Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

A cryptocurrency loan service implemented on a blockchain is called a lending protocol. Decentralized finance (DeFi) is a financial application that operates through a blockchain, removing the need for users to trust any centralized entities.

DeFi loans rely on automated digital contracts called smart contracts to ensure you adhere to the loan requirements. You retain control of your crypto assets, but a lender can take automatic actions against your account if you default or miss a payment.

In the fast-paced world of finance, cryptocurrencies have emerged as a disruptive force, challenging traditional banking systems and reshaping the way we perceive and interact with money.

One of the latest innovations within this realm is the concept of cryptocurrency loan services, implemented on blockchain technology. This article explores what cryptocurrency loan services are, how they function, and the impact they have on the financial landscape.

see also – Naira’s Unending Fall: Nigerian Authorities Ban Access to Crypto Exchanges

A cryptocurrency loan service is a platform that allows users to borrow or lend digital assets such as Bitcoin, Ethereum, or other cryptocurrencies. These services operate similarly to traditional lending platforms but utilize blockchain technology to facilitate transactions securely and transparently.

The sole difference between bank loans backed by securities and cryptocurrency-backed loans is that the former use your bitcoin assets as collateral and the latter do not. Because of their nature, crypto loans are usually exclusively available through crypto lending platforms or exchanges.

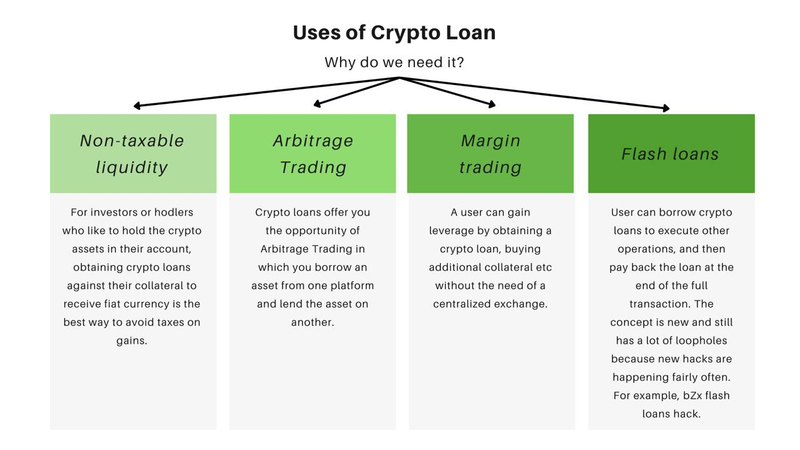

Consider Bitcoin as an illustration. Bitcoin is an erratic investment. Due to market selloffs brought on by the epidemic, the price of Bitcoin fell below $4,000 in March 2020. However, in April 2021, the price of the cryptocurrency surged to over $64,000.

You could occasionally need money to cover living expenditures like a flat tyre or a leaky roof while you wait for Bitcoin’s price to rise. Selling your Bitcoin at the incorrect time could cost you a lot of money or prevent you from making further big profits.

How therefore might you resolve this issue? Lending out your cryptocurrency holdings can be one way to get a crypto loan. Instead of selling your cryptocurrencies at a possibly poor price, you get to borrow USD (or your country’s fiat cash) to cover urgent expenses.

Blockchain, the underlying technology behind cryptocurrencies, plays a crucial role in cryptocurrency loan services. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, enable the automation of loan processes without the need for intermediaries.

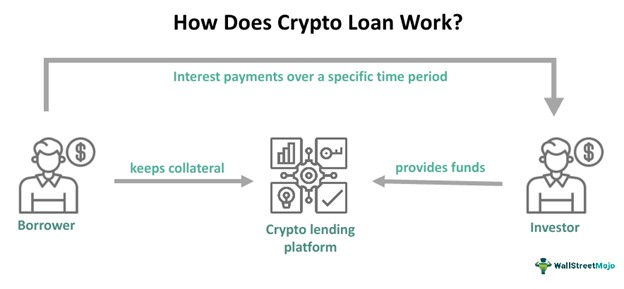

1. Borrowing Cryptocurrency: Users seeking to borrow cryptocurrency can do so by providing collateral in the form of another cryptocurrency. The amount of cryptocurrency that can be borrowed typically depends on the value of the collateral provided. Smart contracts lock the collateral until the borrower repays the loan in full, ensuring security for the lender.

