Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

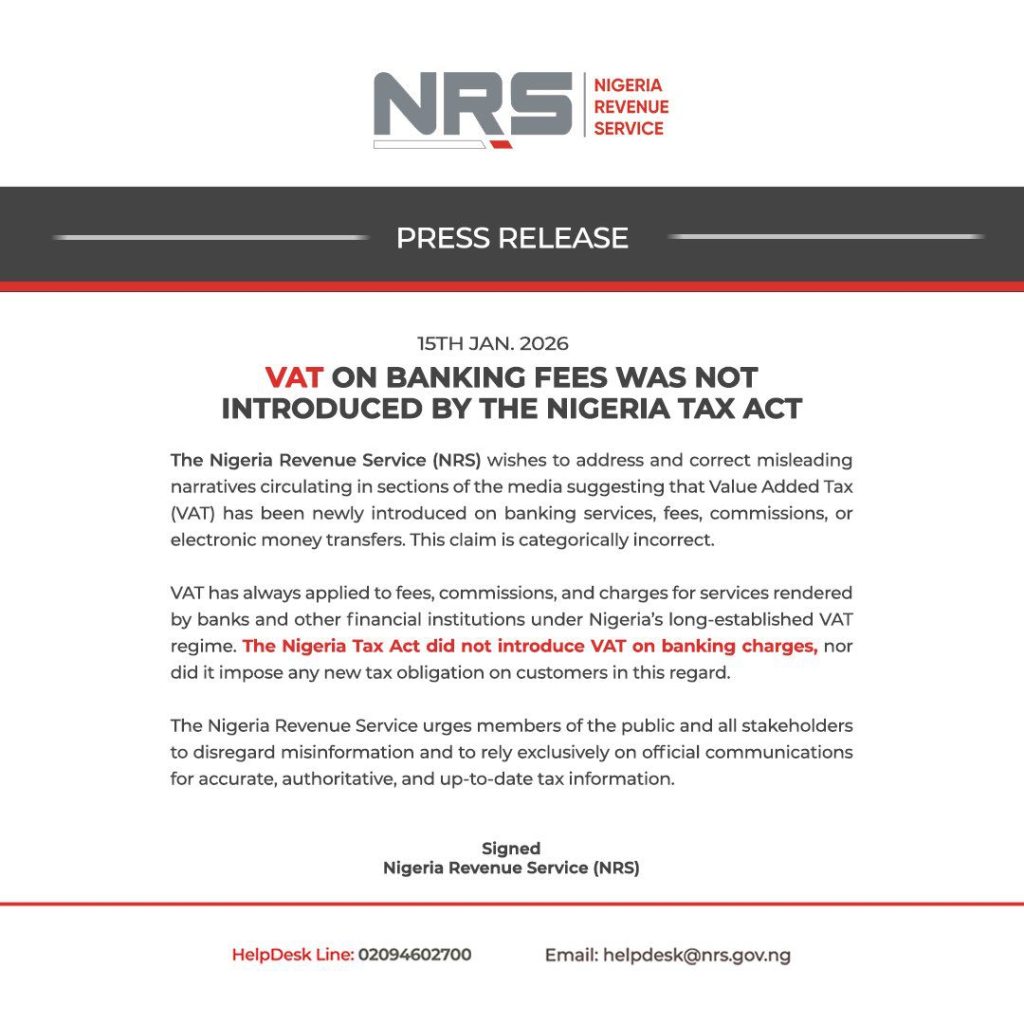

You might have seen those scary posts blowing up on X or WhatsApp lately, claiming that every time you send money through your bank, you’re getting hit with a new 7.5% VAT on the full amount. Well, relax, it’s not like that at all. The Nigeria Revenue Service (NRS) just stepped in to set the record straight, and NRS clarified the 7.5% VAT in the clearest way possible.

In a statement they dropped on Thursday, the NRS shut down all those rumors quickly. They said those stories making the rounds are flat-out wrong and misleading. 7.5% VAT applies solely to bank transfer service fees, not to the actual money you’re sending. No one’s touching your principal amount, that’s the key point they’re hammering home.

“The Nigeria Revenue Service wishes to address and correct misleading narratives circulating in sections of the media suggesting that Value Added Tax has been newly introduced on banking services, fees, commissions, or electronic money transfers. This claim is categorically incorrect,” the statement read. Pretty straightforward, right?

Read Next: MTN Nigeria Tops Airtel and Glo as Nigeria’s Leading Mobile Internet Provider in 2025

This whole mess kicked off in early January 2026, right after the Nigeria Tax Act 2025 went live. Fintech apps like Moniepoint and OPay, along with some regular banks, started emailing their customers about it. Those emails said that starting January 19, 2026, they’d be collecting and passing on a 7.5% VAT on electronic banking charges. They were clear that it was just on the little fees, like ₦10 or ₦25 for a transfer, but once those messages hit social media, people twisted them up.

Suddenly, viral posts everywhere were saying the 7.5% VAT meant you’d lose ₦7.50 on every ₦100 you transfer. Big influencers and some online news sites ran with “Breaking News” headlines that made it sound like a huge new tax grab. With everyone already stressed about rising living costs and all these tax changes, the panic spread like wildfire before anyone could blink.

Now, about NRS’s response to the misinformation, they didn’t hold back. The statement came from Dare Adekanmbi, Special Adviser on Media to NRS Chairman Zaccheus Adedeji. NRS clarifies on the 7.5% VAT by pointing out that the Nigeria Tax Act 2025 didn’t bring any brand-new tax on banking charges. 7.5% VAT on those services? It’s been around forever as part of Nigeria’s tax rules, fitting right into the broader push for smoother digital transactions.

“Recent media reports suggested a fresh tax obligation for electronic money transfers, such assertions are unfounded,” they explained. “VAT has always applied to fees, commissions, and charges for services rendered by banks and other financial institutions under Nigeria’s long-established VAT regime.” In other words, the 7.5% VAT applies solely to bank transfer service fees, the stuff banks charge you for doing the work, like their cut for processing your transfer.

They’re making it super clear: no policy change, no big shift. Your money, the amount you’re actually sending, stays safe. Take a real-life example: Say you transfer ₦10,000, and the bank slaps on a ₦25 fee. The 7.5% VAT only hits that ₦25, which works out to about ₦1.88. Your ₦10,000? Untouched. This is huge for everyday folks leaning into cashless payments, like those quick airtime top-ups or transfers.

Read Next: Access Bank and Visa Team Up on Innovative Card Solution for Nigerian Businesses

This matters a lot right now because more Nigerians are relying on digital transfers for everything in our growing cashless economy. No one wants confusion over basic banking costs. And here’s more good news from the NRS: interest you earn on savings accounts or fixed deposits? That’s not taxable under VAT either.

“Interest income is not a supply of goods or services and therefore does not attract VAT under the Nigeria Tax Act,” they said. Smart move to throw that in, especially with folks watching their savings closely.

Finally, the NRS is begging everyone to chill on the rumors. “The Nigeria Revenue Service urges members of the public and all stakeholders to disregard misinformation and to rely exclusively on official communications for accurate, authoritative, and up-to-date tax information.” NRS clarifies on 7.5% VAT so we don’t keep stressing over fake news, stick to the real sources, and you’re good.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.