Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

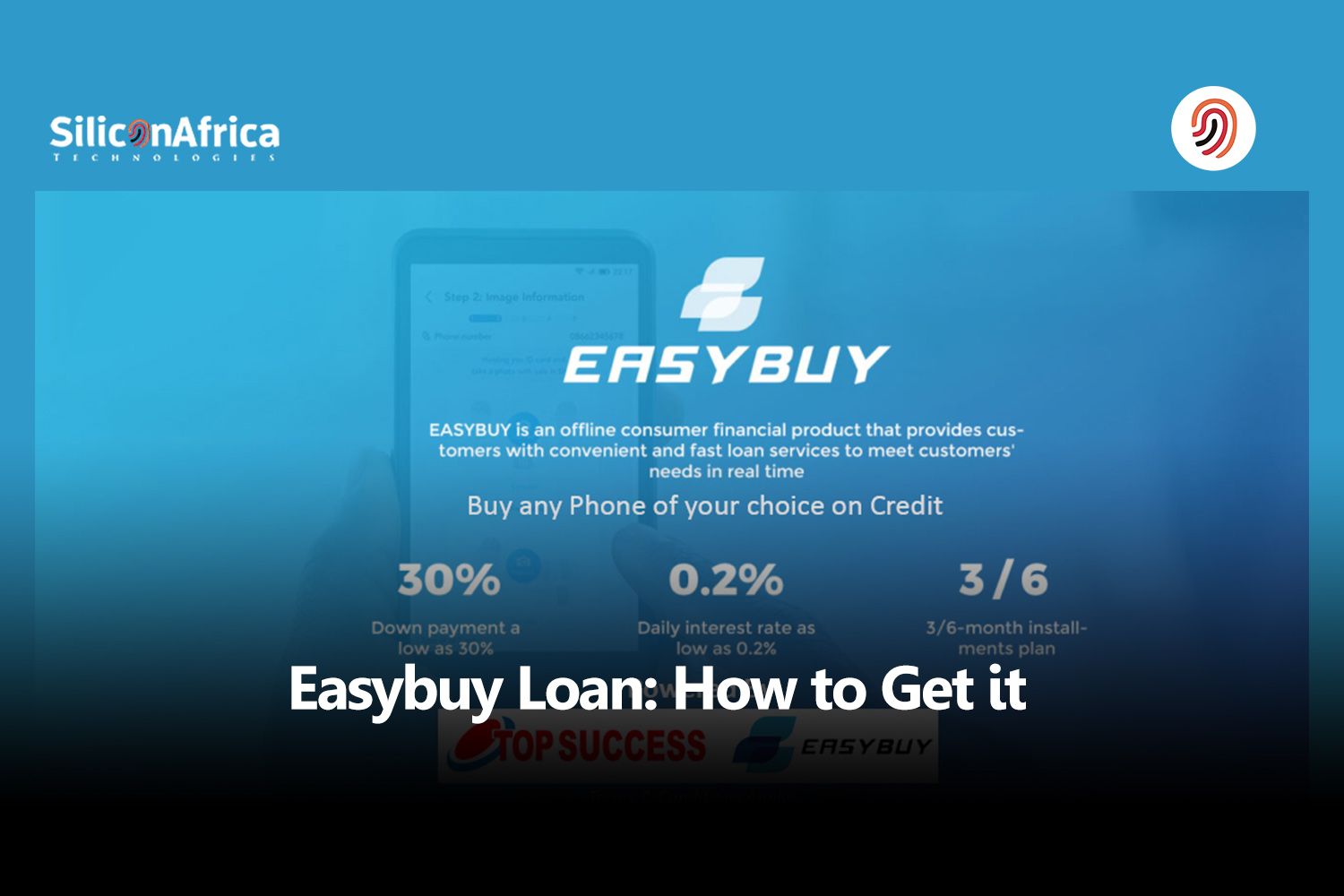

Easybuy is a mobile financial business that provides loan services. It is a subsidiary of Palmcredit. You can use Easybuy Service to purchase your smartphone with a loan that you can repay over time in installments.

Everyone knows that smartphones these days are expensive. While certain low-end phones may be quite inexpensive, most high-end phones tend to be more costly.

The days when it was difficult for consumers to afford their ideal gadgets, like mobile phones, are long gone. Any mobile phone may now be easily purchased on credit with Easybuy and paid back over time in installments. Very cool, huh?

Naturally, it is. For this reason, we have thoroughly covered all you need to know about Easybuy below, including its definition, usage guidelines, financing conditions, and much more. As we dissect everything, fasten your seat belt.

see also – Loan Calculator and How to Use it

Easybuy is a division of Palmcredit, a well-known consumer lending platform, which provides loans to consumers who want to buy mobile devices. An illustration of “Buy Now And Pay Later” in practice.

You can undoubtedly confirm that modern mobile phones are really costly. Please go for a stroll through the closest market if you have any doubts.

But with Easybuy, you may buy any smartphone you want and pay for it whenever it’s convenient for you. Yes, don’t cut corners on your mobile device purchases because you don’t have enough money when Easybuy is always there to support you.

see also – Latest way to Buy Airtel Airtime on MPesa 2024

You must first realize that they offer loan services to people who wish to buy mobile gadgets but are short on cash.

This is a real-world example of how Easybuy functions. Assume for a moment that you wish to spend N50,000 for a mobile phone but do not have the funds.

When you contact Easybuy for assistance, you provide the required paperwork to verify your eligibility and dependability, and you then pay 30% of N50,000. In other words, you need to have N15,000 on hand while Easybuy handles the remaining 70% of the payment.

