Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Saving and investing wisely have become very important in today’s world. As a result, many people want to know how to save and invest in PiggyVest.

Understanding how to save and invest on PiggyVest can help you take control of your finances and build a secure future.

One of the preferred platforms for savings, PiggyVest has been designed to help you curtail your spending excesses and build financial discipline that will secure your future.

This article will explain how to save and invest in PiggyVest, how it works, and why it is always in high demand.

PiggyVest is a Nigerian-based fintech committed to offering a mobile app for safe savings and investments.

Founded in 2016, It has grown into one of the leading savings and investment platforms in West Africa, with over 1 million registered users.

People use it to save for emergencies, trips, and major purchases. The application is user-friendly and offers multiple features for developing the habit of saving, reaching financial goals, and earning returns on investments.

With PiggyVest, you can separate your savings into different target accounts, keeping track of everything.

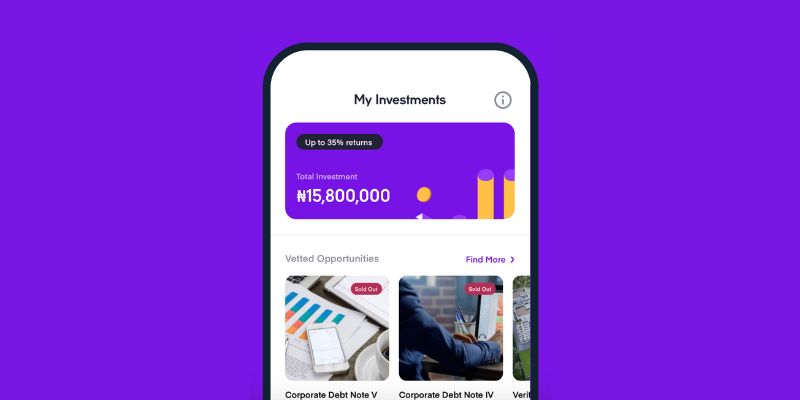

Investment on PiggyVest allows users to invest in fixed-income investment products, agricultural investments, and real estate investments.

The app uses a peer-to-peer lending model where users lend money to small businesses and individuals to make interest on their investments.

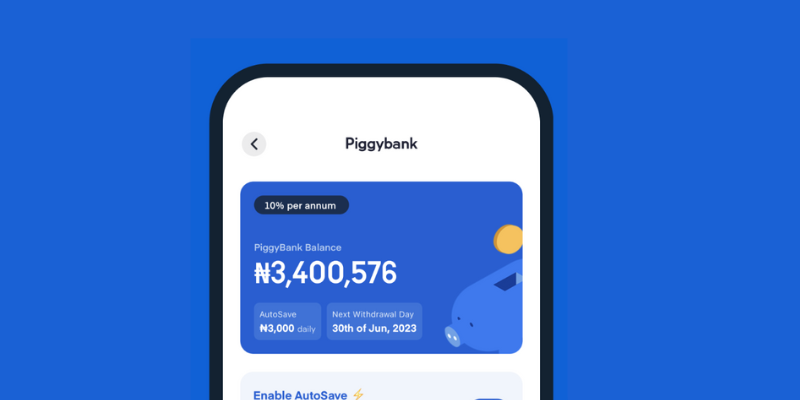

PiggyVest also offers a high-yielding savings account, earning the user as much as 10% interest per annum. The app is secure, and the investments are insured by the Nigerian Deposit Insurance Corporation (NDIC).

Investing on PiggyVest is relatively easy: you sign up on the app, verify your account, and then scroll through the various investment options on the platform.

These may include real estate and agriculture. By choosing an option, you will be allowing your money to work over time and earning returns on your investment.

Also read How to Easily Open a Nigerian Domiciliary Account Online

Most investment opportunities on PiggyVest sell out quickly, as users trust the platform for high returns and safe investment options.

Once such an investment opportunity is uploaded, an avalanche of people rush to invest since these options offer relatively better returns compared to traditional banks.

This also creates room for urgency among the users in investing in those limited spaces, hence the quick sellout. As a user, one has to be frequently on the app and ready to invest once new opportunities become available.

Some of the reasons why PiggyVest investment is always in high demand and is always sold out include;

Using the PiggyVest app is quite easy. Let’s look at some tips to get you started:

You can begin the journey of financial discipline by saving on PiggyVest, there, putting a little fraction of your money into a digital safe deposit made available on the platform. The process of saving on PiggyVest is quite straightforward. Let me show you how to do it:

Interest is credited to your deposits; hence, your savings grow.

