Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Bitcoin crucial 36 hours: The cryptocurrency market is abuzz with anticipation as Bitcoin (BTC) enters a critical 36-hour window.

Investors are anxiously awaiting two key events that have the potential to significantly impact the price of the world’s leading digital currency.

The first is the highly anticipated decision by the US Federal Reserve (Fed) on interest rates, scheduled for Wednesday, June 15th.

The second is the release of crucial US inflation data, set for release on Thursday, June 16th.

Bitcoin’s price movement has historically exhibited an inverse correlation with the US 10-year treasury yield.

When interest rates rise, the yield on government bonds also increases, making them a more attractive investment proposition compared to riskier assets like Bitcoin.

This dynamic has played out in recent months, with Bitcoin’s price experiencing a significant correction as the US Federal Reserve signaled its intention to raise interest rates to combat inflation.

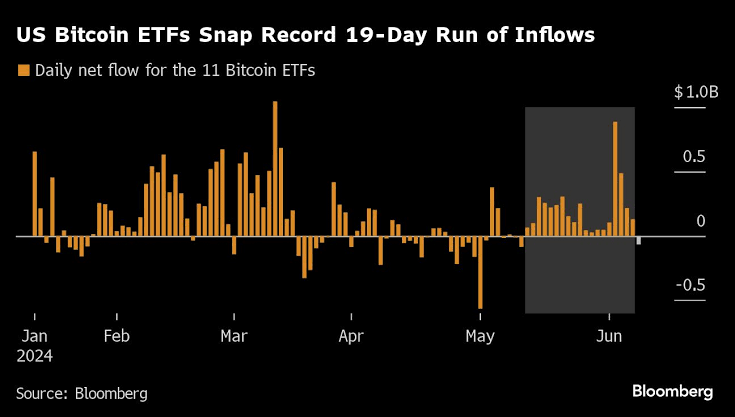

Adding to the uncertainty surrounding Bitcoin’s future is the recent activity in Bitcoin exchange-traded funds (ETFs).

These investment vehicles allow traditional investors to gain exposure to Bitcoin without the need to directly purchase and store the cryptocurrency.

While recent inflows into Bitcoin ETFs have been seen as a positive sign, a sudden one-day pullout has rattled investor confidence.

This volatility highlights the nascent nature of the Bitcoin ETF market and the potential for unpredictable swings in investor sentiment.

Financial analysts are keenly watching the upcoming events, with many believing that the next 36 hours will be crucial for determining Bitcoin’s short-term trajectory.

A hawkish stance from the Fed, coupled with hotter-than-expected inflation data, could trigger a sell-off in Bitcoin, pushing its price lower.

Conversely, a dovish Fed decision and cooler inflation figures could provide a much-needed tailwind for the cryptocurrency.

Several potential scenarios could unfold depending on the outcome of the Fed meeting and the inflation data release.

In a scenario where the Fed delivers a 50 basis point interest rate hike and inflation shows signs of peaking, Bitcoin’s price could experience a modest relief rally.

However, if the Fed adopts a more aggressive stance, raising rates by 75 basis points or more, and inflation remains stubbornly high, Bitcoin could face renewed selling pressure.

Read More: Bitcoin’s Big Update: Controversy Grows Over Bitcoin Software Update

The fate of Bitcoin in the coming days is inextricably linked to the broader cryptocurrency market.

If Bitcoin suffers a significant price decline, it could drag down other digital currencies as well.

Conversely, a strong showing by Bitcoin could boost investor sentiment across the entire cryptocurrency ecosystem.

While the next 36 hours are undoubtedly critical for Bitcoin, it is important to remember that this is just one chapter in the ongoing story of this revolutionary digital asset.

The long-term outlook for Bitcoin remains positive, with many experts believing that it has the potential to become a mainstream asset class in the years to come.

The upcoming events will provide valuable insights into the short-term headwinds facing Bitcoin, but they should not be seen as a definitive verdict on its long-term prospects.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.