Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

LendPlus, legally known as Aventus Technology Limited, entered the Kenyan market in 2021, offering an alternative financing option for short-term needs. Unlike other loan apps that specialize in speed or efficiency, LendPlus combines both aspects into a single platform.

The app provides digital loans of up to Ksh30,000 at a daily interest rate of 2%. Its popularity is evident from the 1,000,000+ downloads on the Google Play Store, showcasing Kenyans’ growing interest in borrowing through this app, especially notable for its loan repayment extension feature.

Apart from the repayment extension, LendPlus offers users flexibility in choosing their repayment date, requires only an ID number for sign-up, and provides an initial loan limit of Ksh15,000, higher than many other digital lenders.

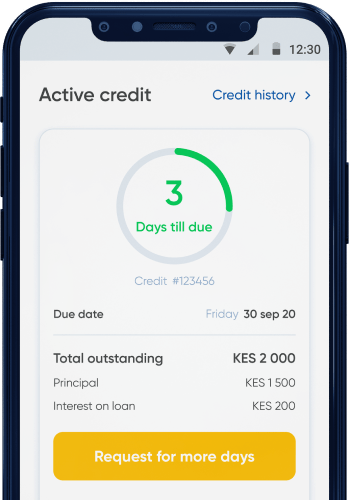

While LendPlus Digital Loan’s minimum tenure is five days and maximum is 30 days, it stands out for allowing borrowers to extend their tenure if needed without additional costs if done before default. However, extending incurs a daily 2% interest rate over the new period.

To extend, users must pay the accrued interest for the original tenure before the extension request, maintaining the pattern for subsequent extensions. Early repayment, though requiring full interest payment, can boost the loan limit with LendPlus.

Overall, LendPlus integrates convenience, flexibility, and financial prudence, making it a notable option in Kenya’s digital lending landscape.

Also read: Full List of Genuine Loan Apps in Kenya

The lender, LendPlus, assures applicants of a swift process, with funds typically disbursed within 15 minutes of downloading the app from the Google Play Store and completing the necessary steps.

However, this quick turnaround is contingent upon meeting certain criteria, such as qualifying for the requested amount and providing essential information for application approval. This involves completing a form that outlines details like income sources, employment status, and entering your national ID card number.

To qualify for a LendPlus Digital Loan, applicants must be Kenyan citizens aged 21 or older, employed or self-employed with a stable income, possess an active M-PESA mobile wallet linked to a valid mobile number, and hold a National ID card.

LendPlus, however, excludes individuals in certain professions like the military, police, or security sectors from borrowing. Additionally, loan availability varies by county, and applicants generally need a credit history and fall within the age range of 18 to 60 years to meet LendPlus’ eligibility criteria.

Also read: Knight Loan: How to Apply and Get the Loan

LendPlus offers customers the flexibility to select their preferred repayment period instead of imposing a predetermined tenure.

With a minimum tenure of 5 days and a maximum tenure of 30 days, borrowers can tailor the repayment period to suit their needs, potentially saving on additional interest compared to a fixed maximum tenure.

It’s important to note, however, that like other digital lenders in Kenya, interest accrues based on the chosen loan tenure, even if repaid early. For instance, opting for a 7-day loan when expecting a payment within that timeframe can save you from paying the 2% daily interest for the extra days that a 30-day tenure would entail.

The LendPlus Digital Loan is designed to be accessible to all, including first-time applicants who can qualify for a loan amount of up to Ksh15,000. This feature makes it an attractive option for small business owners seeking a quick infusion of cash.

It’s worth noting that the first loan carries a maximum repayment period of 20 days, providing a manageable timeframe for repayment.

Once you successfully repay your first loan within the specified period, typically 20 days, you become eligible for higher loan amounts, up to Ksh30,000, on subsequent loans. Additionally, LendPlus extends the maximum repayment period for these subsequent loans to 30 days, offering more flexibility compared to the initial 20-day limit.

LendPlus’ internal system determines the loan amount you qualify for on an individual basis by considering various factors, including your credit history and financial profile. This personalized approach ensures that borrowers receive loan amounts and terms that align with their financial capabilities and needs.

Also read: How to do your Opesa Loan Application Online

To apply for a loan using the LendPlus app, follow these steps:

LendPlus Digital Loan is a mobile app-based lending platform operated by Aventus Technology Limited. It offers quick and convenient digital loans to Kenyan citizens.

First-time applicants can qualify for loan amounts of up to Ksh15,000, making it a viable option for individuals and small business owners in need of immediate funds.

The maximum repayment period for the first loan with LendPlus is 20 days, providing borrowers with a manageable timeframe for repayment.

After successfully repaying the first loan within the specified period, borrowers can qualify for higher loan amounts, up to Ksh30,000, with an extended maximum repayment period of 30 days.

LendPlus’ internal system determines the loan amount a borrower qualifies for by considering factors such as credit history and financial profile, thereby providing personalized loan offers.

To get started, simply visit the Google Play Store or follow the provided link to download the LendPlus app. Once downloaded and installed, open the app and fill in the necessary details to begin the registration process. These details are crucial for verifying your identity and offering you suitable loan options.

Yes, LendPlus promises a quick turnaround time of just 15 minutes from downloading the app to receiving the loan amount in your M-PESA account, subject to meeting the qualification criteria and providing the required information.

Also read: Stawika Loan App: How to Download and Apply for Stawika Loan

In conclusion, LendPlus Digital Loan emerges as a dynamic and accessible solution for Kenyans seeking quick financial assistance. With its user-friendly app interface, flexible loan options, and swift disbursement process, LendPlus caters to a diverse range of borrowers, including first-time applicants and small business owners.

The ability to qualify for initial loan amounts of up to Ksh15,000, coupled with extended repayment periods and personalized loan offers, underscores LendPlus’ commitment to meeting the evolving needs of its users.

As it continues to innovate and expand its services, LendPlus stands out as a reliable and convenient digital lending platform in Kenya’s financial landscape, providing timely support to individuals and businesses alike.

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech