Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

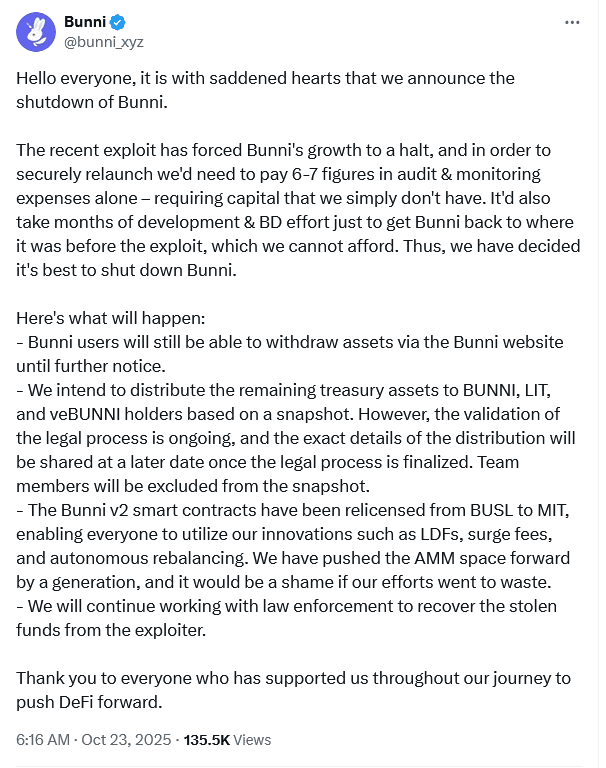

Just days after the layer-1 blockchain Kadena said it was shutting down, another blow hit the crypto world. Bunni DEX, a decentralized exchange, has announced it is shutting down too. This comes after the platform suffered a big $8.4 million hack in September that drained its liquidity and left the team with no money to keep going.

The Bunni DEX team shared on X that they had no choice but to close because they simply don’t have the funds to recover. The hack wiped out their liquidity pools and scared off users and investors. Without money for new security checks or to rebuild, the team said, “We just can’t afford to fix things and make Bunni a safe place for trading again.”

Read Next: Lending Startup Lidya Shuts Down Due to Severe Financial Distress

This is another tough moment for the DeFi space, which has been hit hard lately by hacks, less money flowing in, and less trust from investors.

Bunni DEX used some new ideas on top of Uniswap v4 to manage liquidity and token pools. But those same innovations opened a door for hackers. In early September, someone found a small mistake in the Bunni code, a rounding error in the Liquidity Distribution Function (LDF). The attacker used flash loans and tiny withdrawals to trick the system into releasing funds they didn’t have permission for.

The hacker drained two pools: weETH/ETH on Unichain and USDC/USDT on Ethereum. The total value locked on Bunni dropped from millions to almost nothing overnight. The team even offered the hacker a 10% reward if they returned the money safely, but no luck. The stolen funds were sent through Tornado Cash, a privacy tool that makes tracking money harder.

Bunni DEX said that to reopen, they’d have to completely redo security, hire auditors, bring back liquidity, and rebuild the brand. The costs for this would run from hundreds of thousands to millions of dollars, way beyond what the project can handle now.

User and investor trust took a hit too. Trading slowed down, liquidity providers pulled out their money, and without cash or confidence, Bunni DEX had no way forward.

Still, the Bunni team is trying to close things the right way. Users can still withdraw whatever funds are left. They will take a snapshot of token holders (BUNNI, LIT, veBUNNI) to fairly share any leftover money. Importantly, the team won’t take any compensation themselves.

As a final move, Bunni’s developers made the project’s code open source under the MIT license. This means anyone can now use or change Bunni’s tech—like its liquidity tools and balancing features. So, even though Bunni DEX shuts down, its ideas might live on in other DeFi projects.

This all happened just days after Kadena, a layer-1 blockchain once praised for being scalable and business-ready, announced it couldn’t keep going either. Kadena’s team cited financial problems and said they would stop business operations. While Kadena’s blockchain network will still run in a limited way via independent miners and community support, Bunni DEX will fully stop once its smart contracts retire.

These back-to-back shutdowns have made the crypto community uneasy. It’s clear that innovation isn’t enough for DeFi projects to survive these days without strong security and enough funds.

Bunni DEX’s story is unfortunately common in DeFi. Even with security checks and careful design, smart contracts can have hidden bugs. Many DeFi projects rely heavily on user money and token prices. When something bad happens, like a hack or market crash, they don’t have enough backup funds to recover.

Experts warn that Bunni’s case shows why speed and new features shouldn’t come at the cost of safety. Once a project is hacked, it doesn’t only lose money; it also loses users’ trust. For Bunni, even fixing the technical problems might not have been enough to bring users back.

Read Next: Microsoft’s New Threat Report Issues a High-alert Warning for Africa

The close timing of Kadena and Bunni DEX shutting down highlights how fragile the crypto world is right now. It also raises tough questions about how decentralized projects can stay afloat when they depend on central teams, treasury funds, and user faith.

Bunni’s choice to share its code openly is a hopeful sign. Its tech might live on elsewhere, encouraging better engineering across DeFi. But the main lesson is clear: for DeFi platforms to survive in the long run, they need strong security, reliable funding, and clear governance.

In crypto, bold ideas matter, but Bunni DEX’s shutdown shows endurance is just as important.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.