Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Kenyan consumers may now easily and quickly obtain loans with the help of the Cloud Loan app, a state-of-the-art smartphone lending platform.

The go-to option for handling a range of financial demands, from emergencies to personal spending, is Cloud Loan thanks to its user-friendly interface and speedy loan processing.

You can easily apply for cloud loan in Kenya by downloading the Cloud Loan app and following our step-by-step instructions in this detailed guide.

With Cloud Loan, you can easily fulfill all of your financial needs without having to deal with the hassles of traditional borrowing.

Access to credit has undergone a transformative shift with the advent of innovative financial technologies. One such innovation that has garnered significant attention is the Cloud Loan app, a groundbreaking platform revolutionizing the lending landscape in Kenya.

This article serves as a comprehensive guide to activating Cloud Loan, exploring its features, benefits, and the seamless process of obtaining credit through this innovative application.

se also – Loan Calculator and How to Use it

Cloud Loan is a cutting-edge mobile application that leverages cloud-based technologies to provide quick and convenient access to credit facilities.

Developed with the aim of addressing the financial needs of individuals and businesses in Kenya, Cloud Loan offers a streamlined alternative to traditional lending institutions.

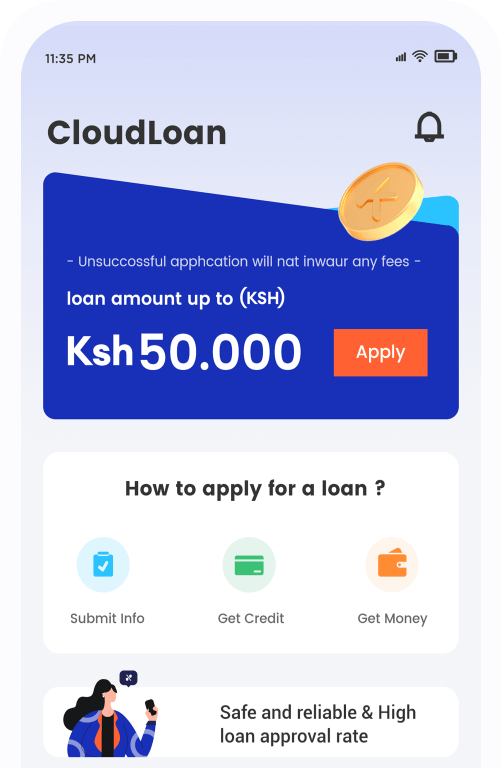

This is the new loan app you’ve been waiting for: the CloudLoan App. It is a digital loan app that is available in Kenya that offers loans through MPesa. Loan amounts range from KEs 3000 to KEs 100,000. The loan interest rate on the Cloud Loans app is between 12% and 50%, and there is a minimum repayment period of 91 days.

Is the Cloud Loan App legit? Where can I get it? The Cloud Loan App is definitely legit. To apply, download the CloudLoan App from the Google Play Store, register with your phone number and ID number, and submit your application to get the loan instantaneously.

By harnessing the power of cloud computing, the app boasts rapid approval processes, minimal documentation requirements, and flexible repayment options, making it an attractive solution for borrowers across the country.

An attribute that sets Cloud Loan apart is its dedication to advancing financial inclusion. In a nation where a sizable segment of the populace is either unbanked or severely underbanked, the app functions as a lifeline for people and enterprises in need of credit. By utilizing cloud-based technologies, Cloud Loan circumvents the customary obstacles connected to traditional brick-and-mortar banks, including protracted application procedures, collateral prerequisites, and geographic restrictions.

see also – How to Opt in and out of MTN DND, Airtel DND, Glo DND and 9mobile DND

We have the solution for you: the Cloud Loan App provides a quick and safe way to obtain cash loans. To use the Cloud Loan App, a person must be a citizen of Kenya who is at least eighteen years old and have an M-Pesa account. After completing the application form, which can be downloaded and completed, you can get your loan.

But that’s not all—Cloud Loan also provides some decent sums, with options ranging from Kshs 3,000 to Kshs 80,000. Additionally, since the entire procedure is done online, you don’t need to visit their physical location. If you have credit history from other platforms than Cloud Loan, you’re in luck because it won’t affect your loan application, so you don’t need to worry.

The parameters of a cloud loan include an annual percentage rate (APR) cap of 20% and a service charge of just 6%. Your service charge is 6%, for instance, if you borrow Ksh20,000 for 180 days at a 10% annual percentage rate. This implies that you will receive Ksh20,000 and repay Ksh22,186 in total, paying Ksh3,698 every month.

also check – Access Bank Set to Acquire Kenya’s National Bank

Activating Cloud Loan is a straightforward process that can be completed within minutes, thanks to its user-friendly interface and intuitive design. Below is a step-by-step guide to initiating the loan activation process:

The first step is to download the Cloud Loan app from the Google Play Store for Android users or the Apple App Store for iOS users. Simply search for “Cloud Loan” and click on the download button to install the application on your smartphone.

Once the app is successfully installed, launch it and proceed to register for an account. Provide the required information, including your name, phone number, email address, and create a secure password. Ensure that the information provided is accurate and up-to-date to facilitate the loan approval process.

