Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

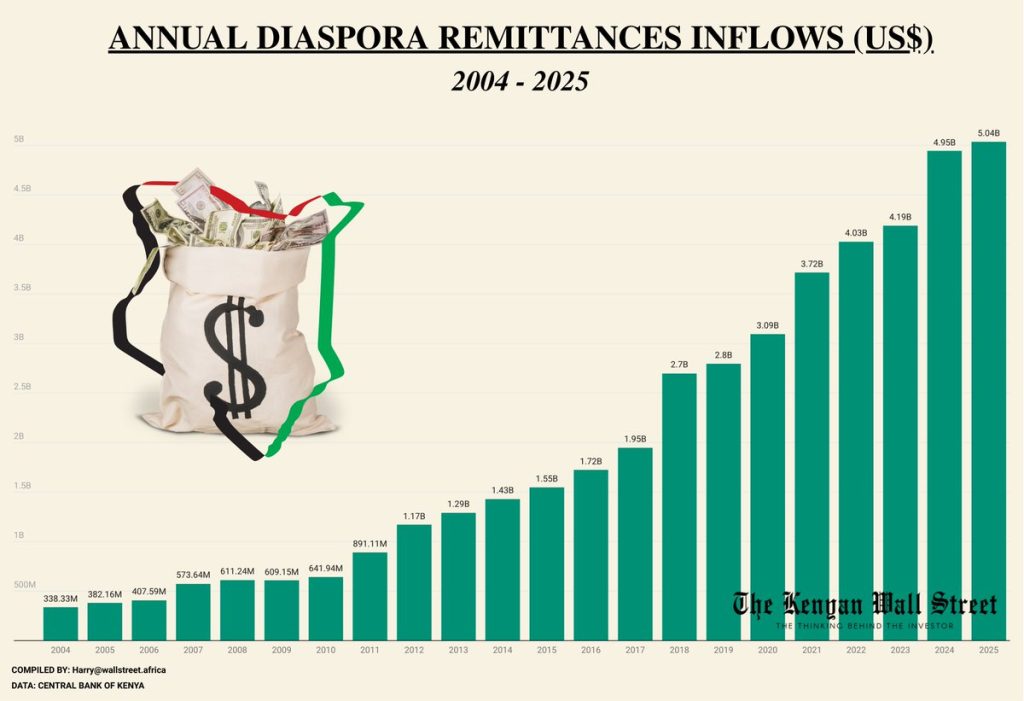

Kenya’s remittances reached $5 billion in 2025, a huge win for the country’s economy. Kenya’s diaspora remittances crossed the $5 billion mark in 2025, marking a historic milestone. But new data from the Central Bank of Kenya (CBK) shows this came with the slowest growth in over 15 years. Kenya’s remittances rose just 1.9% from the year before, hitting US$5.04 billion, or about KSh650 billion. That’s up from US$4.95 billion in 2024. Even with this slowdown, Kenya’s remittances remain the top and steadiest source of foreign money coming into the country.

These funds act like a strong shield for Kenya’s economy. The CBK noted in its latest report that diaspora remittances provide a critical buffer for the balance of payments. This is key now, as other foreign inflows face pressure. Kenya’s remittances reached $5 billion despite tough times abroad. They help keep the Kenyan shilling stable by bringing in steady dollars. Families use this money for daily needs, school fees, health care, and starting small shops. In short, Kenya’s remittances keep everyday life going and support growth.

Read Next: Paystack Marks a 10-Year Milestone, Launches Parent Company The Stack Group

The main reason for the slow growth? Softer job markets in the United States, which sends about half of Kenya’s remittances. CBK data shows monthly inflows dropped in November 2025. They bounced back a bit in December thanks to Christmas spending. But job worries in areas where many Kenyans work, stricter visa rules, and higher fees for sending money hurt flows. The Central Bank explained that higher living costs and unclear policies in rich countries cut the extra cash diaspora families could send home.

It’s not just the US facing issues. Other big sources like the UK, Germany, Canada, Gulf countries, and Australia also saw some slowdowns. Still, Kenya’s remittances reached $5 billion in 2025, proving their strength. Digital tools kept things resilient. People now send money easily through phones, skipping old cash methods that cost more. New services like LemFi, approved by CBK, make transfers faster and cheaper.

Looking forward, experts don’t expect a big jump soon. CBK and government forecasts predict Kenya’s remittances will grow by 3% to 5% in 2026. This assumes the world economy stays steady and more people use official digital ways to send cash. Fintech companies are leading the charge. Firms like M-Pesa Global, Chipper, Flutterwave, Wise, WorldRemit, and Xoom from PayPal offer cheap, fast transfers right to mobile wallets. These services cut costs and make sending money simple from anywhere.

Read Next: One Year On: Telco Tariff Hike Boosts Operators’ Profits but Fuels Consumer Anger

The Kenyan government wants to do even more. Its 2025–2030 Diaspora Investment Strategy aims to drop remittance fees to the world average of 3%. It also pushes to turn some of these funds into long-term projects, like businesses or homes back home. Kenya’s remittances have always been vital, rivaling money from exports and tourism. They prop up homes and the whole economy.

As Kenya steps into a time of $5 billion-plus yearly remittances, the real test is ahead. In 2026, the focus must shift from just surviving global challenges to building real speed. With smart digital shifts and government plans, Kenya’s remittances can keep shining as a pillar of strength. Families count on them, and so does the nation’s future.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.