Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

People take out several different forms of loans. Whether you receive a mortgage loan to buy a house, a home equity loan or line of credit to perform repairs or have access to cash, an auto loan to buy a car, or a personal loan for any number of reasons, most loans have two things in common: They set a defined repayment period for the loan and charge you a fixed interest rate during that time.

Consider creating a roadmap for your loan! A loan amortization schedule is just that. It breaks down your monthly payments, indicating how much goes toward paying off the loan (principal) and how much goes toward interest.

This way, you can track your progress and even use a loan amortization calculator to plan for the future, such as how much sooner you may pay off your loan by making more payments.

In this article, we will look at loan amortization schedules, why they are essential, and how to calculate them. Let’s have a look at this road map to financial freedom!

A loan amortization schedule informs borrowers how their loan payments will be divided between paying down the principal and interest during the loan’s term.

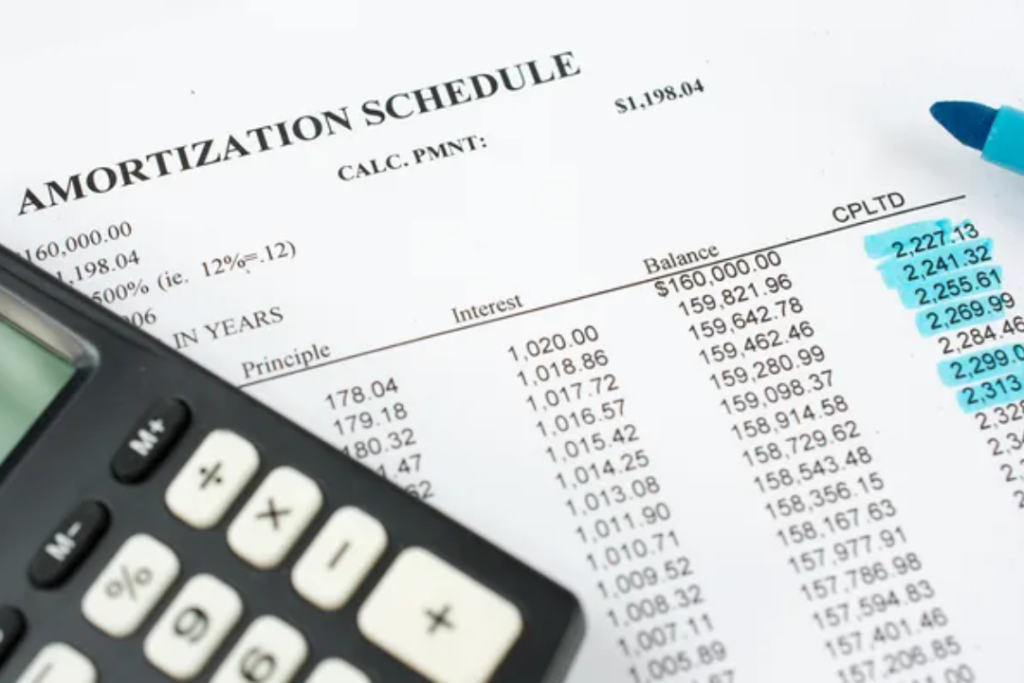

The loan amortization schedule may be provided to the borrower as a table or chart that depicts how these amounts will vary with each payment. Borrowers can then see, month after month, what percentage of their loan payment goes toward interest and what percentage goes toward principal.

The principal is the amount originally borrowed from the lender. The principal balance is the portion of the original loan that the borrower still needs to pay off. You pay interest when you borrow money from a lender.

The interest rate is typically represented as an annual percentage of the total loan amount or principal. Some loans carry a set interest rate. Some loans have variable interest rates.

Fixed-rate loan amortization often involves loan payments that are fixed and equal. Variable-rate loan amortization means that loan payments may fluctuate when the interest rate changes.

Read Also – Shika USSD Code and Loan Application

At the start of the loan period, the majority of the payment is often allocated to interest rather than principal. However, as the loan period proceeds, more and more of the payment is typically used to pay off the principal sum, with less going toward interest.

This is especially true for fixed-rate loans, where the interest rate remains constant but the principal balance gradually falls over time with regular payments.

If a loan has a longer amortization term—that is, a longer length of time to pay it off—the monthly payment will often be cheaper because there is more time to pay it off. However, the total amount paid on interest may be larger throughout the life of the loan because you will need more time to pay off the principal sum.

The following columns are usually found on an amortization schedule:

By examining the amortization schedule, you can discern what proportion of your funds is allocated to clearing the loan as opposed to interest rates. Such information proves valuable in comprehending the actual expenses incurred by borrowing and organizing your economic resources accordingly.

Also read: Understanding a Term Loan

A loan amortization schedule is extremely useful for both borrowers and lenders because it provides information about the payment plan.

The particular amount of your monthly payment, which is required to create financial plans and budgets, is displayed. Aside from that, the loan’s total cost for the repayment time is displayed. This allows you to make informed financial decisions and prevent unforeseen charges.

