Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

In a major development for African financial services, Onafriq and PAPSS have today launched a cross-border payments service in Ghana that promises to transform how money moves across the continent. The new service, which began operations on June 20, 2025, will initially focus on outbound transactions from Ghana, marking a significant step toward borderless financial transactions in Africa.

The Onafriq and PAPSS cross-border payments service in Ghana is the result of a partnership first established in 2022, now finally bearing fruit after three years of development. This collaboration aims to make sending money across African borders as simple as making a local transaction.

Read Next: Binance has Launched “Will Function” to Allow Users Give Crypto Assets to Next of Kin

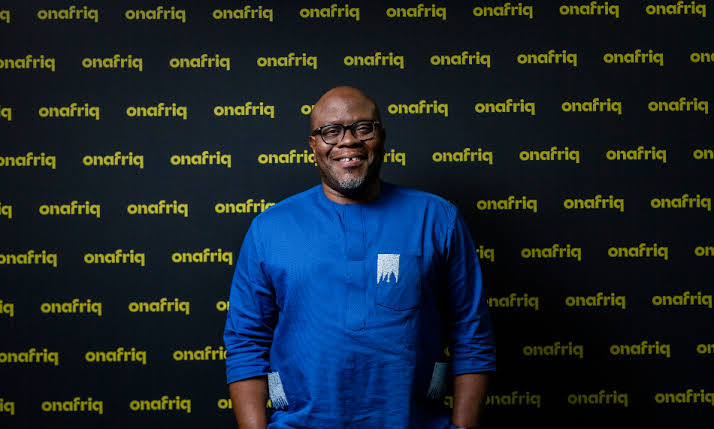

“We are excited to be taking another step in operationalizing our important partnership with PAPSS to bring this innovative cross-border payment solution to our users,” said Dare Okoudjou, Founder and CEO of Onafriq. “This service is not just about convenience; it brings people together and enhances economic activity between Ghana and the region.”

The new system allows customers of participating banks and mobile money providers in Ghana to send and receive money directly into mobile wallets and bank accounts in other African countries. This addresses long-standing problems of high transaction costs and unclear exchange rates that have hindered cross-border trade.

Mike Ogbalu III, CEO of PAPSS, described the launch as “a significant milestone in our journey towards a more integrated financial landscape in Africa,” adding that their partnership with Onafriq represents a commitment to empowering small businesses and individuals by making cross-border transactions simpler.

The Bank of Ghana has approved this initiative as a six-month pilot program. During this period, Onafriq and PAPSS will study how well the system works, how many people use it, and how it handles currency exchange, while offering better rates and more accessible services to customers.

Small and medium-sized businesses stand to benefit the most from this new service. These businesses have traditionally faced significant barriers when trying to send or receive money across African borders. Now, they can access formal payment services more easily, helping them grow their operations beyond national boundaries.

The African Export-Import Bank (Afreximbank) will serve as the settlement entity for these transactions, ensuring that all payments between parties are completed reliably and on time.

This launch is particularly significant for Ghana, which has been at the heart of Onafriq’s mission to eliminate barriers to cross-border transactions. The company has been working with partners to provide solutions for clients with business interests spanning not only within Ghana but also in East Africa.

Read Next: Ghanaian Cybercrime Syndicate Busted in a $100M FBI-Interpol Sting, Faces Extradition to the U.S

The Onafriq and PAPSS launches cross-border payments service is expected to soon be available on mobile money and other fintech-based wallets, further expanding its reach. This development aligns with Onafriq’s long-stated belief that “Africans are not limited by borders and that their money should not be either.”

With this launch, the vision of a financially interconnected Africa takes a significant step forward, potentially transforming how businesses and individuals move money across the continent.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.