Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Opening a bank account used to be one long process of forms, lines, and plenty of “come back tomorrow.” Times have changed. Now, there are banks you can open online for free without leaving your comfort zone.

You can now from the comfort of your phone open accounts with some banks that you can open online in Nigeria, whether large commercial banks or the now trending digital banks.

The majority of Nigerians already have the comfort of banking with these. In this article, I will provide you with the best 15 Nigerian banks you can open online so you can choose one that is suitable for your daily spending, savings goals, or business.

Here are some clear reasons why you should open a bank account online in Nigeria:

So, opening an account online in Nigeria isn’t just modern—it gives you convenience, savings, safety, and control. Why carry wahala when your phone can do the work?

Read Also – List of 15 Online Business that Pays Daily for Students in Nigeria

Now here’s a list of the best fintechs and banks where you can easily open an account online. If you want zero fees, easy transfers, or instant savings, these banks offer it all for you:

Kuda Bank is called “the bank of the free” and for good reason. You can sign up in minutes with nothing more than your phone, BVN, and ID. There is no card maintenance fee in their app, free transfers up to a limit, and instant transaction alerts.

They even deliver your debit card to your doorstep at no extra cost.nWith their ‘Spend+Save’ option, you can save small amounts easily as you spend.

Also, in case you qualify, Kuda delivers overdrafts to you to cover emergencies. If you need a digital bank that saves you money and helps you budget, Kuda is the right choice.

Wema’s ALAT is Nigeria’s first digital bank from start to finish. You open an account within less than 5 minutes with your phone, BVN, and ID. Your virtual account is opened straight away and your debit card sent to you.

Their mobile app features high-interest savings schemes, easy loans without paperwork, and lifestyle services like purchasing cinema tickets and bill payments.

If you want banking with no wahala and other lifestyle choices, ALAT is where you fit in.

Also Read – Latest Update on How to check my BVN Phone Number Online

Opay is everywhere these days. You can create an account online in minutes. For full features, you’ll need your BVN and ID.

Opay has no fees for accounts and instant transfers, airtime and data purchase with cashback, and safe payments for small businesses.

They also have a debit card for online purchases and savings facilities such as ‘Owealth’ to earn interest on a daily basis. If you need a straightforward app to transfer money, purchase airtime, and save with interest, Opay is a great choice.

V Bank by VFD Microfinance Bank makes banking easy. With just your phone, BVN, and simple selfie, you can open an account. You get your virtual account instantly, and their debit card is accepted for all payments.

They allow you to create multiple savings plans, lock funds to spend less, and even save as a group with ESUSU.

With no maintenance fees and minimal transfer fees, V Bank is ideal if you’d love straightforward banking with no hidden bills.

Moniepoint is popular with POS agents and small business individuals. You can register for Moniepoint online through their website or mobile app. It requires your BVN, ID card, and clear selfie for verification.

They offer instant transfers, reliable POS services, and business banking features like daily transaction reports.

If you own a business and you need a simple way of receiving payments, Moniepoint is one of the finest banks you can open online in Nigeria today.

Read Also – Top 10 Online Banking Apps in Nigeria 2025

PalmPay is yet another fintech app that makes banking easy. You can open your account online in 5 minutes through your phone number, BVN, and ID card.

They have no account maintenance fees, fast transfers, and cashback incentives when you buy airtime or pay bills on the app.

Their debit card is perfect for ATM cash withdrawals and internet payments. If you want to save money daily, PalmPay is a good option.

Paga has existed for quite a while now, and it is possible to send and receive money easily. You can register a Paga account just by your phone number and, in order to make full use of it, add your BVN and ID.

With Paga, you can pay bills, buy airtime, send money to any bank, and even receive remittances overseas. If you want an easy mobile money service that is available everywhere in Nigeria, you should give Paga a shot.

PocketApp, previously known as Abeg, is owned by PiggyVest. You can apply for an account online using your phone number, BVN, and ID card.

It allows you to send and receive money effortlessly, create group contributions (ajo or esusu), and pay directly for services in the app.

It’s especially popular among young people for quick transfers and contributions. If you’re already a PiggyVest member, having PocketApp just makes online banking even easier.

Also Read – How to Borrow Money from UBA Bank App Online in Nigeria | A Step-by-Step Guide

If you prefer to use traditional banks you can open online in Nigeria, below are best options that enable you to open your account using your phone without visiting any branch.

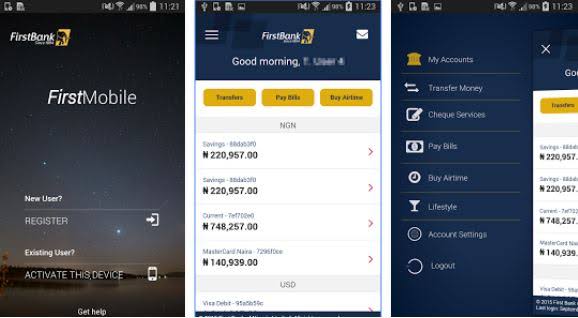

First Bank is one of the oldest banks in Nigeria, and now it’s made easy to open an account online. You can open FirstInstant account via their mobile app or USSD code *894# without visiting the bank.

All you need is your phone number, BVN, and any one of the valid IDs that is your NIN for full features. Their app allows you to transfer money, buy airtime, pay bills, and access your account with ease.

If you desire the trust of First Bank without the queue, then this is one option.

Zenith Bank also provides online account opening for new users. You can also open a Zenith Easy Account via *966# or their mobile app. Provide your phone number, BVN, and ID number to complete registration.

