Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Kenya is planning to change how banks decide the interest rates on loans. Right now, banks look at how risky they think each borrower is and set the loan rates based on that. But this method, called risk-based loan pricing, has made borrowing very expensive for many people and small businesses. So, the Central Bank of Kenya (CBK) wants to stop using this system and instead link loan rates directly to its main interest rate, called the Central Bank Rate (CBR).

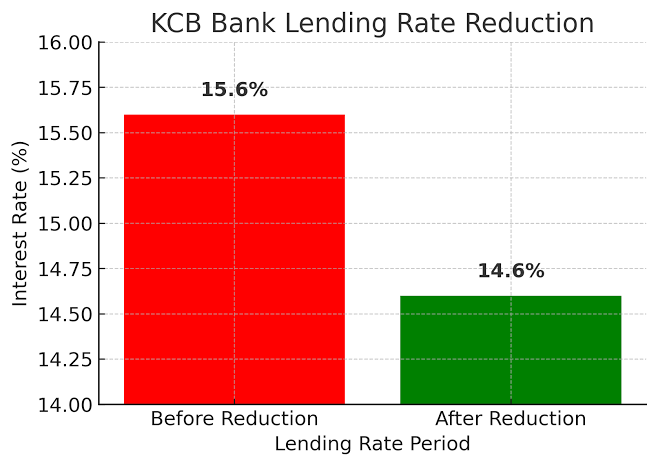

The CBK has been lowering the CBR several times since October 2024 to encourage banks to lend more money and help the economy grow. But even with these cuts, banks have kept their loan rates high. They say they have to do this because some borrowers are risky, so they need to protect themselves. This has frustrated the CBK because the lower CBR is not helping people get cheaper loans as it should.

Now, Kenya plans to remove risk-based loan pricing and make banks use the CBR as the base rate for all loans. Banks will add a small extra amount, called a premium, to cover their costs, profits, and some risk. The CBK will also make these premiums public by sharing them on its website and in newspapers. This way, everyone will know how banks set their loan rates.

The current risk-based system started in 2019. The idea was to encourage banks to lend to more people, even those who might be seen as risky borrowers. But instead, it made loans very expensive for many, especially small businesses and people without a credit history. The system was also hard to understand and not very transparent, which made it easier for banks to charge high rates without clear reasons.

The CBK says it wanted the risk-based pricing to be fair and clear, matching loan prices to how risky a borrower is. But in reality, it didn’t work out that way. By switching to a system where loan rates are tied to the CBR, the CBK hopes that when it lowers the CBR, banks will also lower their loan rates. This should make borrowing cheaper and more predictable for everyone.

This change is a big deal for Kenya. It could help many people and businesses get loans at fairer prices. Lower loan costs mean more people can start businesses, buy homes, or handle everyday expenses without being weighed down by high interest. The CBK believes this new way will make the loan market more open and fair, stopping banks from hiding behind complicated rules to keep rates high.

Kenya to remove risk-based loan pricing is a move to make borrowing easier and more affordable for all Kenyans. It shows the CBK’s commitment to helping the economy and making sure that when it lowers interest rates, the benefits reach ordinary people and businesses.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.