Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

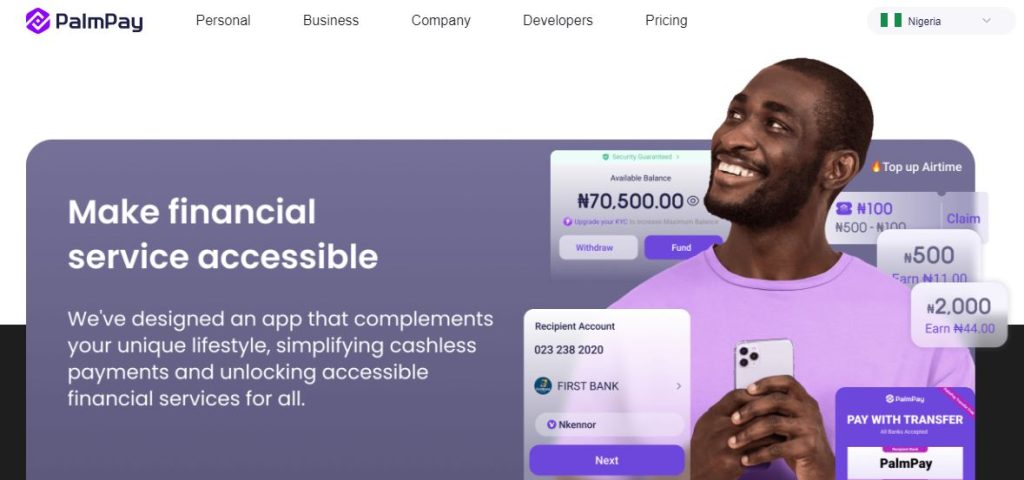

Ensuing the ban from the Central Bank of Nigeria on fintech onboarding new customers, PalmPay, one of the successful fintech players, has announced that its onboarding resumed on its mobile app for users and merchants. Finally, PalmPay onboarding customers resumes.

This development is in line with PalmPay’s ongoing dedication to revolutionizing the Nigerian financial services sector.

This is done by providing seamless, secure, and efficient economic solutions while working with the apex bank regulations.

Chika Nwosu, Managing Director of PalmPay Nigeria, stated, “Our commitment to excellence and financial security remains unwavering as we drive financial inclusion.”

“Despite the growing interest in cryptocurrency, PalmPay does not permit cryptocurrency or virtual asset trading on our platform.”

“In addition, this is in line with the Central Bank of Nigeria (CBN) regulations to protect the financial ecosystem.”

Also read – Cyber Fraud Rise: PalmPay Upgrades in-app Security Features

He went on to express how the company is not only to offer services to the users, but to also understand them. Consequently, providing solutions that align with their problems.

He highlighted that cryptocurrency activities would be reported to the necessary authorities to ensure transparency and avoid illegalities.

“We monitor platform activities diligently and take necessary actions. This includes account closure and reporting to the relevant authorities for any cryptocurrency or other related transactions.”

“We are committed to maintaining robust Know Your Customer (KYC) and Customer Due Diligence (CDD) systems. This will help us understand our users and mitigate risks effectively.”

According to him, the company’s core mission focuses on providing a safe and reliable platform for your everyday financial needs.

To register in the fintech bank, all potential users need to validate their NIN or BVN numbers to confirm identity.

He finally said, “We urge users to ensure that the information on these platforms is up-to-date before commencing registration. Also, we need the information to review the terms and conditions in the app and website to onboard.”

Interact with us if you find this news helpful on

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.