Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

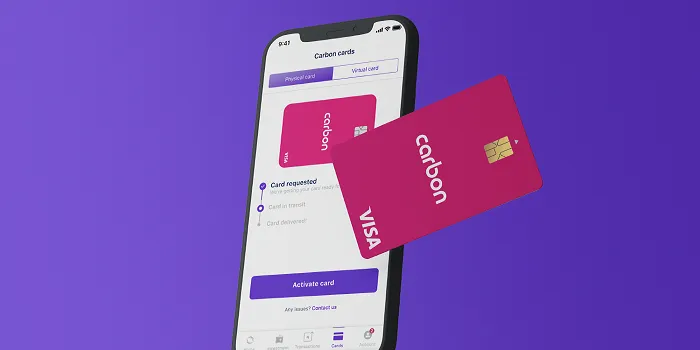

In a move that will likely send shockwaves through Nigeria’s fintech industry, Carbon, a leading digital lender, has announced the discontinuation of its debit card services.

The Carbon debit card shutdown, effective immediately, marks a significant shift in strategy for the company, which has positioned itself as a major player in Nigeria’s digital banking space.

Financial experts have pointed to a number of factors that may have contributed to Carbon’s decision to pull the plug on its debit card offerings.

Analysts suggest that the Nigerian debit card market had become saturated, with several established players already vying for a limited customer base.

This intense competition may have made it difficult for Carbon to carve out a niche for its debit card product.

Moreover, Carbon’s CEO, Ngozi Dozie, has acknowledged that the company’s initial decision to launch debit cards may have been a strategic misstep.

Dozie has since emphasized the importance of conducting thorough market research before venturing into new product lines.

A more rigorous analysis, she argues, could have revealed the redundancy of debit cards in the Nigerian market and steered Carbon in a different direction.

Dozie’s comments underscore the broader challenges faced by fintech startups in today’s rapidly evolving financial landscape.

In an age of constant innovation and disruption, it is crucial for fintech companies to maintain a laser focus on identifying and delivering genuine value propositions to their customers.

Simply following industry trends, without careful consideration of market needs, can lead to costly mistakes, as Carbon’s debit card shutdown illustrates.

The decision to discontinue debit card services is not the first time Carbon has had to make a course correction.

In 2021, the company was forced to scale back its operations in Kenya after encountering unforeseen difficulties in that market.

Analysts believe that Carbon’s expansion into Kenya may have been hampered by an inadequate understanding of the Kenyan financial regulatory environment and consumer preferences.

Carbon’s experience serves as a cautionary tale for other fintech startups.

The company’s struggles highlight the need for a strategic approach that prioritizes market research, customer focus, and a deep understanding of the regulatory landscape.

By learning from Carbon’s missteps, other fintech companies can increase their chances of success in the competitive Nigerian and African financial markets.

Read More: South Africa Might Take the EU’s New Carbon Tax to the World Trade Organization

The Carbon debit card shutdown is a significant development in Nigeria’s fintech industry.

It remains to be seen how other players in the market will respond to Carbon’s decision.

However, one thing is certain: Carbon’s experience offers valuable lessons for all fintech startups, not just in Nigeria but across Africa.

By carefully considering market dynamics, focusing on customer needs, and conducting thorough due diligence, fintech companies can navigate the challenges of the digital financial landscape and position themselves for long-term success.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.