Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

Africa’s connectivity challenges are pushing some surprising team-ups. Late in 2025, Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions. Starlink Partners with Airtel & Vodacom, and it’s a big deal for folks in remote spots. Let me break it down for you.

First off, the Airtel side. They’re diving into Starlink’s “Direct-to-Cell” tech, which lets regular smartphones hook up straight to satellites, no extra gadgets needed. It’s launching in 2026 across 14 markets. Meanwhile, Vodacom is going for satellite backhaul aimed at businesses, with stuff like pay-as-you-go broadband and equipment rentals. They’re already up and running in 25 countries.

Both deals share the same aim: closing those rural internet gaps to help schools, clinics, and fields like farming and mining. Starlink brings the satellite power, while these local giants add their know-how on the ground. With Airtel and Vodacom’s combined 396 million customers, Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions on a huge scale.

Read Next: DDoS Attacks in MENA Were Up 163% Year Over Year in Q3 2025

On the Starlink-Airtel front, Airtel Africa is weaving in Starlink’s Direct-to-Cell (D2C) tech plus cellular backhauling to reach far-off places. D2C means your everyday LTE phone talks directly to satellites, skipping expensive cell towers. Backhauling ties lonely ground stations to Airtel’s main network through space, perfect where fiber just won’t go. Starlink’s newest satellites crank out data speeds 20 times faster than the old ones.

They’re kicking off satellite-to-mobile in Africa by 2026, starting with basic texts and data. By May 2025, SpaceX had licenses in 9 of Airtel’s 14 markets, with the rest still getting approvals.

Airtel Africa had 173.8 million subscribers as of September 2025, and 78.1 million of them are on data plans. That’s a massive pool to tap into once this rolls out. Data’s even beating voice revenue now, $1.16 billion in the first half of fiscal 2026 (April to September 2025).

“Next-generation satellite connectivity will ensure that every individual, business, and community has reliable and affordable voice and data connectivity even in the most remote and currently underserved parts of Africa.” – Sunil Taldar, CEO, Airtel Africa

That subscriber muscle means they can zero in on the right spots.

It covers all 14 Airtel markets, targeting out-of-the-way schools, health spots, rural shops, and overlooked neighborhoods. Mixing satellites with what they’ve already got built also toughens up the network for disasters, keeping key services humming when ground lines fail. Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions like this.

Switching to Starlink-Vodacom: They’re blending Low Earth Orbit (LEO) satellite backhaul into Vodacom’s setup for a hybrid network. Satellites act as data bridges alongside the usual towers. Unlike Airtel’s phone-direct approach, Vodacom can resell Starlink gear and broadband too, like pay-as-you-use backup internet or “100% unbreakable” service for must-run ops.

Vodacom’s got over 223 million customers across Africa, so this really stretches Starlink’s reach where wires can’t follow. It fits their Vision 2030 plan to hit 260 million customers and financial services for 120 million in five years. Linking Starlink’s orbit network to that crowd tackles connectivity headaches head-on.

“Low Earth orbit satellite technology will help bridge the digital divide where traditional infrastructure is not feasible, and this partnership will unlock new possibilities for the unconnected.” – Shameel Joosub, CEO, Vodacom Group

It’s a real push to get fast internet to more ground. Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions through these moves.

The deal spans 25 African countries where Starlink was to live by November 2025, think South Africa, Kenya, DRC, Lesotho, Tanzania, Mozambique. It’s all about linking rural schools, clinics, and heavy hitters like mining, oil and gas, farming, tourism. In South Africa, Starlink pledged 2.5 billion rand (about $145.6 million) to hit the 30% black ownership rule. But rollout there hit snags over those compliance hurdles.

“By collaborating with Vodacom, Starlink can deliver reliable, high-speed connectivity to even more customers, transforming lives and communities across the continent.” – Chad Gibbs, Vice President of Starlink Operations, SpaceX

Digging into how these play out shows the real-world give-and-take of rolling them out in Africa. Each has its wins and bumps that shape how they land.

Airtel-Starlink leans on Direct-to-Cell, so standard phones connect right to satellites, no fancy hardware. That slashes the bill for building towers. It’s eyeing a 2026 start in 14 markets, but regs like South Africa’s 30% local ownership for disadvantaged groups could drag feet.

