Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Boodle Loans, a South African loan company, provides fast and convenient financial solutions to its customers. Since its establishment in 2011, Boodle Loans has emerged as an innovative alternative to traditional banks, offering short-term online loans to individuals seeking quick and easy access to money. A notable aspect of Boodle Loans is its streamlined and efficient lending approach.

In contrast to traditional banks, Boodle Loans enables customers to apply for loans directly through their website or mobile app. This streamlined process ensures quick and convenient access to funds, with customers receiving the money they need within hours.

Throughout this discussion, we will delve into some of the company’s key attributes, including flexibility, transparency, safety, privacy, and exceptional service.

Also read: Capfin Loan and how to Apply for it

Boodle Loans excels in offering flexibility to its customers. With short-term loans and repayment periods of up to 32 days, customers can swiftly address immediate financial needs without committing to long-term obligations, making it particularly beneficial for those requiring quick access to a small amount of money.

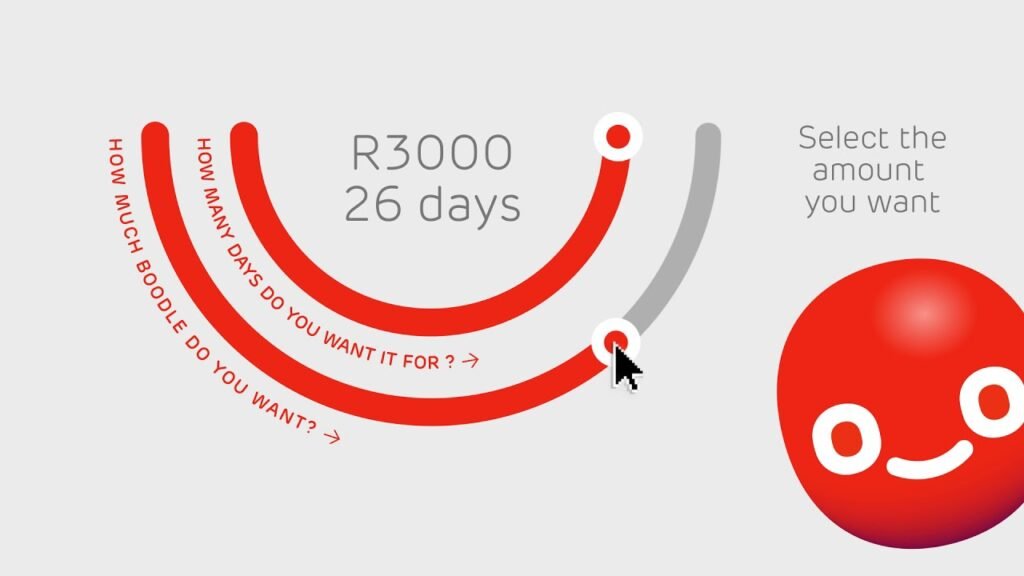

The company prioritizes transparency and accessibility in its lending process. Customers can utilize the loan calculator on Boodle Loans’ website to gain a clear understanding of costs and monthly payments before finalizing their loan decision. This empowers customers to make informed financial choices and avoid unforeseen expenses.

Boodle Loans places a strong emphasis on safeguarding customer data. Utilizing advanced technology, the company ensures the confidentiality of personal and financial information, enhancing customer trust and data security throughout the loan application and repayment process.

Additionally, it distinguishes itself through exceptional customer service. With a dedicated support team accessible via phone, email, and live chat, customers receive prompt and efficient assistance, fostering a positive experience throughout their loan journey.

It’s crucial for customers to use Boodle Loans responsibly, understand loan terms, and meet repayment deadlines to avoid penalties and potential impact on credit scores.

Also read: How to Apply for Capitec Loan in South Africa

Very few loan applications offer the feature of calculating interest rates before applying, making this one of Boodle Loans’ standout features. Unlike other loan services that present loan offers first and reveal interest rates later, Boodle Loans prioritizes transparency.

In many cases, customers, driven by immediate financial needs, might accept loans without fully understanding the associated interest rates. This can lead to unfavorable outcomes. However, Boodle Loans takes a different approach.

They provide an interest rate calculator where customers input the loan amount and desired repayment duration. The calculator then displays real-time interest rates, empowering customers to make informed decisions before committing to a loan.

When applying for a loan, start by adjusting the SmileDial to choose your desired amount and repayment period. Once satisfied, press the SmileDial button.

Then, provide accurate and detailed information during the application process, as this enhances your chances of approval.

After submitting your details, Boodle’s system conducts verification checks. Upon completion, you’ll receive an offer, typically disbursed within 10 minutes.

Also read: Home Loan Repayment Calculator and How to Use It

Boodle Loans is a South African loan company that provides fast and convenient financial solutions, especially short-term online loans, to individuals in need of quick access to money.

It was founded in 2011.

It distinguishes itself from traditional banks by offering a streamlined and efficient lending process that allows customers to apply for loans directly through their website or mobile app.

Some key features of Boodle Loans include flexibility in loan options, transparency in the lending process, prioritization of security and privacy, and exceptional customer service.

Boodle Loans offers short-term loans with repayment periods of up to 32 days, providing customers with quick access to small amounts of money without long-term commitments.

It provides an interest rate calculator on its website, allowing customers to calculate interest rates before applying for a loan and make informed financial decisions.

Boodle Loans utilizes advanced technology to protect customer data, ensuring confidentiality and enhancing trust throughout the loan process.

To apply for a Boodle loan, adjust the SmileDial to select the desired loan amount and repayment period, provide accurate personal information, and wait for verification checks. Once approved, customers receive offers typically disbursed within 10 minutes.

Failing to meet loan repayment deadlines can result in penalties and may impact the customer’s credit score. It is crucial for customers to understand loan terms and obligations before accepting a loan offer.

In conclusion, Boodle Loans stands out as a reliable and innovative financial solution provider in South Africa. With its flexible loan options, transparent lending process, commitment to security and privacy, and exceptional customer service, Boodle Loans offers a seamless experience for individuals in need of quick and convenient access to money.

By prioritizing transparency, accessibility, and customer satisfaction, Boodle Loans continues to set itself apart as a trusted choice for short-term financial needs.

Interact with us via our social media platforms:

Facebook: Silicon Africa

Instagram: Siliconafricatech

Twitter: @siliconafritech