an account with it.

see also – Chipper Cash Lays Off Twenty more Staff in the US and UK

Xcross cash account creation is quite simple if you follow the instructions we’ve listed below;

To apply for a quick loan from Xcrosscash, simply follow the procedures below.

If your application is declined, be sure to check if the details you gave are accurate. Then try again.

With the Xcross cash loan app, you may borrow money between N10,000 and N50,000 without needing any security, guarantor, or property documentation.

If you fulfil the application requirements, your loan will be released into your bank account in a matter of minutes.

You can raise your Xcrosscash loan limit in one of two ways. They are

see also – Exclusive: A Closer Look into the Top 10 Biggest Fintech Companies in Africa 2025

On Xcross cash, there is no set repayment schedule. For the applicant, it is convenient and adaptable. We define flexibility as allowing you to select the payback schedule that works best for you.

Nonetheless, the time frame is often three to six months.

Follow these steps to pay back your Xcrosscash loan:

The interest rate on Xcross cash is a little lower. Each month, they take fees ranging from 4.0% to 4.7% of your loan. Nice, huh? That’s only one of the several reasons you ought to sign up with Xcrosscash right now.

The interest rate on Xcrosscash is a little lower. Each month, they take fees ranging from 4.0% to 4.7% of your loan. Nice, huh? That’s only one of the several reasons you ought to sign up with Xcrosscash right now.

Xcross Cash Loan is a financial service that provides short-term loans to individuals in need of immediate funds.

You can apply for Xcross Cash Loan by visiting their website or using their mobile app. Fill out the application form and submit the required documents.

Eligibility criteria typically include being of legal age, having a steady source of income, and meeting any other requirements set by Xcross Cash Loan.

Loan amounts vary depending on your eligibility and creditworthiness. Typically, you can borrow amounts ranging from a few hundred to several thousand dollars.

You may need to provide identification documents, proof of income, and other documents as requested by Xcross Cash Loan.

Approval times vary, but some applicants receive approval within minutes of submitting their application.

Once approved, funds are usually deposited into your bank account within one to two business days.

Repayment terms and options vary, but typically you’ll need to repay the loan amount plus any interest and fees by the agreed-upon due date.

Some lenders may offer extensions or flexible repayment options, but it’s important to discuss this with Xcross Cash Loan and understand any associated fees or penalties.

In conclusion, Xcross Cash Loan offers a convenient solution for individuals in need of short-term financial assistance. With a simple application process, quick approval times, and flexible repayment options, it provides a reliable way to access funds swiftly.

While borrowers must meet certain eligibility criteria and provide necessary documentation, the service prioritizes privacy and security, ensuring the protection of personal and financial information.

Overall, Xcross Cash Loan stands as a dependable option for those seeking immediate financial support, offering peace of mind and assistance during times of financial uncertainty.

For more related articles like this, you can explore our homepage and kindly leave a comment and follow our social media platforms for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.