Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

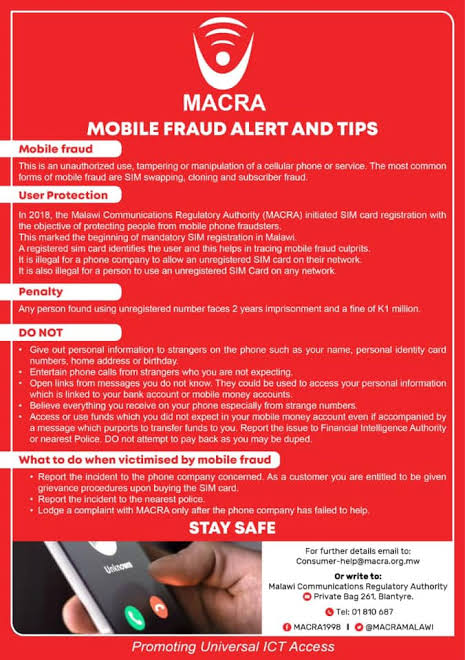

Malawi is stepping up its fight against mobile money fraud, a growing problem that puts businesses and everyday people at risk. Mobile money services have changed life in Malawi for the better, making it easier for people to send and receive cash using their phones. But scams are now stealing that trust and hurting the economy. The Malawi Communications Regulatory Authority (MACRA) just wrapped up its Mobile Money Fraud Prevention Programme to tackle this head-on.

This programme brought together key players, including a special Steering Committee set up to fight the fraud. Lawmakers from the Parliamentary Committee on Media and Communications also joined in, showing strong support. They all met to share ideas and plan better ways to stop the criminals. The goal is clear: protect users and keep mobile money safe for everyone.

Read Next: Google Launches Applications for 10th Africa Startup Accelerator, Focusing on AI Innovation

Kingwell Liphuka, who leads the Parliamentary Committee on Media and Communications, said mobile money fraud is not just about losing money. “It breaks the trust people have in digital services,” he explained. He pointed out that while mobile money has boosted the economy by helping small businesses and families, scams undo all that good work. Fraudsters trick people into sending cash to fake accounts or use sneaky tricks to steal PINs. This leaves ordinary citizens scared to use their phones for payments and businesses losing hard-earned profits.

Liphuka stressed that no one is safe, from market vendors in rural areas to city shop owners. The fraud has grown with more people using services like Airtel Money and TNM Mpamba. Without quick action, it could slow down Malawi’s push towards a cashless future. That’s why the meeting was so important. Everyone agreed they must act fast.

The Parliamentary Committee made firm promises. They will push public awareness campaigns right in their local areas. This means teaching people how to spot scams, like suspicious texts asking for personal details or unexpected reversal requests. Lawmakers want everyone to know the red flags and report them quickly.

They also backed a big review of the laws around mobile money. Current rules need updates to allow new security tools, like better phone verification or real-time alerts for odd transactions. The committee called for tighter teamwork between agencies, such as police, banks, and mobile operators. This united front would make it harder for fraudsters to hide.

Mayamiko Nkoloma, who chairs the Steering Committee and acts as MACRA’s director general, praised the task force for their hard work so far. “You’ve done well, but we need to stay one step ahead,” she said. Nkoloma urged everyone, regulators, companies, and users, to keep working together. She challenged the team to think creatively and outsmart the criminals before they strike next. For example, using AI to detect fake accounts or training agents to verify big transfers could be game-changers.

This push comes at a tough time. Mobile money fraud cases have spiked in Malawi, just like in other African countries where digital payments are booming. In neighbouring nations, similar efforts have cut scams by sharing data across borders. Malawi can learn from that. MACRA plans to roll out more training for agents and users soon.

Read Next: Zimbabwe’s POSB and MasterCard Partner for Seamless Transfers

The stakes are high. Mobile money handles billions of kwacha yearly, supporting everything from farm sales to school fees. If fraud wins, it could push people back to cash, slowing growth. But with leaders like Liphuka and Nkoloma leading the charge, there’s hope.Businesses are already feeling the heat. A small trader in Blantyre lost over 500,000 kwacha to a scam last month, forcing her to close early. Stories like hers show why action matters. Citizens must play their part too, never share PINs and double-check before sending money.

As Malawi builds its digital economy, beating mobile money fraud is key. The recent programme proves the country is serious. With better laws, awareness, and teamwork, trust can return. Safer mobile money means a stronger Malawi for all.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.