While savings are good, investing your money ensures that you get returns on your money over some time. That’s why investing in PiggyVest is a wise step to take. And to do that is not quite easy. See how it works;

Check out the Top 10 Great Geegpay Alternatives

There are several methods one can use to fund a PiggyVest account. The process is simple. Let’s look at the various ways to fund your PiggyVest account.

Using Debit Card

Using a debit card has remained one of the easiest methods. To fund using the debit card method;

Login to your PiggyVest dashboard and click “Add Money”.

Select “Debit Card” as your preferred payment method, then fill in the card details: the card number, expiration date, and CVV.

Specify the amount you want to deposit and confirm the transaction. Your account will be credited instantly.

Through Bank Transfer

Alternatively, you can fund your PiggyVest account by bank transfer. This is good for those who don’t own a debit card or would rather use their bank account. To fund via bank transfer;

Log into your dashboard and tap the “Add Money” button.

Tap “Bank Transfer” as your preferred payment method, then generate a unique payment code.

You can take the payment code to any bank branch and deposit any amount. Your account will be credited within 24 hours.

Through USSD code

Another means of funding your PiggyVest account is via USSD code. This is quite easy for those who do not have access to the internet or probably would not want to deal with internet hassles.

To fund your account using USSD code,

Dial the PiggyVest USSD code, *706*433#, and follow the on-screen command to deposit money into your account. Your account will be credited instantly.

One can withdraw money from PiggyVest Safelock before the due date, which will attract some penalty fee.

Safelock is a feature in the PiggyVest account that allows users to lock their savings for specific periods while earning interest on their savings.

If you need your money before the due date, you can have access by breaking your Safelock.

To withdraw money from the PiggyVest Safelock before it is due;

This is usually a fraction of the interest that accrued on your savings. Once confirmed, the amount will be credited to your wallet on PiggyVest, and you’ll also be able to withdraw into your bank account.

It is, however, worth considering because breaking Safelock before the due date may not be the best idea since you will forsake all interest earned on your savings.

Therefore, you must be very careful when planning your finances to avoid futilely breaking your Safelock.

Aside from this, you could plan for an emergency fund or use the “Flex Naira” feature PiggyVest offers to save and earn savings interest, yet access to your money is still possible when needed.

Of course, this is one of the major advantages of using PiggyVest: the interest rate accorded to platform users.

According to information on its official website, PiggyVest provides an interest rate of as high as 10% per annum, approximately 0.83% every month.

This, on the other hand, puts PiggyVest in good standing compared to the interest rates traditional banks offer their clients; hence, it would automatically make PiggyVest a very attractive alternative for people looking to grow their savings.

Despite the pluses of using it, there are some disadvantages of using PiggyVest to be considered.

One of the significant shortcomings is limited withdrawal possibilities.

Unlike other traditional banks, PiggyVest does not allow users to withdraw money at will. Rather, users of this digital bank can access their savings only on the specified dates. For people who want to have access to their money right away, that may not be very suitable.

Other disadvantages include a lack of physical branches, which might be a problem for users who want face-to-face interactions or help with their accounts.

In addition, PiggyVest charges a small maintenance fee when accounts are dormant, a factor that could also discourage many users who do not regularly use their accounts.

PiggyVest has a very low minimum investment requirement. As low as ₦100 can be used to kick-start one’s investment, making it affordable and accommodating, especially for people who want to have a soft landing into saving and investment with limited capital.

This is quite a low minimum amount to start investing and will benefit low-income earners or students who want to cultivate the habit of saving money.

Another added advantage is that PiggyVest does not charge deposits or withdrawal fees, so it will be economical to use the service.

Overall, with its low minimum investment requirement and competitive interest rate, PiggyVest has proven to be a good option for people who need flexibility when saving and securely investing their money.

Explore to know about the Top 5 Betting Platforms in Nigeria 2024

PiggyVest uses the highest levels of Internet Security

3.5%

Gold Microfinance bank

The PiggyVest mobile app revolutionizes savings and investments in a very safe way. It is very easy to use and offers different investment possibilities, making it an unquestionably useful tool for those who take their financial futures seriously.

With attractive returns, security, and ease, little wonder investment in PiggyVest is always in high demand.

With such information, you may want to decide to start saving and investing on PiggyVest today to take control of your financial future.