Vodacom-Starlink targets businesses and small ops with flexible pay-as-you-go and device leasing to ease startup costs. Their 223 million users set them up for mining, energy, and ag. Downside? Folks need to buy or rent those satellite dishes upfront.

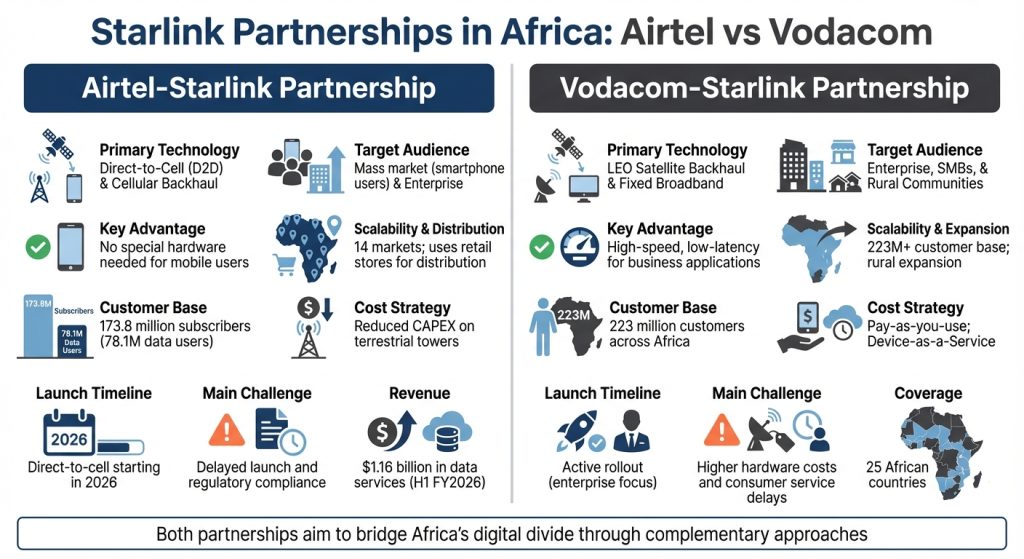

| Feature | Airtel-Starlink Partnership | Vodacom-Starlink Partnership |

| Primary Technology | Direct-to-Cell (D2C) & Cellular Backhaul | LEO Satellite Backhaul & Fixed Broadband |

| Target Audience | Mass market (smartphone users) & Enterprise | Enterprise, SMBs, & Rural Communities |

| Key Advantage | No special hardware needed for mobile users | High-speed, low-latency for business apps |

| Scalability | 14 markets; uses retail stores for distribution | 223M+ customer base; rural expansion |

| Cost Strategy | Reduced CAPEX on terrestrial towers | Pay-as-you-use; Device-as-a-Service |

| Launch Timeline | Direct-to-cell starting in 2026 | Active rollout (enterprise focus) |

| Main Challenge | Delayed launch and regulatory compliance | Higher hardware costs and consumer service delays |

This setup spotlights the perks and pitfalls for each. Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions, and these details show the path ahead in Africa’s tech scene.

Read Next: Bitcoin Rises Above R1.5 Million

These Starlink, Airtel, and Vodacom team-ups mark a switch from competing to teaming up on infrastructure. Airtel’s Direct-to-Cell hits 14 markets in 2026, Vodacom’s enterprise push is underway. Together, they fill everyday user gaps and industry needs like mining, farming, energy.

The numbers tell the story, Airtel Africa’s $1.16 billion data haul in early fiscal 2026. Starlink in 25 countries gives the lift, locals handle markets, rules, distribution. Starlink Partners with Airtel & Vodacom to improve internet access in underserved regions, sparking growth everywhere.

For companies, startups, far-flung villages, it’s real: pay-as-you-go cuts entry barriers, steady net keeps things running at schools and clinics. LEO adds backup for crises, custom fixes for off-grid work. It’s a solid fix for Africa’s digital split.

Watch regs like South Africa’s ownership rules and Airtel’s 2026 launch. Winning means juggling tech with rules, cheap with good, spending with staying power. This model could rewrite connectivity across Africa down the line.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.