Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

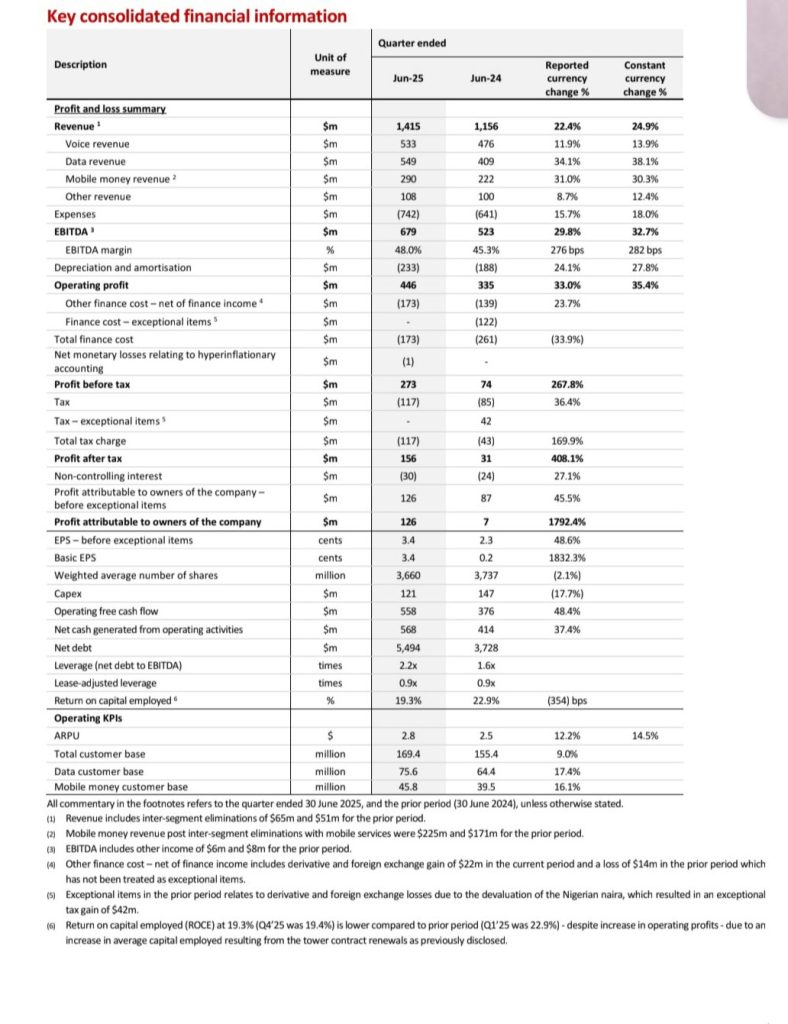

What Airtel Africa has done for the 2025/2026 financial year has, without a doubt, kicked off on a high note, increasing its profit before tax by a whopping 269 percent over the same period last year. Such amazing growth coming via reports of the first three months to June 30, 2025, highlights the strong game plan put in place by the company in the vibrant African market, with total revenues reaching up to $1.415 billion. It is quite clear that demands for data and mobile services across the continent are robustly booming.

Profit after tax had an astonishing jump of 408% at $156 million-the profit they made is almost one-half of what they earned for the entire previous financial year-very evident that this phenomenal surge indicates strong momentum up for Airtel Africa in 2025. It is not about making money only, and smart tariff adjustments-mainly in Nigeria – also played their roles, as well as strong performance in Francophone Africa.

Read Next: MTN Mobile Money Zambia & JUMO Launches Overdraft Service ‘Kwanisa Na MoMo

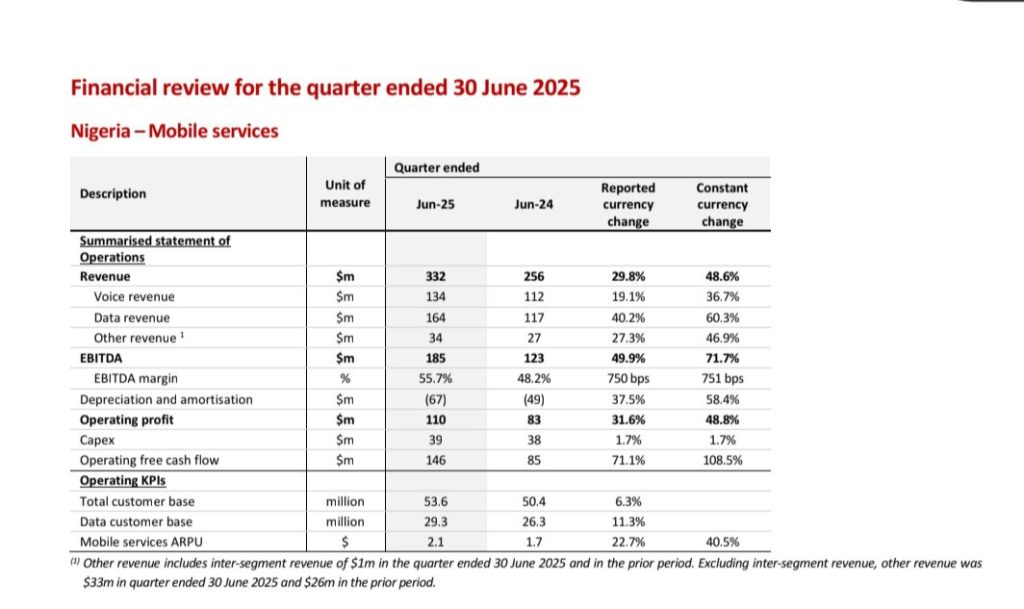

Much has been said, as already mentioned, of Airtel Africa in Nigeria. Since that country has become a powerhouse for Airtel Africa’s growth potential, Nigeria contributes even more than that: 24% of overall Q1 2025 revenues for Airtel Africa. This statistics indicates just how critical the country is to the overall financial health of the telecom giant. Revenue in Nigeria alone skyrocketed by 48.9% in terms of stable currency rates, due mainly to new tariff changes which were approved by the Secretary of the Nigerian Communications Commission, and which were necessary in order to help the company tackle the vicissitudes of the economy relating to fluctuating values of the Nigerian Naira.

Airtel Africa has also been investing heavily into its network. Moreover, it raised more than 2,300 new network sites to bring the total to 37,579 and extended its fibre optic network by 2,700 kilometers to have at its disposal a total of over 79,600 kilometers. These actions have driven 4G coverage to around 74.7% against a population, a significant improvement of at least 3.4% over last season. This expanded reach is specifically addressing a growing hunger for high-speed internet and ensuring that more people can connect. He has given Airtel 169.4 million customers and is obviously working to connect more and more Africans.

This increase in connectivity has directly led to a very significant rise in data consumption. Data revenues went up by 38.1% due to a 17.4% increase to 75.6 million data customers. Consumption showed a sharp rise of 47.4% over the previous year, with a considerable increase in the number of data-hungry smartphone users, who now comprise 45.9% of its customer base. Airtel’s network expansion strategy sits squarely with the goal of closing the digital divide, especially in areas that have never enjoyed good internet connectivity.

Mobile money services stand out as one of the bright spots of Airtel Africa. These services grew by 30.3%, with 45.8 million customers now using Airtel’s mobile money platform-an increase of 16.1% over last year. The impressive totals of processed transactions per annum reached a staggering $162 billion-increasing by 35%. The average amount of cash made by every mobile money user was also higher by 11.3%. The ‘My Airtel App’, merging service provision through cell phones with mobile wallet features, had a remarkable 92% increase in active users, a clear indication of their talent in digital innovation.

Sunil Taldar, the CEO of Airtel Africa, had this to say, we are pleased with results from: “We are very pleased with the strong growth in our operating and financial performance. This strong growth scale reflects the continuous demand for our services and the strength of our business model.” He also explained the company’s focus on improving the customer’s experience and using technology to make it easier for people to get and use smartphones.

Read Next: Vine, a Twitter-owned Short Video App, Set to Return in AI Form After 8 Years

Yet, Airtel Africa faces some challenges despite such stellar performances. The fluctuation of currency values in countries like Nigeria, Malawi, and Zambia, where energy prices are escalating, requires the company to look after its spending. Although their capital expenditure on network upgrades was slightly less this quarter due to the timing of construction, it was still significant when viewed across the full year. To protect itself from foreign exchange risks, Airtel has smartly ensured that of its operating company debt, approximately 95% is now from local currencies. They also showed confidence in their financial health by buying back $16.9 million worth of shares.

Airtel Africa’s Q1 performance in 2025 was special in relation to the entire financial year. Strong growth in data demand, booming mobile money businesses, and significant contributions from markets like Nigeria are the attributes that propel Airtel Africa toward easily tapping into the growing connections needs all over the continent. Setting up an agile network and developing cost-effective innovative digital solutions puts the company on the path to continuous success. As Mr. Taldar put it: “Africa holds immense opportunities, and we are making the right investments to prepare for the AI wave and explosion in data consumption.”

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.