The payment schedule breaks down the interest and principal components of each payment in detail. With such clarity, you may readily distinguish between the sums designated for reducing your loan balance (principal) and covering accruing interest expenses.

Payments will gradually reduce the interest portion, while more will be allocated to repaying the real debt owed. Overall, it’s a pretty valuable tool for tracking progress toward debt-freedom.

With a comprehensive awareness of the overall interest paid, you can weigh the benefits and drawbacks of various early repayment schemes. One such option is to allocate more cash to reduce the principal debt, which results in future savings on overall interest payments; hence, making an informed decision becomes critical.

You may be able to deduct a portion of your loan interest from your taxes. Check the amortization schedule to see how much interest you paid over the year.

Comparing loan offers is more accurate when using an amortization schedule because it reveals the true cost of each loan rather than simply the interest rate. The long repayment term has a considerable impact on the overall amount paid in interest.

Also Read – Full List of Blacklisted Loan Apps in Nigeria

Loans can vary greatly depending on a variety of criteria, including their purpose, term, interest rate, and other variables. If a loan consists of regular, monthly installments, we can fairly call it an amortization loan. What are the most common types?

Car loans are amortized. They are typically short-term (5 years or less) with fixed monthly installments. The duration may be extended at times, but keep in mind that it is not justified for smaller sums of money. After the period, you will have paid more for interest than the loan’s principal.

Mortgages are a common type of amortization loan. These are house loans that require borrowers to secure the property itself. They usually have longer periods than conventional loans because the amount of money is substantially larger.

A common mortgage length is twenty or twenty-five years. In most cases, consumers refinance their mortgage or sell the house, thus, the amortization plan is unlikely to be used for the entire duration.

Personal loans, sometimes known as amortization loans, are borrowed by borrowers for debt consolidation, minor repairs, vacations, weddings, and other purposes. These loans have a set interest rate and length (3, 4, 5, or 10 years).

Some loans do not require amortization. Are credit cards among them? The short answer is affirmative. Why?

If you own a credit card, you are aware that you can borrow money as long as you make the minimum payment each month. You decide whether or not to make extra payments. Credit cards do not have fixed payment terms or amounts. Furthermore, certain credit cards offer variable interest rates.

Another type of loan that does not amortize is known as an “interest-only loan.” These loans have a defined term during which borrowers must pay only the interest. Payments towards the principal begin later or can be made as an additional payment. The payout is not fixed and may alter over time.

A balloon loan is another sort of debt that does not amortize over time. You must start with small payments. As a result, after the term, you will be required to make a “balloon” payment to return the entire principal.

Calculating a loan amortization schedule on your own is more difficult than you might think. Fortunately, there are shortcuts, such as online loan amortization calculators, that can be useful.

It is crucial to realize that amortization calculations will differ depending on the type of loan, interest rate, loan amount, and other factors.

Many lenders will perform amortization calculations for you once you have agreed to a loan. However, if you’re taking the DIY approach and using an online loan amortization calculator, attempt to study as many details as possible to get an accurate assessment. That includes knowing stuff like:

It’s also a good idea to account for any additional payments you want to make. The loan’s book value gradually decreases over the borrowing term, until the outstanding balance is zero on the maturity date.

If the amount does approach zero, it indicates that you completed all of your debt obligations on time and did not default, which means you did not miss an interest or principal payment.

Read Also – Faraja Loan: How to Borrow from Faraja

You can generate a loan amortization chart using a conventional calculator and the amortization formula. You might also use an amortization calculator to help you design an amortization schedule or keep track of your loan payments.

Here are some internet sites for loan amortization calculators:

The type of loan amortization that a borrower selects may be very influential in their ability to pay back the loan as well as the total interest that will be paid over the life of the loan. In this section, we are going to investigate some of the key factors that affect loan amortization and how they can impact a borrower’s payment schedule.

One of the main factors that may affect loan amortization is the COFI index. This index is used to adjust interest rates for adjustable-rate mortgages (ARMs) and it is based on the average interest rate paid on savings accounts held at banks located in the 11th Federal Home Loan Bank District. As the COFI index fluctuates, so will the interest rate on the borrower’s loan, which can affect his/her monthly payments.

The period for which the loan is given is also another important factor in this case. Generally, loans with longer terms have lower monthly payments since they are spread over a longer period of time. However, longer-term loans also mean that the borrower pays more in interest over the life of the loan. Shorter-term loans, on the other hand, entail greater monthly payments but pay less interest over time.

The interest rate on a loan is another vital component that can impact loan amortization. Higher interest rates will result in higher monthly payments and extra interest paid over the existence of the loan. Conversely, lower interest costs will bring about lower month-to-month bills and much less interest paid overall.

