Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Yellow Card is pushing hard for the use of stablecoins in Africa, and for good reasons. Stablecoins are a special kind of digital money that stays steady in value because they are linked to stable assets like the US dollar. This makes them a smart choice for people and businesses in Africa, where many local currencies can lose value quickly and make everyday money matters tricky.

Sean van Kerckhoven, who leads partnerships at Yellow Card, shared in an interview that stablecoins are helping to modernize how money moves across Africa. They make sending and receiving money faster and cheaper, which is a big deal for many people and companies. Yellow Card is working closely with banks and governments to make sure stablecoins are used safely and follow the rules. They also want to teach businesses about how stablecoins can help them grow.

Read Next: Kenyan BNPL Startup, Watu, Profits Decline by 85% to $1.2 Million, Due to a Rise in Loan Defaults

One of the ways Yellow Card is making this happen is through their payment API. Think of it as a tool that lets companies start doing business in up to 20 African countries without the usual headaches like setting up local offices or dealing with lots of paperwork. This saves time and money, making it easier for businesses to join Africa’s growing market.

Stablecoins also help people protect their money from losing value. Since some African currencies can drop in value quickly, holding stablecoins means people can keep their savings safe. Plus, stablecoins make sending money between countries quicker and cheaper because they don’t rely on slow, traditional banks that often charge high fees. This is especially helpful in places where it’s hard to get US dollars, which are often needed for big transactions.

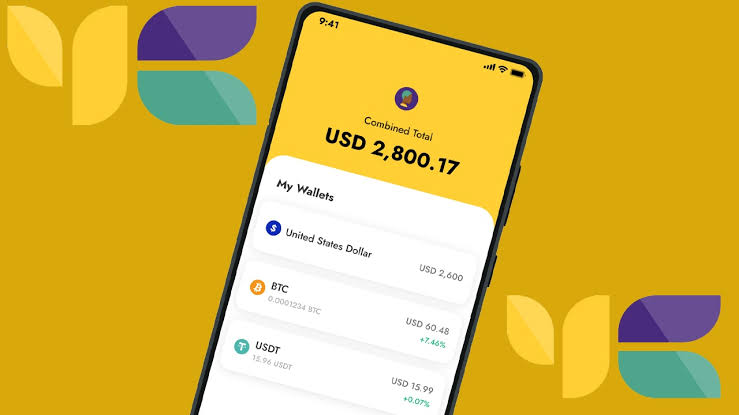

Yellow Card is already the biggest platform in Africa for buying and selling popular stablecoins like USDT, USDC, and PYUSD using local money. They have built a strong network that connects with 45 banks, 45 mobile money services, and 25,000 cash agents across 20 countries. This makes it easy for everyday people and businesses to use stablecoins without needing a bank account, just a phone or internet connection.

Recently, Yellow Card raised $33 million to improve their stablecoin services and expand their payment API. This shows how important and promising digital money is for Africa’s future. The company is also teaming up with big global players like Coinbase and Block to bring more financial services to Africa, helping the continent’s digital economy grow.

Read Next: IHS to Exit Rwanda in H2 of 2025, Sells Business to Paradigm for $274.5M

Besides building technology and partnerships, Yellow Card believes in education. They run programs to help people understand stablecoins and cryptocurrencies better, so more Africans can use these tools confidently. This helps break down barriers and brings more people into the financial system.

Yellow Card pushes for the use of stablecoin in Africa because it offers a safer, faster, and cheaper way to handle money. Stablecoins protect people from unstable currencies and make it easier for businesses to work across borders. With strong partnerships, good regulation, and education, Yellow Card is leading the way to a future where more Africans can join the financial world with confidence.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.