Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

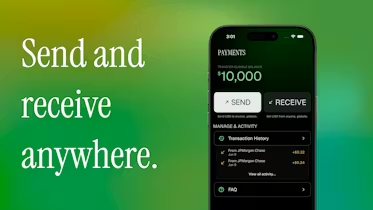

Nigerian startup Karsa has launched an exciting new platform designed to make banking with US dollars easier for users in Nigeria and beyond. The company offers virtual US bank accounts that allow users to receive payments in dollars, send money internationally, and soon, spend directly with a Visa card. This move by Karsa launches to provide users with virtual US bank accounts that simplify how people manage their money across borders.

Karsa was founded earlier this year by Shahryar Hasnani and Dale Wilson, and it’s backed by Y Combinator as part of its W25 batch. The startup’s goal is to help people in Nigeria and similar markets hold and transact in US dollars more easily. “In Nigeria, moving money globally still feels like stitching together a dozen tools,” Hasnani explained. “You get paid through one app, convert through another, stash savings in a third, and still can’t easily spend those dollars. There’s no simple, trusted home for global money, especially for remote workers, freelancers, and anyone trying to hold US dollars.”

Read Next: Bitcoin Dips Below $96,000, Raising New Market Fears

What Karsa launched to provide users with virtual US bank accounts really brings to the table a unified solution through a mobile app. Users get a virtual US bank account that lets them get paid, pay others, and soon spend using a Visa card. This full-service offering sets it apart from other products that often focus on just one part of the puzzle, like only sending money or only receiving freelancer payments.

Millions of people across places like Pakistan, Nigeria, Kenya, and India need something just like this — access to stable foreign currency accounts and reliable international payment tools. According to Hasnani, freelancers and those receiving remittances are hit hardest, but the problem actually affects anyone trying to store or move value internationally. Many current services either serve narrow use cases or only part of the financial needs. Karsa has launched its platform to address all three core needs—save, send, and spend—so it can be everyone’s main financial account, not just a tool for a niche group.

Karsa’s app is already available on both Android and iOS and is gaining traction across South Asia and Africa. The biggest milestone for the company has been its ability to provide full US bank account connectivity from countries where such access is rarely available. During its Y Combinator batch, Karsa soft-launched with a basic website and managed to process over US$50,000 in transaction volume. Since then, they rebuilt the product from scratch, and after officially launching the full app, demand quickly grew in markets like Pakistan, Nigeria, India, and Kenya.

Read Next: New Proptech Platform ExpertListing Launches to Boost Transparency in Nigeria’s Real Estate Market

Early adopters of the platform include freelancers, crypto users, and anyone looking for a reliable way to save or move dollars. Karsa makes money by charging small fees on currency exchange for cross-border transactions. Once the Visa card feature rolls out, the startup will also take a small cut on card transactions. They plan to earn some interest margin when they launch deposit features too.

In summary, Karsa launches to provide users with virtual US bank accounts that solve a big problem for many people trying to handle dollars internationally. With its all-in-one app, it’s making global payments, savings, and spending simpler and more accessible for people in Nigeria and other markets that have long struggled with these financial needs.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.