2. Lending Cryptocurrency: On the other side, individuals who have excess cryptocurrency can lend it out to earn interest. Lenders deposit their digital assets into smart contracts, which automatically distribute interest payments to their wallets based on predetermined terms.

see also – Tinubu Lifts Cryptocurrency Ban in Nigeria, Pledges Support for Crypto Users

1. Decentralization: Unlike traditional banking systems, cryptocurrency loan services operate on decentralized blockchain networks, eliminating the need for intermediaries such as banks or financial institutions. This decentralization fosters trust and transparency in transactions.

2. Global Accessibility: Cryptocurrency loans are accessible to anyone with an internet connection, regardless of geographical location. This accessibility opens up financial opportunities for individuals who may be excluded from traditional banking services due to factors such as location or credit history.

3. Reduced Fees: By bypassing intermediaries, cryptocurrency loan services often offer lower fees compared to traditional lending platforms. Smart contracts automate the loan process, reducing administrative costs and overhead expenses.

4. Instant Transactions: Blockchain technology enables near-instantaneous transactions, eliminating the delays associated with traditional loan processing. Borrowers can receive funds quickly, providing them with greater flexibility and convenience.

CeFi and DeFi crypto loans are the two forms of cryptocurrency loan services that are currently offered. We’ll examine the parallels and divergences between these two categories of cryptocurrency loans.

Centralized Finance, or CeFi Cryptocurrency loans are given out by centralized organizations. These centralized organizations function similarly to pawn shops, accepting cryptocurrency as collateral in exchange for a USD loan.

The very concept of centralization suggests the existence of a single point of failure. You can lose the cryptocurrency you store on these sites as collateral if these centralized organizations fail.

On centralized exchanges or platforms like Binance, you can apply for or lend money in cryptocurrency. You will earn income on your cryptocurrency holdings if you lend them out, but you will also have to pay interest if you borrow.

For instance, on the centralized financial platform Nexo:

Decentralised Finance, or DeFi, refers to financial apps that run on a blockchain, eliminating the need for customers to have faith in any centralised organisations. The main advantage of utilising DeFi is that consumers are in charge of their money and can distribute it anyway they like.

Contract execution can be automated with the use of a smart contract. It includes a programmed transaction that fixes the payment terms and collateral value.

Through a lending protocol, DeFi loans enable users to lend their cryptocurrency straight to another party and earn interest. Lenders on a DeFi lending system can be anyone. Lending pools, which take the place of traditional banks’ loan offices, facilitate this procedure.

Lender assets are pooled and dispersed to borrowers using smart contracts. Collateral must be placed with a loan in order to receive one from a typical bank. For instance, the vehicle itself serves as collateral for a car loan. The bank will be entitled to take possession of the car if the borrower defaults on the loan.

While cryptocurrency loan services offer numerous benefits, they also come with their own set of risks and challenges.

1. Volatility: The volatile nature of cryptocurrencies poses a risk to both borrowers and lenders. Fluctuations in the value of digital assets can result in significant losses for borrowers who use volatile assets as collateral or for lenders who receive repayment in depreciated currencies.

2. Security Concerns: While blockchain technology provides a high level of security, cryptocurrency loan services are not immune to hacking or security breaches. Users must exercise caution and employ best practices to protect their digital assets from theft or unauthorized access.

3. Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies and blockchain technology remains uncertain in many jurisdictions. Regulatory changes or crackdowns could impact the legality and operation of cryptocurrency loan services, creating uncertainty for users and investors.

Despite the challenges, the future of cryptocurrency loan services looks promising. As blockchain technology continues to evolve and mature, cryptocurrency loan platforms are likely to become more sophisticated and user-friendly. Additionally, as mainstream adoption of cryptocurrencies increases, the demand for cryptocurrency lending and borrowing services is expected to grow.