Loan price frequency may affect loan amortization. For instance, if a borrower chooses to make bi-weekly payments as opposed to month-to-month bills, then he or she will make 26 payments in line with the year instead of 12. This will assist in reducing the total interest of the loan and shortening the term of the loan.

Also Read – Loan Calculator and How to Use it

Now that you’ve learned the ins and outs of a loan amortization schedule, you’re probably wondering how you might design one for yourself. Here are three steps that will assist you in setting up.

Before you open a spreadsheet (which is, by and large, the most common and popular method for producing an amortization schedule on your own), be sure you have all of the necessary information.

Whether you’re designing a business loan amortization plan, a mortgage amortization schedule, or any type of loan amortization schedule, you’ll need four pieces of information. Here are some instances.

Example, $100,000

For example, 7%

For example, ten years

Example: Monthly

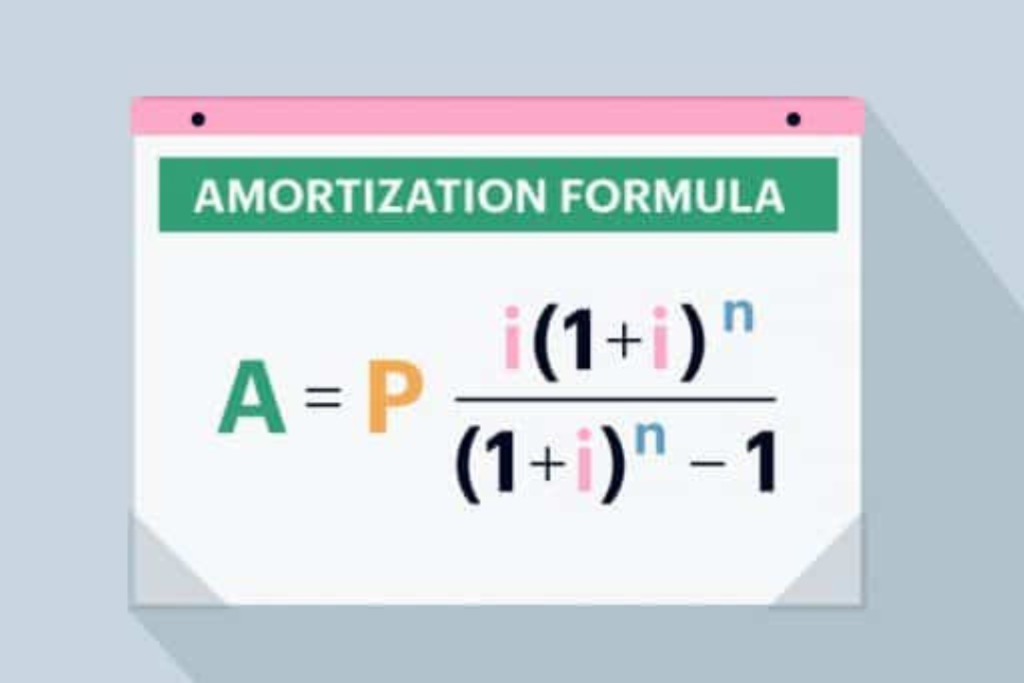

Are you ready for a short math lesson? Here’s an example of an amortization formula you can use to manually calculate your monthly payments:

Before you start sweating and remembering your high school algebra class, here’s what all those numbers and letters mean:

A = monthly payment amount.

P = principal amount, net of initial payments.

i = Interest rate (remember to get the interest rate for your period rather than merely taking the annual interest rate — for our case, you’d divide.07% by 12 months to get the monthly interest rate for your loan)

n = total number of payments (thus, if you’re paying monthly, you must multiply the years of your loan by 12).

You don’t want to have to use a difficult calculation every time you want to understand your monthly payment and where your money is going. That is why all of your monthly payment details should be computed in advance.

These will subsequently be shown in your amortization schedule, which should comprise columns for:

As previously stated, the final row of your amortization schedule should have a zero-ending balance. That implies your loan has been paid off, and it’s time to rejoice.

Understanding your loan amortization schedule is important for effective financial management. This separation makes it easier to select the principal and interest components of each payment, allowing for more effective budgeting.

Using a loan amortization calculator simplifies the process even more by assisting in the development of effective financial strategies.

Armed with these tools, one may confidently manage their debt adventure while understanding how each installment contributes to gradually diminishing it over time – allowing for informed loan decision-making

An amortized loan is a type of financing that is repayable over time. This form of repayment arrangement requires the borrower to make the same payment throughout the loan period, with the first portion going toward interest and the remaining amount going toward the outstanding loan principal.

The majority of the monthly payment is used to pay interest early in the loan’s life, while the remainder is used to pay the principal.

Installments are normally made monthly, although not necessarily. Each recurring payment consists of both the principal and the interest part. Amortization is the process of reducing the outstanding loan principal amount. Because of this structure, amortizing loans are also frequently referred to as decreasing loans.

An amortization schedule is a table that summarizes key loan information such as payment amount, interest vs. principle, and current balance.