Their platform enables you to send money, purchase airtime, and pay bills at any time. If you desire a bank with robust security and extensive ATM coverage, Zenith Bank is among the top Nigerian banks you can open an account online today.

Read Also – 7 Apps To Make Money Online In Nigeria As A Student In 2025

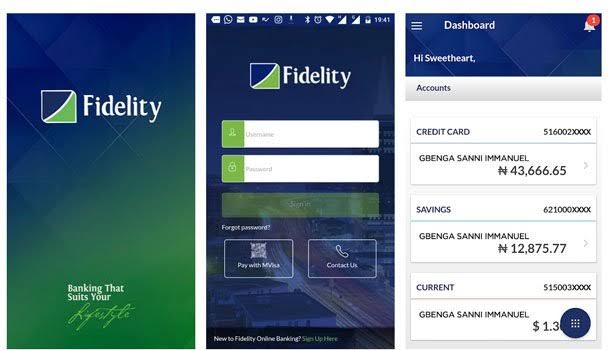

Fidelity Bank makes banking convenient with their Instant Account service. You can open your account online using their mobile application or by calling *770#.

With just your ID, BVN, and phone number, your account will be opened within minutes. Their app consists of easy transfers, airtime purchase, and bill payment.

If you want a bank that is reliable as far as customer service and convenience services are concerned, Fidelity Bank is an ideal choice.

FCMB facilitates real-time online opening of accounts through their New Mobile application or USSD code *329#. You can open an account through your phone number, BVN, and ID card.

Once you are registered, you can send money and receive money, buy airtime, and pay bills from your phone on the go.

FCMB is renowned for serving students and small-size businesses that have flexible banking facilities. In the event you need a regular bank account without visiting the branch, FCMB is the one to attempt.

Also Read – Nigerian Banks Resolve $132 Million USSD Debt with Telecom Providers

Standard Chartered Bank offers online account opening for its mobile banking customers. You can open an account through their SC Mobile app without a visit to any branch.

You need your BVN, valid ID card, and clear selfie for verification. Their app gives you access to international-standard banking services, including savings, investments, and foreign currency accounts.

For you who would rather have a bank that is international-standard with local convenience, Standard Chartered is available.

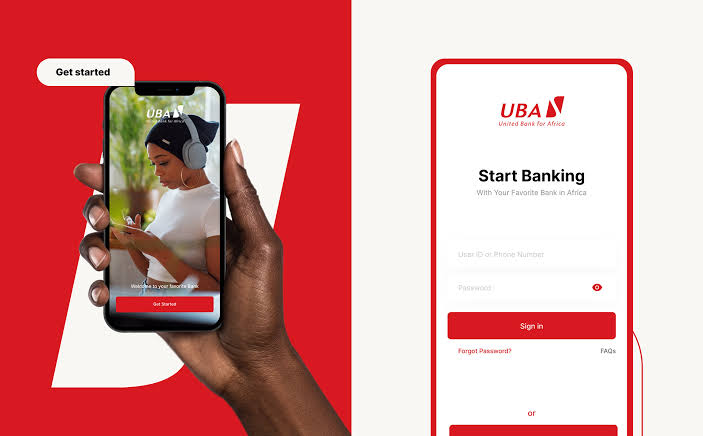

UBA makes opening an account a breeze with their mobile app or USSD code *919#. You can open an UBA Instant Account by entering your phone number, BVN, and valid ID card.

Once you’ve opened, you can transfer money, buy airtime, pay bills, and even take out loans from within the app. UBA is famous for their reliable services across Africa. If you like a bank that works seamlessly both locally and internationally, UBA is an excellent option.

Jaiz Bank is Nigeria’s first non-interest (Islamic) bank, and they allow you to open your account online through their mobile app or web portal.

You need your BVN, ID card, and phone number to register. They bank on ethical and Islamic values in their banking, offering savings, current, and business accounts free of interest charges.

If you desire banking on Islamic finance or ethical banking values, Jaiz Bank is something to look into.

Read Also – A Comprehensive List of Banks That Offer Credit Cards in Nigeria

It’s not one-size-fits-all. Some banks are wonderful for market traders or entrepreneurs, others for working-class individuals or students who require convenience. Here’s what to check:

Also Read – How to Easily Open a Nigerian Domiciliary Account Online

No more story that touches. Online banking is now for everyone, whether you’re in Lagos, Abuja, or chilling in your village!

Get in control of your money—open an account today, feel real comfort, and join the millions of Nigerians who are already banking online! No story, no fuss—just cut-to-the-quick banking that gets the job done for you.

Can I open a bank account online for free?

Yes. Most of the banks you can open online in Nigeria don’t charge you for opening an account.

Can I borrow money from these online banks?

Yes. Kuda, ALAT, Opay, and PalmPay offer instant loans if you qualify.

Which Nigerian bank is the best for students?

Kuda, Opay, and V Bank are popular among students because there is no charge and it is easy to open an account.

Can I open an account without BVN?

You can open limited accounts in some banks without BVN, but for full operation, the BVN must be included.

In summary, these online banks make things easy. Be it Kuda, Opay, or First Bank, there are many banks you can open online for free in Nigeria.

With them, you do not have stress and lines. Your phone, BVN, and data, and your account is opened.

These Nigerian banks that can be opened online put banking at your fingertips. In fact, banking has never been easier for Nigerians.

If you find this piece useful, kindly leave a comment and follow for more updates

Facebook at Silicon Africa

Instagram at Siliconafricatech

Twitter at @siliconafritech.