Furthermore, the integration of decentralized finance (DeFi) protocols with cryptocurrency loan services could unlock even greater potential. DeFi platforms leverage blockchain technology to offer a wide range of financial services, including lending, borrowing, and trading, without the need for traditional intermediaries.

Cryptocurrency loan services implemented on blockchain technology represent a revolutionary development in the financial industry. By leveraging the transparency, security, and efficiency of blockchain technology, these platforms offer a decentralized alternative to traditional lending systems. While challenges remain, the potential benefits of cryptocurrency loans are vast, paving the way for a more inclusive and accessible financial future.

see also – Here are the Top 6 Crypto Exchanges Nigerians Can Use for Buying/Selling Bitcoin in 2024

Even with all of their advantages, cryptocurrency lending is not a risk-free venture. You should be aware of the hazards associated with crypto loans.

Insolvency Risk: Lending using cryptocurrency may result in double-digit interest rates. But, if the platform provider files for bankruptcy, you can lose all of your cryptocurrency holdings because there isn’t any insurance available. After then, the assets would be incorporated into the bankruptcy estate, and the bankruptcy procedures would treat you as a creditor. The financial health of the cryptocurrency loan platforms should be known to you, and you should exercise extra caution when using less-established platforms.

Counterparty Risk: Your cryptocurrency deposits could be used by CeFi platforms to lend to institutional investors, hedge funds, cryptocurrency exchanges, and over the counter (OTC) traders. If the counterparties to these trades don’t return the lent deposits, your lending platform provider can go bankrupt.

Hacks and problems in smart contracts – One benefit of smart contracts is that they are transparent and fully automated. On the other hand, a poorly written piece of code could leave the smart contract open to hacking. For instance, the Cream Finance attack resulted in cryptocurrency losses exceeding $34 million.

Admin keys risk: DeFi protocol developers might have authority over admin keys. The whole protocol budget could be drained by developers if the admin keys are not burned or decentralized.

Risks Associated with Liquidation: Liquidation happens when the value of the cryptocurrency you are using as collateral drops, and your loan is less than the collateral ratio.

A cryptocurrency loan service allows individuals to borrow or lend digital currencies, typically through a decentralized platform, using smart contracts on a blockchain.

Users can deposit their cryptocurrency as collateral and borrow another cryptocurrency or fiat currency. Smart contracts execute the loan terms, ensuring transparency and security.

Benefits include quick access to liquidity without selling assets, lower interest rates compared to traditional loans, and the ability to diversify investment strategies.

When implemented on a blockchain, cryptocurrency loan services offer increased security through cryptographic techniques and transparent, immutable transaction records.

Smart contracts automatically liquidate the collateral to cover the loan amount, minimizing the risk for lenders.

Yes, borrowers risk losing their collateral if they fail to repay the loan according to the terms specified in the smart contract.

Yes, most platforms have minimal requirements for participation, such as owning cryptocurrency to use as collateral.

Interest rates are often determined by market demand and supply dynamics, with some platforms offering variable rates based on factors like loan duration and collateral value.

Regulations vary by jurisdiction, but as the industry matures, there is increasing scrutiny and efforts to establish regulatory frameworks for cryptocurrency lending.

Users should research platforms thoroughly, understand the terms and risks involved, and consider factors such as interest rates, collateral requirements, and regulatory compliance.

Both DeFi and CeFi, each with their own advantages and disadvantages, are vital to today’s cryptocurrency loan services industry. For newbies, CeFi loans might be a simpler option, but customers must pay the rates that these companies establish.

Conversely, you have complete control over loan management and collateralization ratio with DeFi loans. However, hackers might be able to syphon off the protocol’s cash due to the potential for smart contract vulnerabilities and attacks.

Do your homework and weigh the dangers before choosing to take out a cryptocurrency loan, as you should with anything related to cryptocurrencies.

You can check out other useful content by following us on X/Twitter: @siliconafritech.

Instagram: @SiliconAfricaTech.

Facebook: @SiliconAfrica