The remaining 70% can then be repaid in installments at your discretion; these typically last between three and six months.

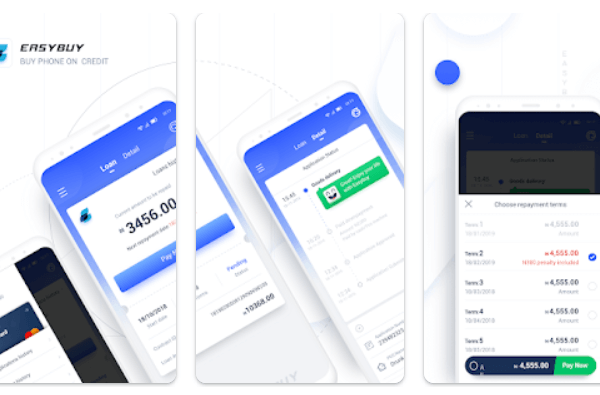

You may get the Easybuy app from the Google Play Store. You may manage your loan history by using the Easybuy application to request and repay loans.

The Easybuy loan app includes fantastic features that make it simple and straightforward for consumers to use; it has an attractive interface.

They have received over a million downloads, 47 thousand reviews, and 4.0 stars in the Google Play Store, which goes to show just how good it is. The cherry on top is that you may download the Easybuy loan app for a little 6.4 MB.

see also – Easy Loan: How to Easily Apply

If you’d like, go ahead and register for an account with Easybuy after downloading the mobile lending app. You can follow the instructions below.

Such loans cannot be provided by Easybuy without first verifying your eligibility.

Therefore, the prerequisites listed below are necessary if you must use Easybuy’s service.

A validated means of identity is the first prerequisite on our list. This could be your national ID card, voter’s card, driver’s licence, or even an overseas passport.

It also requires your Bank Verification Number (BVN). It’s really helpful for both verifying your banking history and tracking down thieves.

Additionally, you must present your valid ATM card.

You must have a stable and consistent source of income in order to qualify for an Easybuy mobile device loan. In this manner, Easybuy will be highly persuaded that you will repay your loan when it’s due.

Another prerequisite is having thirty percent of the entire number of mobile phones you wish to buy. Only 30% of the total would be covered by Easybuy.

see also – Shika Loan App: How to Apply

To purchase the phone of your choice using Easybuy, simply follow the instructions below.

Informing them about the loan prior to submitting your application will let you accomplish this with ease. It is not a good idea to call someone out of the blue and ask for a reference without first giving them notice.

Easybuy assists you in covering 70% of the cost of your smartphone; nevertheless, the maximum loan amount is N50,000. That is to say, the Easybuy mobile lending app allows you to borrow as little as N10,000 and as much as N50,000.

Typically, a loan has a period of three to six months. Easybuy therefore offers two payments options for you to select from.

Easybuy loans can be repaid in a few different ways.

read also – Shika USSD Code and Loan Application

Easybuy loan interest rate depends on the repayment plan you chose. The repayment plan on Easybuy is usually between 6% and 9% per month.

You pay 9% for the 3 months repayment plan and 6% for the 6 months repayment plan. Using our illustration earlier;

For 3 months repayment plan

Phone worth=50,000

30% deposit= 15, 000

Interest rate per month= 3,000

The interest rate in 3 months= 13,500

Total amount to be paid=13, 500 + 35, 000= 48,500.

For 6 months repayment plan

Phone worth = 50,000

30% deposit= 15,000

Interest rate per month=3,000

The interest rate in 6 months= 18, 000

Total amount to be paid = 18, 000 + 35,000= 53,000.

Easybuy may contact the four people you removed from your list of guarantors or impose additional fees if you fail to make your loan repayments on time.

Know the meaning of that? Disgrace!

Easybuy indeed has its agent in almost every mobile shop however, their head office is located at Number 9, Ogunnusi Road, Ogba, Ikeja in Lagos, Nigeria.

You can contact them for more information or complaints below;

Phone number: 018888188

Email Address: support@easybuy.com

Easybuy Loan is a financial service that provides loans to individuals for purchasing various items, such as electronics, appliances, furniture, and more.

You can apply by visiting their website or contacting their customer service. The application process typically involves filling out a form and providing necessary documentation.

Easybuy Loan allows you to purchase a wide range of items, including smartphones, laptops, TVs, home appliances, furniture, and more.

Eligibility criteria may include being of legal age, having a steady income, and meeting any other requirements set by Easybuy Loan.

Loan amounts vary depending on your eligibility and the item you wish to purchase. Typically, you can borrow amounts ranging from a few hundred to several thousand dollars.

You may need to provide identification documents, proof of income, and information about the item you intend to purchase.

Approval times vary, but some applicants receive approval within a few hours of submitting their application.

Once approved, funds are usually disbursed directly to the vendor or seller, allowing you to acquire the item immediately.

Repayment terms and options vary, but typically you’ll need to repay the loan amount plus any interest and fees in installments over a predetermined period.

In conclusion, Easybuy Loan offers a convenient financing solution for purchasing a wide range of items, from electronics to furniture. With a straightforward application process, quick approval times, and flexible repayment options, it provides accessibility to those in need of immediate purchases.

While eligibility criteria and documentation requirements exist, Easybuy Loan aims to streamline the borrowing experience. Funds are disbursed promptly upon approval, enabling customers to acquire desired items without delay.

Whether for essential appliances or luxury electronics, Easybuy Loan stands as a reliable option for individuals seeking convenient financing solutions tailored to their needs.

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech