Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

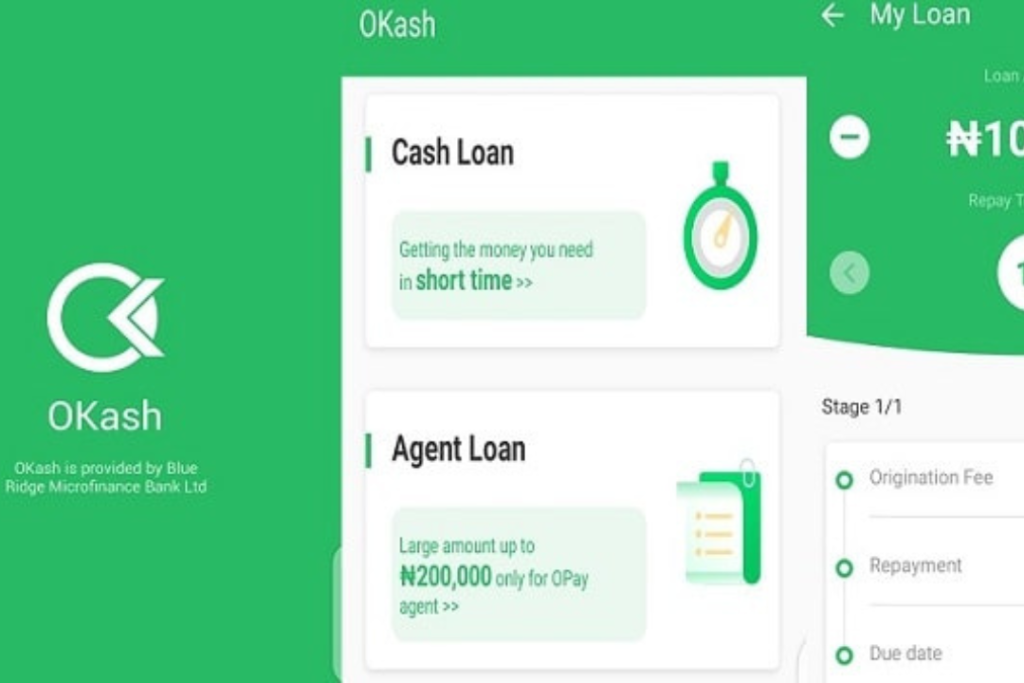

Knowing how to borrow money from Okash, if you need a loan in Nigeria, might be very instrumental. Okash is a top-rated loaning app that helps advance fast loans right from your smartphone.

From extra money for other expenses to raising capital for some small projects, Okash makes it easy and simple.

If you are asking, How can I borrow money from Okash? Well, it is way much easier than you think. Apply for a loan on your phone in a few steps and get the funds deposited into your account directly.

Provided you have also been thinking of questions like “Can I borrow from Okash without BVN ”? Or how can I borrow money from Okash without BVN? You will realize that it is discussed as you read.

Since the Okash loan makes provisions for conducting business without BVN, there can be better coverage. It simply means that you could get financial backing without all the complexities involved in the process.

This is a step-by-step guide to every step involved in borrowing money from Okash. We’ll take you from downloading the app to finally receiving your loan. So, if you’re ready to learn how to borrow money on Okash, let’s get started!

Okash is an online platform offering digital lending services to people in need of loans, both personal and business.

This is a product of Blue Ridge Microfinance Bank Limited. Okash is one of the leading online platforms for no-collateral instant loans with reduced paperwork to users.

Okash works the same way as all loan apps do. It disburses loans to users within a very short time, usually a few minutes. If you have an account with Okash and meet the requirements, then you will be good to go borrowing from them.

Okash runs a proprietary algorithm that gauges creditworthiness and loan eligibility. It facilitates flexible repayment plans at competitive interest rates, hence highly sought after by people and small businesses who need quick access to funds.

Some of the main features of Okash include the following:

If you are asking can I borrow money from Okash? Okash has a mission to make access to financial services more convenient for the underserved populations of Nigeria.

Read Also – How to Borrow Money from PalmPay Without BVN in Nigeria | A Step-by-Step Guide

Knowing how to borrow from Okash is quite easy, but to qualify and be eligible for an Okash loan, you must meet the following requirements.

So if you ask how can I borrow money from Okash? You can increase your chances of getting approved for a loan on Okash by simply ensuring that you adhere to the following:

Also Read – How to Borrow Money from Ecobank in Nigeria | A Step-by-Step Guide

Okash loan in Nigeria is an easy scheme put in place to help people financially in difficult times. Below is the step-by-step on how to borrow money from Okash:

You can go to the Google Play Store and download the Okash app.

Be sure that you’re installing an original app so as not to fall into the scammers’ trap.

Open it and sign up by following the on-screen instructions to open an account.

You will be asked to fill in your personal information, including, but not limited to, your name, phone number, and bank account details.

Fill in all the information required about yourself, like your occupation, income, and contacts.

Correct information enhances loaning approval chances.

After filling in your profile details, you can now request a loan. Please provide the amount you want to borrow and the time you can pay it back.

In this case, Okash may require further verification via a call or SMS. Fully cooperate with the verification so that your application may stand a better chance of success.

In case of positive consideration of your loan request, the money will be disbursed into your linked bank account. In most cases, it is usually very fast in terms of disbursement.

With these steps and having considered key factors, anyone can easily borrow money from Okash.

One can borrow from Okash without BVN, and very many people have succeeded in doing so. If you wonder how to borrow money from Okash without BVN or ask yourself, “Can I borrow money from Okash without BVN?”, the answer is yes! The steps to follow are thus:

Note: If you don’t have BVN, Okash may request more documents or manual verification before approving your loan.