To comply with regulatory requirements and prevent fraud, Cloud Loan utilizes advanced identity verification mechanisms. You may be required to upload a scanned copy of your national identification card (ID), passport, or other supporting documents for verification purposes. Follow the on-screen instructions to complete this step.

With your account set up and verified, you can now proceed to apply for a loan. Navigate to the loan application section within the app and enter the desired loan amount along with the repayment duration. Cloud Loan offers flexible repayment terms tailored to suit individual preferences and financial capabilities.

Upon submission of your loan application, Cloud Loan employs sophisticated algorithms to assess your creditworthiness based on various factors, including your credit history, income level, and repayment behavior. The automated credit scoring system ensures swift processing and objective decision-making, eliminating the need for lengthy approval delays.

Once your loan application is approved, you will receive a notification via the app, informing you of the approved loan amount and repayment terms. The funds will be disbursed directly to your registered bank account or mobile money wallet, enabling instant access to the credit facility.

Create a CloudLoan account by entering the required information. Assist yourself by creating a strong password.

To find out if you qualify for a loan, fill out the essential fields. The information you have supplied will be used by CloudLoan to determine your eligibility.

Depending on your financial situation, choose the loan amount and payback duration you want.

Provide the required paperwork and correct information to finish the loan application procedure.

CloudLoan will examine and confirm the information you have submitted in your loan application.

You’ll get an email acknowledging loan acceptance as soon as it’s approved.

also check – Microsoft is Facing Antitrust Probe in South Africa Over Azure Cloud Practices

Cloud Loan offers a plethora of benefits that set it apart from traditional lending institutions and other fintech platforms. Some of the key advantages include:

With the Cloud Loan app, borrowers can access credit anytime, anywhere, directly from their smartphones. The streamlined application process and quick approval mechanism ensure rapid disbursal of funds, catering to urgent financial needs.

Cloud Loan promotes financial inclusion by reaching underserved segments of the population who may have limited access to formal banking services. The app welcomes individuals from all walks of life, including salaried employees, entrepreneurs, and self-employed individuals.

Unlike traditional loans that impose rigid repayment structures, the Cloud Loan app offers flexibility in repayment, allowing borrowers to choose repayment terms that align with their financial capabilities. Whether it’s a short-term loan for immediate expenses or a long-term loan for investment purposes, Cloud Loan caters to diverse needs.

Cloud Loan prioritizes transparency and security, ensuring that borrowers have full visibility into the terms and conditions of the loan agreement. The app employs robust encryption protocols to safeguard sensitive information and prevent unauthorized access.

see also – Easy Loan: How to Easily Apply

5 star Rating: Caroline Mbithe

It’s one of the best lending apps I’ve come across so far. I would totally recommend it to anyone to its efficiency

4 star Rating: Stella Mwikali

Very fast in lending you should try this app.

1 star Rating: Kelvin Omondi

An unreliable app I first applied for a loan and disbursed on time. After I cleared the second loan application I’ve been kept on waiting. It’s over 24 hrs now. On my app account the message is I will be patient while my application is being reviewed. My conclusion is to just now cancel my application because it will be of no help now.

1 star Rating: Faith Kihugo

It keeps sending messages that your loan has been approved when you apply, it keeps telling you try again ,,,, it can be used for emergencies

Cloud Loan is a mobile application that provides access to instant credit facilities using cloud-based technologies.

You can download the Cloud Loan app from the Google Play Store for Android devices or the Apple App Store for iOS devices.

You will need to provide basic personal information such as your name, phone number, email address, and a scanned copy of your national identification card or passport for identity verification.

The approval process for a loan with Cloud Loan is rapid, often taking just a few minutes once all necessary information has been provided.

Cloud Loan utilizes advanced credit scoring algorithms to assess borrowers’ creditworthiness, taking into account various factors beyond just credit scores. Therefore, individuals with lower credit scores may still be eligible for a loan.

Cloud Loan offers flexible repayment options, allowing borrowers to choose repayment durations and frequencies that suit their financial circumstances.

Yes, Cloud Loan prioritizes data security and employs robust encryption protocols to safeguard users’ personal and financial information.

While it is possible to have multiple active loans with Cloud Loan, borrowers are encouraged to borrow responsibly and manage their debt obligations effectively.

As your go-to online lender in Kenya, CloudLoan provides a quick and easy way to apply for loans. Get the CloudLoan app now to see how simple it is to apply for loans online.

Cloud Loan represents a paradigm shift in the lending landscape, offering a convenient, accessible, and secure platform for accessing credit in Kenya. By following the simple steps outlined in this guide, individuals and businesses can activate Cloud Loan and unlock a world of financial opportunities.

With the Cloud Loan app, bid adieu to the difficulties of traditional borrowing and welcome the future of financing. With a few taps on your tablet, you can achieve your financial goals!

You can check out other useful content by following us on

X/Twitter: @siliconafritech.

Instagram: @SiliconAfricaTech.

Facebook: @SiliconAfrica