Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

According to the definition of inflation on Wikipedia, taking the general idea from economics, I quote:

“Inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.”

In Ghana, the Consumer Price Index (CPI) is dominated by Food and Non-Alcoholic Beverages (43.6%), followed by Housing, Water, Electricity, Gas, and Other Utilities (9.5%), and Clothing and Footwear (8.9%); transport, miscellaneous goods and services, hotels, cafés, and restaurants, as well as furnishing and household equipment, make up the rest. Education, Recreation and Culture, Communication, Health, and Alcoholic Beverages, Tobacco, and Narcotics have smaller contributions.

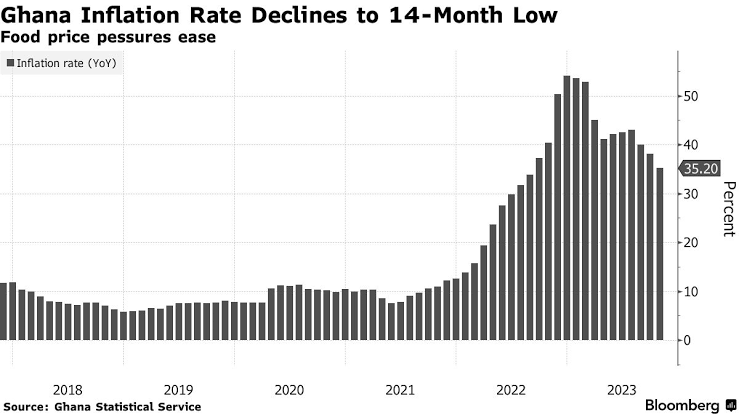

Recently, Ghana’s annual inflation rate rose to 23.5% in January 2024, up from 23.2% the previous month, exceeding the central bank’s target range of 6% to 10%. This increase follows five months of decline, attributed to a weakening currency. Non-food prices grew by 20.5% in January, up from December’s 18.7%, while food inflation decreased slightly to 27.1% from 28.7% in December.

Inflation can stem from either demand pressures (demand-pull) or supply pressures (cost-push). Demand pressures occur when aggregate demand surpasses aggregate supply. Supply and cost pressures arise from increased production costs.

Two main schools of thought on inflation are monetarists and structuralists. Monetarists attribute inflation to a rise in the money supply, while structuralists see it as a result of structural rigidities in developing-country economies, limiting supply and raising prices.

In Ghana, inflation results from both monetary and structural factors, including the expansion of the monetary base to cover budget deficits, high borrowing costs leading to increased production costs and consumer prices, and declining food production, especially cereals, driving up food prices and inflation.

Exchange rate depreciation causes higher domestic prices due to the continuous and persistent depreciation of the domestic currency. Imported inflation occurs when rising world market prices of crude oil increase production costs domestically, while falling export earnings lead to foreign exchange shortages.

Inflation inertia refers to prices continuing to rise because of past inflation.

Ghana’s inflation rate increased to 23.5% in January 2024 from 23.2% in December 2023, marking the first rise in six months and reducing the likelihood of a rate cut next month. Samuel Kobina Annim, Ghana’s government statistician, announced the change. In January 2023, the country’s inflation peaked at 54.1%, the highest in 22 years.

According to the January 2024 report, food inflation decreased to 27.1% from 28.7% in December, while non-food prices rose to 20.5% from 18.7%, the largest price increases were seen in clothing and footwear, followed by housing, water, electricity, gas, and other fuels. Education, information and communication, insurance and financial services, and transport also saw notable increases.

Ghanaian President Nana Akufo-Addo recently reshuffled his cabinet, affecting over 20 ministers, including replacing Ken Ofori-Atta, the finance minister. Additionally, a 2023 World Bank report highlighted domestic imbalances and external shocks contributing to macroeconomic challenges in Ghana.

Inflation in any economy can have both positive and negative effects, with winners and losers during periods of high inflation.

However, people generally view high inflation negatively because it can impact economic growth, poverty reduction, income distribution, and macroeconomic stability. Inflation can be anticipated or unexpected.

It can lead to income redistribution between debtors and creditors, with debtors benefiting as they repay loans with less valuable currency, while creditors lose out. Fixed income earners suffer as their purchasing power diminishes. Inflation also discourages savings by eroding the value of saved money, though it may temporarily boost business profitability and investment.

Unanticipated inflation can increase nominal tax revenues for the government but complicates economic planning and fosters uncertainty, hindering long-term investment. It also raises borrowing costs, dampens investment, and encourages capital flight as investors seek foreign assets over domestic ones.

High inflation imposes menu costs on firms, who must frequently update prices, and can have social and political repercussions, particularly through rising food prices. It may weaken the banking system as people favor assets over cash, and promote currency substitution, with individuals preferring foreign currency, leading to the devaluation of the domestic currency.

Governments employ a mix of fiscal and monetary policies to manage inflation, aiming to reduce budget deficits, curb spending, and control excess demand through tax policies. Monetary policy tools include adjusting the bank rate, conducting open market operations, and regulating reserve ratios and credit. These measures make credit costlier, reducing money supply and aggregate spending.

Addressing inflation caused by structural issues requires policies to boost output, such as improving production technology and controlling production costs and wages. Import reduction can stabilize exchange rates and curb price increases for imported goods.

In Ghana, various inflation management schemes, including domestic credit control, open market operations, and monetary target regimes, have been used, implemented over different periods up to 2006.

1. What is the current inflation rate in Ghana?

2. What are the main factors contributing to Ghana’s food inflation, for example?

3. How does inflation affect different sectors of the Ghanaian economy?

4. What measures does the Ghanaian government take to control inflation?

5. How does inflation impact the average Ghanaian citizen?

6. Are there any recent developments or policy changes related to Ghana’s inflation?

7. What are the potential consequences of high inflation in Ghana?

8. How does Ghana’s inflation rate compare to other countries in the region?

9. Is there a historical perspective on Ghana’s inflation trends?

10. Where can I find more information about Ghana’s inflation and related economic indicators?

In conclusion, Ghana’s inflation trends are dynamic and influenced by a combination of domestic and global factors. The recent increase in inflation to 23.5% in January 2024 highlights the challenges faced by the Ghanaian economy. While inflation management schemes have been implemented over the years, including measures like domestic credit control and monetary target regimes, the persistence of high inflation rates underscores the need for effective policy interventions.

High inflation negatively impacts economic growth, income distribution, and macroeconomic stability, posing challenges for both policymakers and citizens. However, it is essential to recognize that inflation can be managed through a combination of fiscal and monetary policies aimed at controlling budget deficits, regulating the money supply, and addressing structural issues in the economy.