Physical Address

60 Ekwema Cres, Layout 460281, Imo

Physical Address

60 Ekwema Cres, Layout 460281, Imo

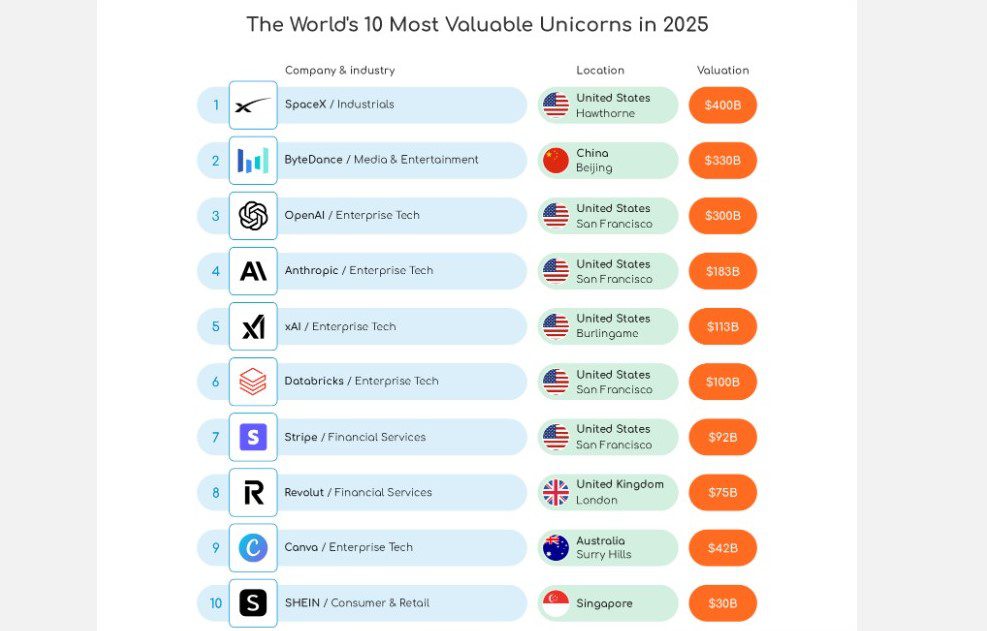

Starlink’s SpaceX, TikTok’s ByteDance, and ChatGPT’s OpenAI have emerged among the world’s most valuable startups in 2025, leading the charts as the top private companies globally, according to a recent report by BestBrokers. This report, which compiled findings from CB Insights and data from PitchBook, highlights the significant growth and value creation powered by innovation and scalable technology across these companies.

SpaceX, founded by Elon Musk, is the most valuable startup in the world in 2025 with an impressive valuation of $400 billion. This marks an increase from $350 billion in December 2024, boosted by an insider share sale. SpaceX’s rapid growth is driven primarily by the expansion of its satellite internet service Starlink. The company recently secured a wireless spectrum license from EchoStar, allowing Starlink to extend its satellite network and provide direct-to-cell 5G services worldwide. The projected substantial revenue for 2025 is a strong sign of SpaceX’s steady financial progress alongside its ambitious exploration projects.

Read Next: Uncertainty for 650 Million Users as Microsoft Ends Windows 10 Support in October

Following closely behind is ByteDance, the Chinese parent company of TikTok, valued at $330 billion. Despite regulatory challenges in markets like the United States, ByteDance remains a global powerhouse in media and entertainment. Its portfolio extends beyond TikTok to popular platforms like Douyin, Capcut, and Lemon8, enabling the company to maintain its leadership position and continue expanding its user base and revenues.

OpenAI, which developed the popular AI conversational model ChatGPT, ranks third with a $300 billion valuation. This valuation was significantly supported by a historic $40 billion funding round led by SoftBank in April 2025. OpenAI is currently undergoing a transition to restructure into a for-profit company, which has sparked some legal disagreements with co-founder Elon Musk. If successful, this restructuring could pave the way for an initial public offering (IPO) aimed at a $500 billion valuation. OpenAI’s remarkable rise reflects the massive interest and investment in artificial intelligence across the globe.

Other notable names among the world’s top 10 most valuable startups include Anthropic, valued at $183 billion, a U.S.-based AI research lab behind the AI assistant Claude. Anthropic reached this valuation through a $13 billion Series F funding round led by ICONIQ Capital. Another of Elon Musk’s ventures, xAI, tops the top five with a $113 billion valuation following the acquisition of Twitter (now rebranded as X) and significant investments boosting its worth.

Additional top startups by valuation include Databricks at $100 billion, Stripe with $92 billion, Revolut valued at $75 billion, Canva at $42 billion, and SHEIN at $30 billion, making a combined valuation of about $1.665 trillion for the ten most valuable startups.

Geographically, the United States hosts 60% of these leading startups, underscoring its dominance as a global technology and artificial intelligence hub. This dominance is supported by the country’s strong venture capital ecosystem and legal protections that encourage significant investments. China, the United Kingdom, Singapore, and Australia each contribute one company to the top 10 list, reflecting the international nature of tech innovation today.

The report also sheds light on a clear trend: artificial intelligence and technology startups are driving the valuation surge in 2025. Seventeen of the 63 private unicorn companies established this year specialize in AI, representing 27% of all newly minted unicorns. Enterprise technology startups closely follow 15 companies (23.8%), while fintech, robotics, and healthcare sectors also contribute to the unicorn population.

Venture capital investors are displaying increased caution in 2025, focusing their support on fewer companies but with larger investments in high-demand sectors such as AI and fintech. The companies best able to convert breakthrough technology into steady revenue are garnering the most investment interest and rising to ultra-unicorn status, with valuations exceeding $5 billion, and even more startups now reaching valuations surpassing $100 billion.

Read Next: South African fintech, Yoco Appoints New CEO as Katlego Maphai Steps Down After 10 Years

Ultimately, SpaceX, ByteDance, and OpenAI being among the world’s most valuable startups in 2025 exemplifies how innovation in satellite technology, social media, and artificial intelligence continues to captivate investors and reshape the global business landscape. As these companies expand their market reach and technological capabilities, they not only drive the global economy forward but also set new benchmarks for startup valuations worldwide. Their success story reflects the growing importance of AI and scalable tech solutions in addressing everyday challenges and creating vast economic opportunities.

SpaceX, ByteDance, OpenAI among the world’s most valuable startups prove the power of innovation and technological advancement in 2025, shaping the future of industries across the globe.

Was this information useful? Drop a nice comment below. You can also check out other useful contents by following us on X/Twitter @siliconafritech, Instagram @Siliconafricatech, or Facebook @SiliconAfrica.