Read Also – How to Borrow Money from Stanbic Bank in Nigeria | A Step-by-Step Guide

Download and Install the Okash App

Open the App

Enter Login Credentials

Two-Factor Authentication (if necessary)

Access Your Account

Forgot Password

When one wonders how to borrow money from Okash, many people usually ask, “How much can I borrow?” One can borrow from Okash from ₦3,000 to ₦500,000, depending on your creditworthiness and repayment record.

New borrowers are usually given a small limit, sometimes ₦3,000 to ₦10,000, and may increase their limits with time. Returning customers with good repayment records are considered for offers as high as ₦500,000.

Okash uses a proprietary algorithm to determine loan eligibility and amount, considering income, credit score, and loan payback history.

You can ensure higher chances of getting better loan offers by borrowing responsibly and paying on time.

Okash is known for processing loans within the shortest time. Your application will be approved or not, within only 15 seconds upon applying. This is followed by an extremely fast appraisal, after which the disbursal process is started in almost no time.

Funds are often transferred to your account within a few minutes. In most cases, you can have the loan amount available in as little as 20 minutes from the initiation of your application.

Although this would, in most instances, mirror the situation with Okash’s service, unforeseen circumstances like systemic glitches or unexpected extra verification requirements might sometimes incur slight delays in these timelines.

Also Read – How to Borrow Money from Fidelity Bank in Nigeria | A Step-by-Step Guide

One of the most asked questions that comes to mind when thinking of how to borrow from Okash is, “What is the interest rate and the repayment terms?”

Among Okash’s differentiated aspects is its competitive interest rate. Okash charges an interest rate as low as 9.1% every three months, which is equivalent to about 3.0% every month. Compared to some other loaning apps, this is pretty low, so users find Okash very attractive.

As far as repayment is concerned, Okash gives you a flexible and convenient way to repay. You will not have any specific Okash loan app repayment plans. To put it another way, you will pay your way back in time:

– Monthly

– Every 3 months

– Every four months

– At the end of 12 months.

This flexibility makes it hassle-free and non-stressful to borrow from Okash. With loans offered by Okash, you can increase your chances of accessing a higher amount of money, always at low interest rates and flexible repayment terms, if you consistently borrow responsibly and repay on time.

The overview of the main process of repayment of money borrowed from Okash in Nigeria is as follows:

1. Launch the Okash app on your mobile device.

2. Log into your account.

3. Tap the “Make a repayment” option

4. Fill in the details

5. Double-check for accuracy and attached details

6. Then select the “repay button”

7. on successful completion of the transaction, the alert will indicate that the loan has been repaid.

Note that Okash uses the Auto debit system that instantly deducts your loan balance from its

due date.

Read Also – How to Borrow Money from Zenith Bank in Nigeria | A Step-by-Step Guide

Here’s the expanded write-up:

Sometimes borrowing money from Okash is challenging. For example, if you wonder how to borrow money from Okash, you might have some issues. Here is a guide that will help you resync the situation and solve most of the problems:

If your loan application is rejected, check your eligibility criteria based on age, income, credit history, and phone number verification. Do provide the right information and ensure it is complete. If possible, improve your credit score to increase your chances of approval.

Poor Loan Offer: If the amount offered is not up to your expectations, keep in mind that Okash determines many factors in providing loan amounts based on their creditworthiness. Repeated successful repayments can avail a borrowing limit rise in the future. To get access to better loan offers, make timely loan repayments.

Your loan disbursement could also find technical glitches in the process. Try later, or inquire from support at Okash. Verify the information on your bank account is accurate. This helps avoid unnecessary delays.

If, for instance, you are finding it hard to repay, consider some repayment plans with Okash. Consolidation of debts is also an option to make your repayments more affordable. Try to repay on time because even late repayments could hurt your credit score. Okash will work with you to find an acceptable solution.

In case you notice incorrect deductions, first of all, ensure that your transaction history is okay. You can then reach Okash customer care for remittance and clarification of the anomaly. This will assist in making sure that there are no more anomalies.

If you forgot your password or cannot log in for one reason or the other, remember the password recovery option. If you are unable to use the option, contact Okash support. They will guide you on how to gain access to your account.

Change your password immediately if your account’s security has been breached. Contact Okash support to report the issue. They will provide guidelines on securing your account from potential fraud.

Follow these tips to troubleshoot some common issues and borrow from Okash the right way. Exercise caution and initiative regarding your account and payments.

In Nigeria, Okash is a convenient place to borrow money. The Okash platform has flexible options for quick loans, with or without a BVN.

Remember to download the app, register, and apply for whatever loan amount you want. Please leave a comment if this is helpful on how to borrow money from Okash.

Also, do not forget to follow us on our social media handles: Facebook at Silicon Africa, Instagram at Siliconafricatech, and Twitter at @siliconafritech for more updates and guides.

Okash borrowing simply involves downloading the Okash app, registering, filling out the form required for loan applications, and then submitting it for approval. You must, of course, provide basic personal and financial information.

Yes, one can borrow without BVN from Okash. The platform requires other identification documents in place of BVN, like a national ID card, driver’s license, or an international passport.

Okash does consider some borrowers with bad credit scores, although the amount lent to them may be less, with a higher interest rate. Improving your credit score can help your chances of getting better loan terms.

Okash is a licensed, very popular, and credible loan app in Nigeria. It operates within the regulator’s guidelines and ensures transparency, security, and customer satisfaction.